FINANCE MINISTER DEFENDS TAX RELIEF AMID OPPOSITION CRITICISMS

Why in the news?

Finance Minister Nirmala Sitharaman defends tax relief measures for the middle class amid opposition criticism, highlighting increased deductions and liberalised income tax slabs while addressing concerns over corporate tax disparities.

About Tax Relief Measures for Middle Class:

- Finance Minister’s Statement:

- Nirmala Sitharaman addressed concerns in the Lok Sabha about tax relief for the middle class.

- Claimed significant liberalisation of personal income tax slabs in 2023, reducing liabilities by ₹37,500.

- Enhanced family pension deduction from ₹15,000 to ₹30,000.

- Raised employer’s contribution deduction from 10% to 14%.

source:slideshare

- Opposition Criticisms:

- Opposition alleges the government has shifted the tax burden to the middle class.

- Criticisms include claims that corporate taxes are less compared to personal income taxes.

- Opposition MPs walked out after an amendment on GST rates for insurance premiums was not addressed.

- Corporate Tax Issues:

- Sitharaman disputed the narrative that corporate taxes are lower than personal income taxes.

- Highlighted that dividend income is taxed as part of corporate profits.

About Taxation in India:

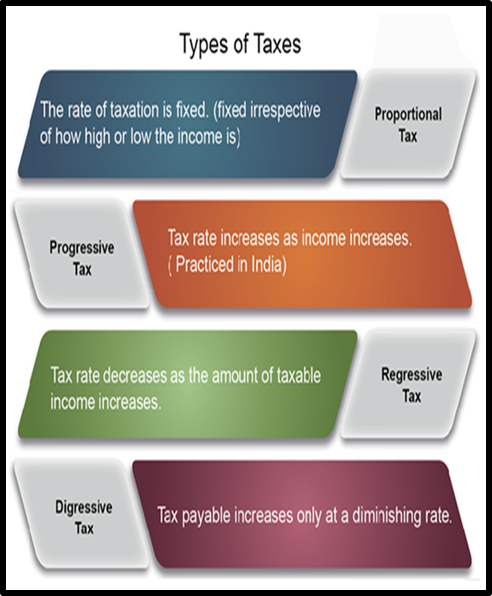

Types of Taxation in India: Direct Tax

Indirect Tax

|