FM CREDITS IBC FOR AIDING BANKS IN NPA CRISIS RECOVERY

Why in the news?

- The Finance Minister cites the RBI report emphasizing IBC’s role in aiding banks to recover from the NPA crisis.

- IBC served as a crucial mechanism for banks to address stressed assets and facilitate recovery.

source:micoope

About the NPA crisis:

- Non-Performing Assets (NPAs) are loans where payments haven’t been made for 90 days.

- Twin balance sheet crisis: Banks and corporates are heavily stressed and overleveraged.

- NPAs categorized into Substandard, Doubtful, and Loss Assets based on duration.

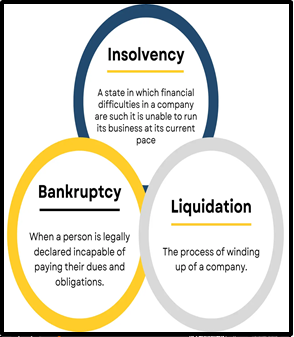

About Insolvency and Bankruptcy Code, 2016 :

Associated Article: https://universalinstitutions.com/insolvency-and-bankruptcy-code/ |