“FPIS SELL, DIIS BUY: IMPACT ON INDIAN STOCK MARKET”

Why in the news?

- Market dynamics analyzed as FPIs sell and DIIs buy, influencing Indian stock market sentiment amid geopolitical uncertainties and election outcomes.

- Foreign Portfolio Investors (FPIs) engaged in extensive selling in the lead-up to elections, totaling Rs 75,000 crore.

- Conversely, Domestic Institutional Investors (DIIs), including mutual funds and insurance companies, purchased stocks worth Rs 300,000 crore during the same period.

Key points:Stocks

- Stocks, shares, or equities represent ownership in a company.

- Ownership grants a claim on the company’s assets and earnings.

- Companies issue stocks to raise capital for growth or debt repayment.

- Investors buying stocks provide funds to the company.

- Some companies pay dividends, a portion of earnings distributed per share to shareholders.

source:slideshare

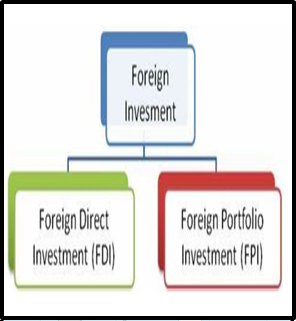

Understanding Foreign Portfolio Investment (FPI):

Regulation in India:

Advantages:

About Domestic Institutional Investors (DIIs):

Associated Article: https://universalinstitutions.com/why-fiis-are-taking-flight/ |