EU CARBON TAX: INDIA FLAGS RISK OF TRADE INFO GETTING COMPROMISED

Why in the News?

- India has expressed apprehensions about the potential compromise of sensitive and confidential trade data of its exporters.

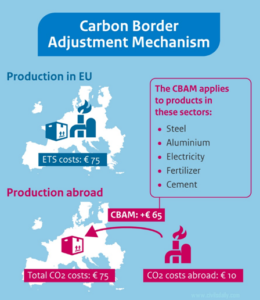

- The concerns are specifically linked to compliance with the European Union’s Carbon Border Adjustment Mechanism (CBAM).

- CBAM is recognized as the world’s inaugural system that imposes carbon emission tariffs on various imports, including iron, steel, aluminium, and cement, within the 27-nation bloc.

About the CBAM

- CBAM is scheduled to be implemented from 2026, but the transition period, during which exporters must provide data to EU authorities, commenced on October 1, 2023.

- EU importers are obligated under CBAM to furnish nearly 1,000 data points and disclose production methods employed by exporters, with the primary goal of assessing carbon emissions.

- Despite the EU’s stated objective, Indian exporters are apprehensive about divulging critical information, fearing potential erosion of their competitive advantage.

Concerns about CBAM

- India exports more than 15 percent of its overall goods to the European Union.

- For the fiscal year 2022-23, India recorded exports valued at $75 billion to the EU.

- There is a noticeable deceleration in India’s exports to the EU this year, attributed to diminishing demand in the western markets.

- Key sectors in Indian manufacturing, including steel, oil refining, and cement, exhibit strong alignment with global cost competitiveness standards.

- The European Union contends that the data collection associated with CBAM is intended to assess carbon emissions.

- However, Indian exporters express concerns about potential repercussions, fearing a compromise in their competitive edge due to the disclosure of critical information.

Solutions to tackle CBAM

- The Indian government has raised queries about the CBAM in the World Trade Organization (WTO) and is actively seeking concessions.

- Ongoing negotiations with the EU are predominantly taking place within the framework of the Trade and Technology Council (TTC).

- India’s engagements in the TTC gain significance as the EU maintains a bilateral forum of this nature exclusively with the United States.

- While the EU has consented to incorporating CBAM-related solutions in the Free Trade Agreement (FTA) currently under negotiation, the specific details of these arrangements have not been finalized.