”EVALUATING THE BUDGET’S PATH TO FISCAL CONSOLIDATION AND GROWTH”

Syllabus:

- GS-3- Budget , fiscal consolidation , economic development

Focus :

- The article focuses on the recent Budget’s clear objectives for fiscal consolidation and economic growth while highlighting the uncertainties in its implementation strategies. It scrutinizes the differences between the interim and final Budgets, assesses the effectiveness of revenue and expenditure measures, and underscores the importance of performance budgeting and private sector investment.

Source - IE

Introduction

- The Budget outlines clear objectives and action plans, but the roadmaps to achieve these objectives are not well-defined.

- Effective implementation of projects is crucial, especially given the emphasis on expenditures.

Comparison with Interim Budget

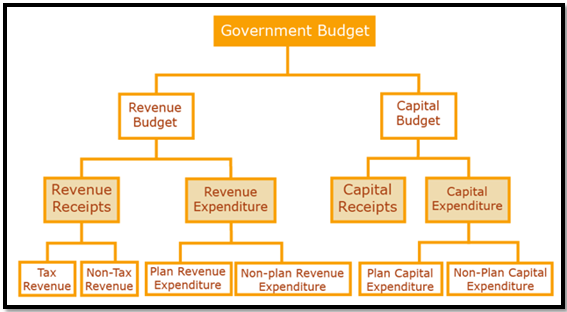

Expenditure Side

- Only marginal differences between the interim and final Budgets on the expenditure side.

- Revenue expenditure growth increased from 4.6% in the interim Budget to 6.2% in the final Budget over the provisional actuals of 2023-24.

Revenue Side

- Significant impact from RBI’s increased dividends.

- Gross tax revenue estimated at Rs 38.4 lakh crore, assuming a gross tax buoyancy of 1.03 and nominal GDP growth of 10.5%.

- Provision of tax devolution to the States increased by Rs 27,428 crore.

Revenue and Fiscal Measures

Tax Revenues

- Gross tax revenue estimated based on realistic GDP growth assumptions.

- Government’s net tax revenues stand at Rs 25.83 lakh crore.

Non-Tax Revenues

- Estimated at Rs 5.46 lakh crore, with total net revenue receipts amounting to Rs 31.29 lakh crore.

Fiscal Deficit

- Fiscal deficit targeted at Rs 16.13 lakh crore, brought down to 4.9% of GDP from 5.1% in the interim Budget.

- Fiscal consolidation should aim to reduce the fiscal deficit to 3% of GDP as soon as possible.

Expenditure Allocation

Revenue and Capital Expenditures

- Total expenditure budgeted at Rs 48.20 lakh crore, with a ratio of 77:23 between revenue and capital expenditures.

- No change in the budgeted amount of capital expenditures, which remains at Rs 11.11 lakh crore.

- Non-defense capital outlay reduced by nearly Rs 21,000 crore, added to loans and advances.

Loans to States

- Provision for lending interest-free loans to States, continuing since the COVID-19 year of 2020-21.

- Limited utilization of these loans by States, with higher usage by less developed States like Bihar, Madhya Pradesh, Rajasthan, and Uttar Pradesh.

Revenue Measures

Income Tax Act Review

- Comprehensive review of the Income Tax Act, 1961, to be completed in six months.

- Rationalization and rate increases for capital gains tax, with concerns about the discontinuation of indexing for real estate assets.

- Move towards a single model for personal income tax, eliminating the dual alternative system

Angel Tax Removal

- Removal of the angel tax to facilitate venture capital flow into startups.

Employment and Economic Growth

Employment Linked Incentives

- Introduction of Employment Linked Incentives with three components.

- Doubts about whether these schemes will lead to formal, stable, and long-term employment.

- Potential for these schemes to provide temporary employment and training, improving absorption in the formal non-farm sectors.

Employment Elasticity of Growth

- The link between output growth and technology choice is critical.

- New technologies like AI and Gen AI may reduce the absorption of people for each unit of output, necessitating higher growth for increased employment.

Performance Budgeting

- Emphasis on performance budgeting to ensure actual expenditures match planned expenditures.

- Quantification of the success of past schemes is necessary to evaluate the effectiveness of current and future initiatives.

Conclusion

- The Budget has highlighted critical areas for growth and emphasized fiscal consolidation.

- Effective implementation of projects and performance budgeting are crucial to achieving the Budget’s objectives.

- There is a need for clearer roadmaps and continuous fiscal consolidation to create space for private sector investment and sustainable economic growth.

Mains UPSC Question

“Critically examine the recent Budget’s approach to fiscal consolidation and economic growth. Discuss the differences between the interim and final Budgets, and evaluate the potential impact of revenue and expenditure measures on the economy.” (250 words)

Associated Article –

https://universalinstitutions.com/budget-session-of-parliament/