FDI Trends in India

Syllabus:

- GS 2: Government Policies and intetventions

- GS 3: Liberalization

Why in the News?

Recently, Chief Justice D.Y. Chandrachud stressed the importance of rule of law as the regional office of the Permanent Court of Arbitration was set up in New Delhi to boost investor confidence.

Introduction

- Regional office of the Hague Permanent Court of Arbitration was established in New Delhi to build investor confidence highlights the important role of “rule of law”.

- This development aligns with India’s aim to be a global arbitration centre, which will create favourable conditions for foreign investment.

Foreign Direct Investment (FDI)

- Foreign Direct Investment (FDI) catalyst to India’s economic growth story, providing much-needed capital, expertise and access to global markets.

- FDI has become the cornerstone of India’s development agenda over the past decade.

- But in the wake of changing global dynamics and geoplolitics, regulatory challenges and investor sentiment, it is important to examine the current scenario of FDI in India.

Relevance of FDI for Indian economy

- India relies heavily on FDI to meet its growing capital needs.

- The domestic capital market has declined, since then foreign exchange has played an important role in India’s rapid economic growth.

- FDI brings not only economic empowerment but also exposure to technological know-how and best practices of global businesses and trade, which are critical for industries such as manufacturing, technology and services.

- Foreign direct investment created millions of jobs in various industries in India, contributing to the overall socio-economic development of the country.

- Foreign investment encourages establishment of export-oriented industries, integrating India with the global economy.

Rule of law: upholding Investor’s confidence

- Key to protecting the rights of investors is Rule of law.

- As Chief Justice D.Y. Chandrachud said, “a strong rule of law, guarantees that rights are protected, treaties are enforced and disputes are resolved quickly”.

- This helps creates a environment that is stable and predictable, which is necessary to attract FDI.

- Investment-State Dispute Settlement (ISDS): Many of the trade and investment agreements contain ISDS-like mechanisms that permits foreign investors to challenge governments before international courts.

- But ISDS has been criticized many times for allowing foreign investors only without giving domestic investors opportunities to challenge the government.

- India’s experience with ISDS, like White Industries and Antrix, has raised concerns about its adequacy and suitability to resolve investors concerns.

- Critics argue that domestic/National courts and commercial arbitrators can effectively handle investment disputes without recourse to specialized courts/tribunals for foreign companies.

Issues with ISDS Mechanism

- ISDS cases often involve important public policy issues, including the interpretation of national law which is not true like commercial arbitration.

- Making ISDS a challenging tool for dispute resolution, as it bypasses the domestic judicial system.

- Since many years, ISDS has given rise to conflicting decisions from courts, creating confusion and inconsistencies in international investment law.

- United States and other key proponents of ISDS began to withdraw from the it.

- For example, the S. and the Mexico-Canada Compact (USMCA), which replaced NAFTA, phased out ISDS for U.S. and Canadian exporters and investors.

India’s view on Investment Treaties

- Brazil-India Investment Cooperation and facilitation Agreement focuses more on investment facilitation than ISDS.

- This model emphasizes conflict resolution through domestic level ombudsmen supporting investors and preventing disputes from escalating.

- Mechanisms such as joint dispute resolution committees are included in the agreement.

- If disputes cannot be resolved, mediation remains an option, but only as a last resort.

- India has also signed trade and investment partnership agreements with Switzerland, Iceland, Norway and Liechtenstein.

- The agreement emphasizes investors’ confidence building and cooperation, and has an advisory mechanism for dispute resolution.

Regulatory concerns

- The idea of creating a regulatory framework for the follow-up of foreign investment is currently being explored by the Government of India.

- The objective is to assure that foreign investment is legal and used as desired, especially in light of national security concerns.

- While greater oversight will improve safety, there is concern that foreign investors will come under greater regulatory pressure.

- Many industries in India are now regulated, so adding more could make investments more difficult.

Need of the hour: Deregulation

- Even after climbing good on ease of doing index, India is still considered to be the most regulated in the world, despite policies for corporate growth.

- Policymakers must strike a balance between security and the enhancement of an environment conducive to business.

- Excessive regulation can deter foreign investors, undermining the broader goal of attracting more FDI.

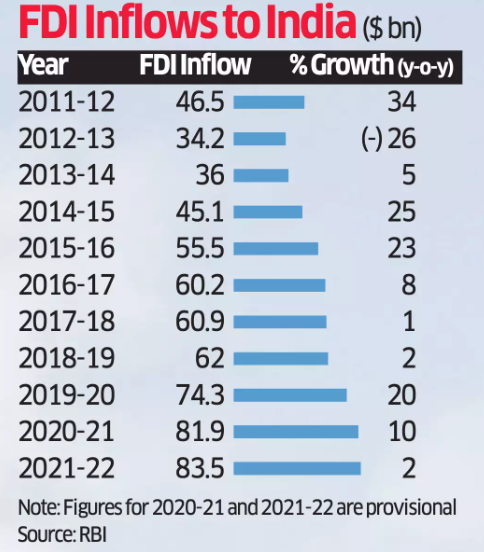

FDI Trends in India

- In 2023-24, domestic and foreign investment in India declined by 3% from 22% in the previous year.

- This raised concerns, as FDI inflows have yet to reach the peak of about $60 billion recorded in 2020-21 and 2021-22.

- FDI inflows picked up in 2024, up 48% in the April-June quarter, to $16.2 billion.

- This means that India remains an attractive investment destination, although challenges remain.

- India faces stiff competition from other emerging markets. Brazil, for example, has attracted significant FDI without relying on ISDS.

- Its approach focuses on investment facilitation and conflict prevention, providing a valuable model for India to consider.

Learn from Global best practices

- An important issue on how India can increase investment without relying on ISDS is the Investment Promotion and Cooperation chapter of the Agreements with Switzerland, Iceland, Norway and Liechtenstein.

- The aim is to create an investor-friendly environment through collaboration and promotion.

- Indo-Pacific Economic Framework (IPEF): India has demonstrated its commitment to enabling investments, especially in areas such as workforce development and clean energy, by incorporating the IPEF Program

- The strength of the deal is consistent with India’s larger economic objectives.

Clarity and stability Needed

- To attract more FDI, India should focus on further simplifying its regulatory frameworks.

- Uncertainty about what is allowed and not allowed creates uncertainty for investors.

- Clear and consistent regulation is essential to increase investor confidence.

- While national security is a legitimate concern, arbitrary measures that create additional barriers for investors should be avoided.

- Policymakers need to ensure that the new rules are transparent and fair.

- India has improved its ease of doing business, offering incentives in 14 sectors.

- More needs to be done to ensure a business-friendly environment that attracts long-term investment and encourage FDI.

Conclusion

FDI is backbone for Indian economic expansion. Need of the hour is prioritize rule of law, transparent regulatory framework, that will attract investment and innovation, and foster long-term prosperity and confidence in regional trade.

Source: Livemint

Mains Practice Question:

How Rule of law can impact FDI in India. Mention the investor dispute settlement mechanism introduced in India, is it investor friendly?