Global dispute settlement, India and appellate review

Relevance

- GS Paper – 2 Bilateral Groupings & Agreements.

- Tags: #WorldTradeOrganization(WTO) #WTO’sAppellateBody #BilateralInvestmentTreaties(BITs) #Investor-state-disputesettlement.

Why in the news?

The recently concluded G-20 Declaration, among its many commitments, reiterated the need to pursue reform of the World Trade Organization (WTO) to improve all its functions and conduct proactive discussions “to ensure a fully and well-functioning dispute settlement system accessible to all members by 2024”.

Main Issue

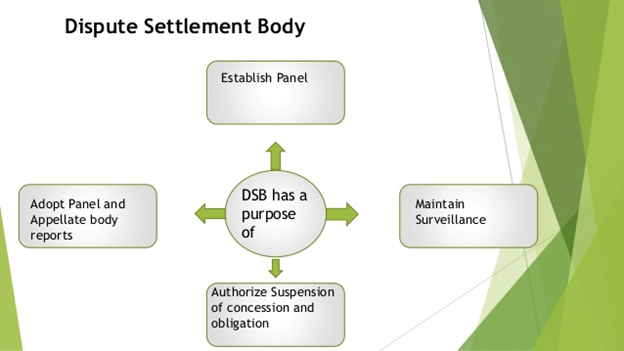

- The WTO’s dispute settlement system, conceived as a two-tier panel cum appellate body structure, has been dysfunctional since 2019, because the United States has blocked the appointment of appellate body members.

- Hailed as the crown jewel of the WTO, the dispute settlement system, with the scope for appellate review and mechanisms to enforce rulings, has issued over 493 rulings since its establishment in 1995. To put this in context, the International Court of Justice has dealt with only around 190 cases since 1947.

- The appellate body has been crucial in ensuring coherence and predictability in rulings, ensuring confidence in the WTO dispute settlement process.

WTO’s Appellate Body

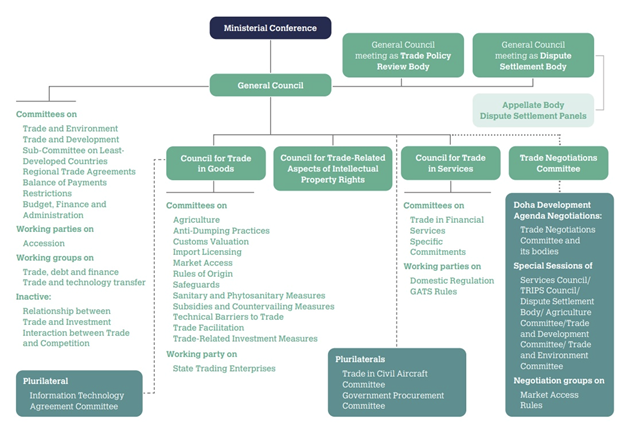

- WTO was established to provide a platform for negotiations for liberating trade and creating rules, as well as to monitor and administer multilateral trades.

- One of the key objectives was also to address the grievances between its members by acting as a court for global trade.

- The Appellate Body, set up in 1995, is a standing committee of seven members with a limited four-year term that presides over appeals against judgments passed in trade-related disputes brought by WTO members.

- Disputes arise when a member country observes that another member government is breaching a commitment, or a trade agreement made at the WTO.

ISDS

- While the WTO’s appellate process is uncertain, another area of international law witnessing the formative stages for an appellate process is international investment law through investor-state-dispute settlement (ISDS), an ubiquitous component of Bilateral Investment Treaties (BITs).

- The ISDS today is the principal means to settle international investment law disputes.

- Till January 1, 2023, 1,257 ISDS cases have been initiated. India has had a chequered history with ISDS, with five adverse awards: four in favour, and several pending claims.

Benefits of an appellate review

- A critical structural facet of the ISDS mechanism (also present in India’s BITs and a few free trade agreements) is that it operates through ad hoc or one-off arbitration tribunals without any appellate review.

- In international investment law, hundreds of ISDS tribunals operating under different arbitral institutions have, on several occasions, offered diverging interpretations of the same treaty provision. Likewise, these tribunals have reached opposite conclusions despite interpreting and applying the same treaty to the same facts.

- The absence of an appellate review mechanism has meant that inconsistent and incoherent decisions and legal reasoning dot the landscape of international investment law.

- This has caused instability and improbability for states and foreign investors, making the regime chaotic.

- An appellate review mechanism will allow for rectifying errors of law and harmonizing diverging interpretations. It will have the power to uphold, modify, or reverse the decision of a first-tier tribunal and thus bring coherence and consistency, which, in turn, will infuse predictability and certainty into the ISDS system.

- An appellate mechanism will also be better than existing mechanisms such as the annulment proceedings, which only apply to arbitrations administered by the International Centre for Settlement of Investment Disputes — an institution India is not a member of.

- Further, such annulment proceedings can only address limited issues, such as the improper constitution of an arbitration tribunal or corruption but cannot correct errors in legal interpretation.

- The appellate mechanism will also be superior to getting an ISDS award set aside on limited procedural grounds in a court at the seat of arbitration.

Challenges

There are several critical issues in creating an appellate review, such as

- what form it should take — an ad hoc appellate mechanism (a body constituted by the disputing parties on a case-by-case basis) or a standing appellate mechanism;

- what the standard to review the decisions of the first-tier tribunal should be; and

- what the time frame and the effect of the decision should be.

India’s stand

- Although India has not made a formal statement on this issue, India, presumably, supports the idea of an appellate review in the ISDS because Article 29 of the Indian model BIT talks of it.

- Given India’s concerns about inconsistency and incoherence in the ISDS system, supporting the creation of an appellate review mechanism will be in India’s interest.

- In any case, India will have to take a stand on this issue as part of the ongoing investment treaty negotiations with the European Union, which is championing the creation of an appellate review mechanism for investment disputes.

Conclusion

- Since India’s quest has always been to establish a rule-based global order, it should support an appellate review which will usher in greater confidence for states and investors in international investment law.

- For those same reasons, India should also push for the restoration of the WTO appellate body towards achieving the goal of a fully and well-functioning dispute settlement system at the WTO.

Source: The Hindu

Mains Question

Examine the role of the appellate body in the WTO’s dispute settlement system and its significance in upholding international law and holding powerful countries accountable. Discuss the criticisms raised by the US against the appellate body and its approach to creating binding precedents. Assess the potential impact of the US’s opposition on the functioning of the DSS and propose measures to address the concerns raised.