GDP Figures Show India is Back on the Road to Growth

GDP Figures Show India is Back on the Road to Growth

Why in the News?

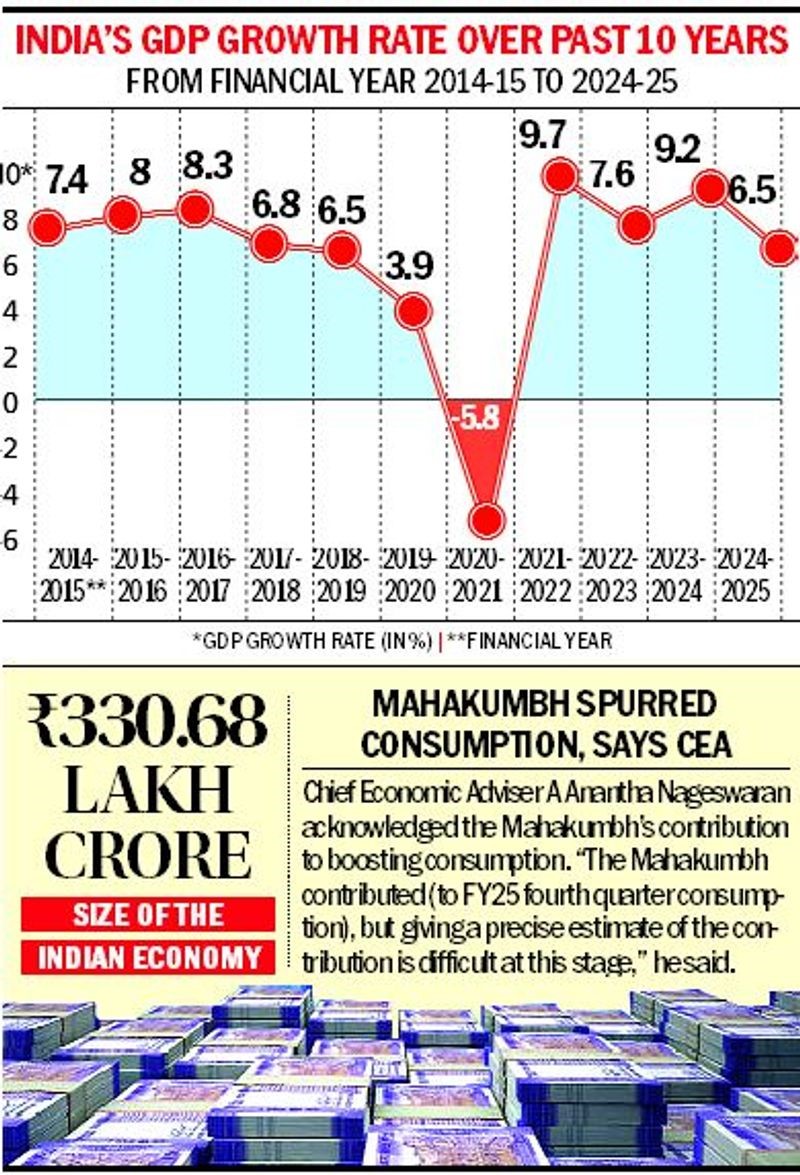

The latest Indian economic news reveals a promising trajectory for the GDP of India. According to the National Statistics Office (NSO), the India growth rate for FY25 is provisionally estimated at 6.5%. This estimate of India GDP data shows a slight improvement over the first and second advance estimates, which had projected 6.4% and 6.5%, respectively. The fourth quarter GDP (Q4 GDP) posted a strong growth of 7.4%, indicating robust economic momentum in the India GDP growth story.

This growth comes despite weak domestic private investment and the government’s constrained fiscal capacity to increase public investment. Notably, India’s economic growth is benefiting from global supply chain realignments, which are helping support the GDP growth rate of India amid domestic challenges.

Highlights from Provisional GDP Estimates (2023–24 & 2024–25):

The recent trend of upward GDP revisions seen in the past three years may be tapering off, suggesting a return to India’s long-term average growth trend. The decadal average GDP growth prior to the pandemic stood at 6.6%, aligning closely with current trends in the Indian economy GDP growth rate.

For FY 2023–24:

- First advance estimate: 7.3%

- Provisional estimate: Revised to 8.2%, then to 9.2%

Provisional estimates are considered more reliable than earlier advance estimates. The next update for FY25 GDP will be released in early 2026, making current provisional data key for economic analysis of India amid global uncertainties.

Nominal GDP & Economic Size:

The nominal GDP (which includes inflation) grew 9.8% in FY25. This growth has increased the Indian economy in trillion terms from $3.6 trillion (FY24) to $3.91 trillion (FY25), solidifying India’s position as a major player in the global economic landscape. This progression in the India GDP in billion terms is a significant milestone in the current position of Indian economy today.

Consumption & Investment Trends:

Private consumption rose by 7.2%, largely driven by rural demand, while urban consumption remained subdued. These private consumption trends are crucial indicators of the overall health of India’s economic growth. However, consumption growth slowed to 6% in Q4.

Government consumption expenditure was modest:

- Grew 2.3% for the full fiscal

- Contracted by -1.8% in Q4

Government investment surged in the fourth quarter, pushing overall investment growth above GDP growth. The central government capital expenditure (capex) exceeded revised estimates for FY25, indicating a strong focus on infrastructure development as part of government initiatives to boost India GDP growth.

