“EXAMINING INDIA’S PHARMACEUTICAL INDUSTRY: POLICY CHANGES, CHALLENGES, AND QUALITY ASSURANCE”

Syllabus:

- GS-3 :India’s Pharmaceutical industry , localization and related trade

Focus :

- The article delves into the recent policy shifts led by the Central Drugs Standard Control Organisation (CDSCO) regarding the centralization of licensing authority for export drugs in India’s pharmaceutical industry.

- It examines the potential ramifications of these changes on India’s global pharmaceutical standing, including challenges, quality assurance efforts, and industry reactions.

Source - TH

Introduction:

- The Central Drugs Standard Control Organisation (CDSCO) has withdrawn powers delegated to State licensing authorities for issuing NOCs for certain drugs meant for export.

- This decision comes amidst scrutiny over allegations of supplying substandard drugs, highlighting India’s significant role in the global pharmaceutical market.

| About CDSCO:

1. Regulatory Authority: The Central Drugs Standard Control Organisation (CDSCO) is India’s primary regulatory body responsible for regulating pharmaceuticals, medical devices, and cosmetics. It operates under the Directorate General of Health Services, Ministry of Health and Family Welfare. 2. Drug Approval and Regulation: CDSCO oversees the approval and regulation of drugs in India, ensuring their safety, efficacy, and quality. It evaluates new drug applications, conducts inspections of manufacturing facilities, and monitors post-market surveillance to uphold standards. 3. Licensing and Permissions: CDSCO grants manufacturing licenses, import licenses, and market approvals for pharmaceutical products. It sets guidelines for Good Manufacturing Practices (GMP) and issues NOCs (No Objection Certificates) for the export of drugs. 4. Quality Control and Testing: CDSCO conducts quality control tests on pharmaceutical products to ensure compliance with regulatory standards. It establishes laboratories for testing drug samples and collaborates with national and international agencies for quality assurance. 5. International Collaborations: CDSCO collaborates with international regulatory agencies, including the US FDA, WHO, and EMA, to harmonize regulatory practices and enhance global cooperation in drug regulation. This facilitates the exchange of information, expertise, and best practices. 6. Policy Formulation: CDSCO plays a key role in formulating policies and guidelines related to drug regulation and pharmaceutical manufacturing. It regularly updates regulations to align with international standards and address emerging challenges in the pharmaceutical sector. |

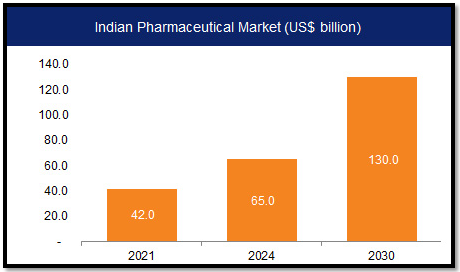

India’s Role in the Pharma Market:

- India ranks third globally in drug production, exporting to around 200 countries/territories.

- The Indian pharmaceutical industry supplies a significant portion of global vaccine demand, including crucial vaccines like DPT, BCG, and measles vaccines.

- At least 70% of WHO’s vaccines are sourced from India, showcasing its pivotal role in global healthcare.

Impact of Policy Changes:

- Centralization of licensing authority for export drugs has a direct impact on manufacturers and importers.

- The move is significant as India gears up to capitalize on a projected $251 billion worth of drug sales going off-patent in the coming decade.

- India’s focus on self-reliance necessitates timely identification and entry of new drugs into the market, promoting generic drug manufacturing.

Challenges in the Pharma Industry:

- Challenges include tackling intellectual property rights, enhancing research and development, and navigating regulatory requirements.

- Understanding external factors such as political, economic, sociocultural, technological, environmental, and legal aspects is vital for industry success.

- Adapting to changes, leveraging technology advancements, and aligning strategies with industry needs are essential for global competitiveness.

Response from Industry Experts:

- Raheel Shah from BDR Pharmaceuticals welcomes the centralization of NOCs, citing increased efficiency and bolstered exports to international markets.

- Harish K. Jain, president of Federation of Pharma Entrepreneurs, anticipates no major impact on costing or delays due to the centralization, highlighting that export of drugs falls under the Union List.

Quality Assurance Measures:

- Recent actions by the Indian government, including cancellation of licenses and crackdowns on poor quality manufacturing, demonstrate a commitment to quality assurance.

- The government’s crackdown followed inspections of numerous drug firms across multiple states.

- Strict measures are being implemented, including obtaining NOCs from zonal CDSCOoffices before applying for manufacturing licenses from State/UT drug regulators.

Historical Context and Regulatory Changes:

- The centralization of powers reflects a continuous effort to streamline processes and address inefficiencies in drug regulation.

- Earlier, the CDSCO had delegated the authority to grant permissions for exporting specific drugs to State and UT drug licensing authorities.

- The latest order requires local regulators to provide details of approvals granted from August 2018 to May 2024 to CDSCO, ensuring centralized oversight.

Conclusion:

- India’s pharmaceutical industry plays a crucial role in global healthcare, and policy changes aim to strengthen its position.

- Challenges such as ensuring quality assurance, navigating regulatory complexities, and promoting research and development require concerted efforts from industry stakeholders.

- The centralization of licensing authority for export drugs reflects ongoing efforts to enhance efficiency and regulatory oversight in the pharmaceutical sector.

Source:Indian Express

Associated article :

https://universalinstitutions.com/the-cost-of-cheap-drugs/

Mains Practice Question :

GS-3

“Analyse the recent policy changes initiated by the Central Drugs Standard Control Organisation (CDSCO) regarding the centralisation of licensing authority for export drugs in India’s pharmaceutical industry.” (250 words)