Excessive Cess Usage Reduces States’ Revenue Share

Why in the news?

The Union government’s increasing use of cess, reducing the share of divisible taxes to states, has sparked concerns over federalism and financial fairness for state governments.

Cess as a Tool to Centralise Revenue:

- Cess is a specific tax imposed for a designated purpose but not shared with state governments.

- The Modi government has increasingly used cess, depriving states of their rightful revenue from the divisible tax pool.

- In 2012, cess accounted for 7% of Union tax revenue, which increased to 16% in 2023.

Impacts on State Finances

- The rise in cess and surcharges has reduced the divisible tax pool, shrinking it from 89% of gross tax revenue in 2011 to 79% in 2021.

- Between 2019-2023, the Union government collected ₹13 lakh crore in cess, excluding GST compensation.

- A CAG report found that ₹1 lakh crore of cess collected in 2018-19 was withheld from its designated funds.

Definition of Cess:

- A cess is an additional tax imposed for a specific purpose, on top of existing taxes.

- Revenue from cess is used for the designated purpose after parliamentary approval.

- Article 270 of the Constitution excludes cess from the divisible pool of taxes shared with states.

Types of Cess:

- Common examples include:

- Health and Education Cess

- Road and Infrastructure Cess

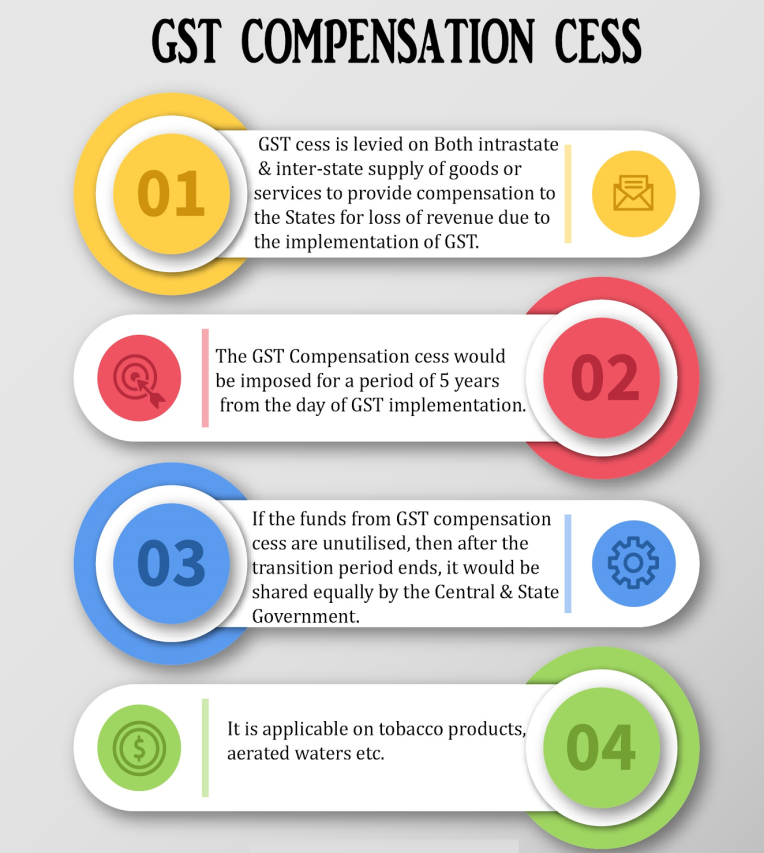

- GST Compensation Cess

- National Calamity Contingent Duty

- Cess on Crude Oil, Exports, and Tobacco

- Health Cess on imported medical devices (introduced in 2020)

Background:

- India has imposed 42 different cesses since 1944.

- Initially, cesses targeted specific industries like salt, tea, and welfare of workers in mines and film industries.

Sources Referred:

PIB, The Hindu, Indian Express, Hindustan Times