Supply-Side Highlights:

The agriculture and services sectors showed strong performance, with the services sector continuing to be a major contributor to India’s GDP. However, the manufacturing sector lagged, growing at 4.5%, which is slower than agriculture. This disparity in sectoral growth rates presents both challenges and opportunities for balanced economic growth.

Merchandise exports remained nearly flat:

- FY25: $437.41 billion

- FY 2023–24: $437.07 billion

The labour-intensive construction sector grew 9.4%, building on last year’s double-digit growth — a positive sign for employment generation and overall economic resilience.

Outlook for FY 2025–26:

Economic prospects for India GDP in 2025 hinge on the interaction between global tariff shocks and India’s domestic policy tools and buffers. Although India remains a domestically driven economy, increasing integration with global markets makes it vulnerable to external disruptions.

Global Trade & Geopolitical Influences:

US reciprocal tariffs and ongoing trade tensions are reshaping the global environment:

- Direct impact: Slower US growth (1.5% in 2025, down from 2.8% in 2024) may reduce demand for Indian exports.

- India’s competitiveness could be hurt by increased tariffs on exports to the US.

- The outcome of the India-US trade deal will be crucial in determining long-term impacts on the Indian economy GDP growth rate and beyond.

Indirect effects could arise from:

- Slower growth in other key markets such as the EU and Asia.

- S&P Global forecasts global growth to fall to 2.7% in 2025, from 3.3% in 2024.

The China factor remains significant:

- Elevated US tariffs on Chinese goods may worsen China’s overcapacity and deflation, leading it to divert excess supply to markets like India.

- A recent 115% tariff reduction agreement between the US and China (for 90 days) provides only temporary relief, with uncertainty looming post this window.

Macroeconomic Outlook & Investment Climate (FY 2025–26):

Challenges to Private Investment & Financial Stability:

Persistent global uncertainty is causing delays in private investment decisions. This also raises concerns about volatility in capital flows, financial markets, and currency exchange rates. Despite these challenges, positive domestic developments are expected to support growth this fiscal year, contributing to the overall India GDP growth.

Export Composition & Trade Resilience:

India’s export base shows resilience due to the dominance of services exports, which now constitute nearly 50% of total exports. According to the WTO:

- Global goods trade is projected to contract by 0.2% in calendar 2025.

- Global services trade is expected to grow by 4%.

This composition offers partial insulation from global trade slowdowns and underscores the importance of the services sector in maintaining India’s economic momentum.

External Buffers:

Low current account deficit, moderate government external debt, and robust forex reserves (at $686 billion) help cushion India against global shocks. These foreign exchange reserves play a crucial role in maintaining economic stability. However, these buffers do not offer full protection from external risks.

Agriculture & Inflation Outlook:

A record wheat harvest, strong pulses output, and a favourable monsoon are expected to:

- Boost agricultural production

- Keep food inflation low

Crude oil prices are projected to average $65 per barrel, supporting macroeconomic stability. These trends provide the RBI with room to ease policy—two rate cuts of 25 basis points each are anticipated this fiscal.

Consumption Dynamics:

Low food inflation will increase discretionary spending, especially for lower-income households. Urban consumption will be supported by:

- Low interest rates

- Income tax cuts announced in the Union Budget (effective this fiscal)

These factors will complement strong rural demand, sustaining overall consumer spending and contributing to India’s GDP growth.

Public Investment & Supply Chain Shifts:

Despite fiscal considerations, the central government is frontloading capital expenditure:

- April capex stood at ₹1.59 lakh crore, or 14.3% of the full-year target.

Global supply-chain realignment continues to benefit India:

- Apple plans to manufacture most US-destined iPhones in India.

- A Vietnamese EV maker is launching operations in India by June 2025.

Corporate India’s strong balance sheets (especially large and mid-sized firms) enhance flexibility and resilience to seize such investment opportunities, potentially boosting industrial activity and overall economic performance.

Way Forward:

To maintain and accelerate India’s economic growth, several key areas require focus:

- Accelerate Structural Reforms: Emphasize land, labour, and ease of doing business reforms to enhance India’s long-term investment attractiveness.

- Boost Private Investment: Strengthen investor confidence through policy clarity, faster project clearances, and stable regulatory frameworks.

- Deepen Global Trade Engagement: Finalize and diversify trade agreements (e.g., India-US, EU-India) to mitigate tariff risks and gain market access.

- Leverage Services Export Strength: Promote IT, fintech, professional services, and R&D exports which are more resilient to global trade fluctuations.

- Enhance Rural Demand: Support income growth in rural areas through targeted subsidies, improved agricultural productivity, and rural infrastructure.

- Sustain Public Capex Momentum: Continue frontloading capital expenditure while maintaining fiscal discipline to stimulate demand and job creation.

- Ensure Food & Energy Security: Maintain buffer stock levels, monitor monsoon-dependent crops, and secure favorable crude oil import terms.

- Support Monetary Policy Transmission: Ensure banks and NBFCs transmit policy rate cuts effectively to stimulate consumption and investment.

- Strengthen External Buffers: Continue building forex reserves, maintain a manageable current account deficit, and monitor external debt exposure.

- Monitor Global Risks Closely: Stay agile in responding to global trade tensions, slowing global demand, and shifting geopolitical alignments.

By addressing these areas, India can strengthen its economic resilience and maintain its position as one of the fastest-growing major economies in the world. The IMF estimates for India’s growth rate remain optimistic, further supporting the positive outlook for the Indian economy 2024 and beyond.

Mains Question (250 words):

“Discuss the key drivers and constraints of India’s current GDP growth trajectory in the context of global economic shifts & domestic investment climate.”