EPFO ALERT: HANDLING REJECTIONS AND DELAYS

Syllabus:

- GS 2: Governance

Why in the News?

Recently, challenges in transferring a Provident Fund (PF) have highlighted bureaucratic hurdles in India’s retirement system, including issues like incorrect pension enrollments, administrative errors, and complex account management.

Source: Livemint

Introduction

- Navigating India’s Provident Fund (PF) system often presents significant bureaucratic hurdles.

- Employees frequently encounter delays, errors, and complex processes in managing their PF accounts, leading to frustration and prolonged resolution times.

- Despite efforts to streamline operations, challenges persist in ensuring smooth transactions and accurate record-keeping.

Employees’ Provident Fund Organisation (EPFO)

|

Bureaucratic Hurdles in India’s Provident Fund System

Complexities in Provident Fund Transfers

- Incorrect Enrollments: Errors in pension scheme enrollments can complicate PF transfers and withdrawals. Mistakes by employers or the Provident Fund Office (EPFO) often require lengthy corrections, leading to frustration.

- Administrative Errors: Issues with account management, such as mismatched or missing contributions, exacerbate the problem. These errors can prevent employees from accessing their funds promptly.

- Delayed Withdrawals: The process of withdrawing PF funds can be hindered by procedural delays and a lack of clarity. Employees may face rejections and require multiple interventions to resolve their issues.

Systemic Challenges

- The rigid structure of the PF system and lack of transparency contribute to these problems.

- Even multiple visits to EPFO offices often yield little relief, leaving employees in a prolonged state of uncertainty and financial distress.

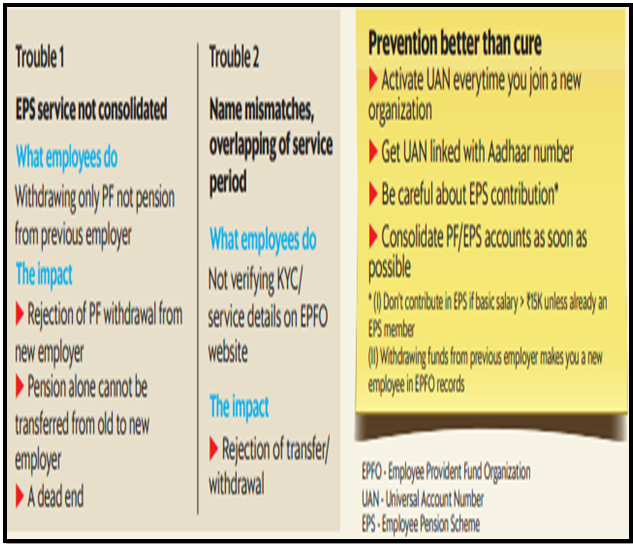

Issues with EPS Contributions

Employees’ Pension Scheme (EPS) presents two main challenges

Transfer vs. Withdrawal

- For Exempted Employers: If an employee does not consolidate their EPS account, transferring or withdrawing PF remains possible, provided all credentials are correct.

- For Unexempted Employers: If PF is withdrawn without transferring EPS, the EPS contribution cannot be transferred separately, creating a deadlock situation.

New Employee Eligibility

- Contribution Rules: Since 1 September 2014, employees earning a basic wage over ₹15,000 per month are eligible only for EPF.

- This means the entire 24% contribution (12% from both employee and employer) is retained in the PF account.

- Impact of Withdrawal: If an employee withdraws PF from a previous employer and joins a new firm, they are treated as a new employee.

- This status can complicate EPS contributions and withdrawals.

- To access EPS funds, the amount must be transferred to the current PF account, and employees might be required to forgo interest on it.

Challenges with Universal Account Number (UAN)

Issues with Transfer Records

- One significant challenge with the Universal Account Number (UAN) system is the difficulty in tracking Provident Fund (PF) transfers.

- If an employee’s UAN is active, it should ideally reflect all contributions.

- However, records from exempted organizations often do not appear on the EPFO website, leading to uncertainty about whether transfers have been completed.

- Employees may find it challenging to verify their PF transfer status online, especially if the deposit statements are not visible.

Online vs. Offline Processes

- EPFO’s shift to online-only processes has created hurdles for those unfamiliar with digital systems.

- Transfer and withdrawal requests can no longer be processed offline, making it difficult for individuals who face issues signing in online.

- This transition has made it essential for employees to manage all transactions through the EPFO portal.

Data Accuracy

- Name mismatches and incorrect data entries pose significant problems.

- EPFO relies heavily on the accuracy of information provided by employees, such as names, parentage, and other personal details. Errors in these details can halt the entire process.

- It is crucial for employers to verify and upload accurate KYC documents, such as PAN, Aadhaar, and bank account details linked to the UAN, to avoid delays and complications.

Resolving EPF Issues

Strengthened Procedures

- Online Submission of Forms: EPFO has introduced Standard Operating Procedures (SOPs) for online submission of joint declaration forms, which must be completed by both the employer and employee.

- Regional Meetings: Despite online processes, employees might still need to meet with regional PF commissioners for corrections.

Complaint Resolution

- Resolution Timeline: EPFO aims to resolve queries within 20 days. If delays occur, employees can file complaints on the Centralized Public Grievance Redress and Monitoring System.

- Escalation: Complaints can be escalated to the Directorate of Public Grievances, which forwards them to the Prime Minister’s Office for faster resolution.

Way Forward for EPFO System

- Improve Process Efficiency: Streamline PF transfer and withdrawal procedures to minimize bureaucratic delays.

- Enhance online systems to reduce dependency on physical visits and manual processes.

- Address Administrative Errors: Implement robust mechanisms for accurate enrolment and timely corrections.

- Increase transparency in handling EPS issues and ensure proper consolidation of records.

- Enhance User Experience: Upgrade the EPFO portal for better user interface and accessibility.

- Provide clear guidelines and support for employees facing challenges with UAN and PF transfers.

- Strengthen Accountability: Establish clearer timelines for resolving queries and complaints.

- Facilitate quicker resolution through escalation mechanisms, including involvement of higher authorities if necessary.

Conclusion

The complexities and inefficiencies in India’s provident fund system highlight the need for streamlined processes, improved transparency, and better user support to facilitate smoother transactions and resolve common issues effectively.

Source:Livemint

Mains Practice Question:

Discuss the key challenges faced by employees in managing Provident Fund (PF) accounts in India. How do these challenges impact the efficiency of the retirement fund system?

Associated Article:

https://universalinstitutions.com/employee-provident-fund-organization-new-instructions/