FATF report on India and its categorization in “regular follow-up” category

Syllabus:

GS 2:

- Bilateral, Regional and Global Groupings and Agreements involving India and/or affecting India’s Interest.

GS 3:

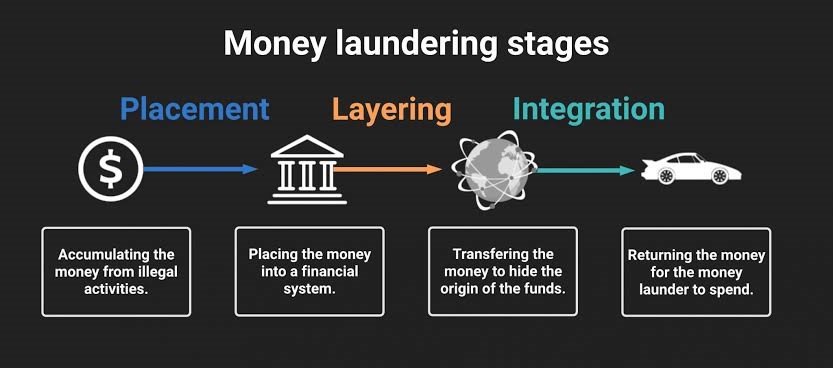

- Money Laundering and associated Issues

Focus:

India’s recent Mutual Evaluation Report by the Financial Action Task Force (FATF) has placed the country in the “regular follow-up” category. While it highlights India’s efforts in combating money laundering and terror financing, the report also flagged crucial areas for improvement in financial regulation and prosecution.

Overview of FATF and India’s Membership:

- FATF Role: FATF is a global watchdog focused on preventing money laundering (ML) and terrorist financing (TF) through a set of international standards.

- Formation: Established in 1989 as a G7 initiative, FATF aims to combat financial crimes like ML and TF globally, expanding its mandate in 2001.

- Membership: India became an FATF member in 2020, joining a group of 40 countries working collaboratively to curb illicit financial flows.

- Recommendations: FATF provides 40 recommendations divided into seven categories, including preventive measures, transparency, and international cooperation.

- Evaluation History: India’s first FATF mutual evaluation occurred in 2010, with a follow-up report in 2013. The latest onsite assessment took place in November 2023.

About Financial Action Task Force (FATF)

What is the FATF?

- Global Watchdog: FATF is an international body established in 1989 during a G-7 meeting in Paris to combat money laundering.

- Mandate Expansion: After the 9/11 attacks, its mandate extended in 2001 to include efforts against terrorist financing, and in 2012 to counter financing of Weapons of Mass Destruction (WMD).

Members and Observers of FATF

- Members: FATF has 39 members, including major global financial centres. Two regional organizations – European Commission and Gulf Cooperation Council – are also members.

- India’s Membership: India became an observer in 2006 and a full member in 2010. It is also part of FATF’s regional groups like APG and EAG.

- Observers: Indonesia is the only observer country, with organizations like ADB, IMF, Interpol, and World Bank also holding observer status.

Grey and Black Lists of FATF

- Tri-annual Meetings: FATF reviews countries ‘ Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) regimes three times a year.

- Grey List: Countries under “increased monitoring” due to deficiencies in AML/CFT measures are placed here. They must meet FATF recommendations to avoid blacklisting.

- Black List: Countries with severe deficiencies are placed on the “high-risk jurisdictions” list. Currently, Iran, North Korea, and Myanmar are blacklisted due to terror financing concerns.

Mutual Evaluation Report and India’s Ranking

- Evaluation Process: FATF conducts peer-reviewed mutual evaluations, assessing countries on anti-money laundering and counter-terrorism financing systems.

- India’s Ranking: India’s placement in the “regular follow-up” category is viewed positively, particularly against objections raised by developed countries.

- Follow-up Categories: Only four G20 nations, including the UK and France, share India’s “regular follow-up” ranking, requiring reports every three years.

- Comparative Standing: Most developing nations are placed in the “enhanced follow-up” category, which mandates annual submissions and stricter monitoring.

- Favourable Outcome: India’s ranking indicates sufficient compliance with FATF standards, allowing for less frequent evaluations compared to higher-risk countries.

Key Findings and Areas of Concern:

- Money Laundering Sources: India faces significant money laundering risks from internal activities like fraud, corruption, drug trafficking, and cyber-enabled fraud.

- Terrorism Threats: Regional insurgencies in the Northeast, Left-Wing Extremist groups, and IS-linked factions in Jammu and Kashmir pose major terrorism threats.

- Prosecution Challenges: India needs to improve prosecution and conviction rates in money laundering and terrorism financing cases to enhance its regulatory framework.

- Registry Monitoring: FATF highlighted the need for better monitoring of accurate ownership information in the Ministry of Corporate Affairs (MCA) registry.

- Non-Profit Sector: The NPO sector requires additional measures to prevent its misuse for terrorist financing, with stronger oversight and implementation of regulations.

Improvement Areas Highlighted by FATF:

- Prosecutions: FATF urged India to increase the number of prosecutions and convictions in both money laundering and terror financing cases to deter future crimes.

- Customer Risk Profiling: Financial institutions need enhanced customer risk profiling systems to better identify and mitigate potential money laundering

- MCA Registry: There is a need to improve the accuracy of beneficial ownership information in the Ministry of Corporate Affairs (MCA) database to ensure transparency.

- Human Trafficking Link: FATF pointed out the connection between money laundering and human trafficking, suggesting more robust efforts to tackle this nexus.

- Terror Financing Delays: The report called for addressing delays in prosecuting terror financing cases, which currently hinder India’s efforts to combat such crimes effectively.

Significance of India’s FATF Report

- Global Standing: India’s ranking in the “regular follow-up” category enhances its reputation globally as a nation taking steps to combat financial crimes effectively.

- G20 Comparison: Being in a category with only four G20 members highlights India’s strong compliance, distinguishing it from many developing countries.

- Economic Impact: Improved anti-money laundering and counter-terrorism financing frameworks can attract more foreign investment, boosting India’s economic credibility.

- Regulatory Strengthening: The report emphasizes the importance of continual improvements in India’s financial and regulatory sectors to meet FATF’s global standards.

- Long-Term Goals: India’s ability to strengthen its financial systems will significantly impact its ongoing fight against terrorism, corruption, and financial crimes.

Conclusion:

The FATF report acknowledges India’s progress in aligning with global anti-money laundering and terror financing norms but emphasizes the need for strengthening regulatory frameworks. Addressing prosecution gaps, improving financial transparency, and safeguarding the non-profit sector will be essential for India to meet international standards and ensure economic security.

Source: Indian Express

Mains Practice Question

Critically analyze the findings of the FATF’s Mutual Evaluation Report on India. Highlight the key areas for improvement and suggest measures to enhance India’s efforts in combating money laundering and terror financing.

Associated Article:

https://universalinstitutions.com/india-achieves-outstanding-outcome-in-fatf-evaluation/