DPIIT SUPPORTS INDUSTRY’S CALL TO REMOVE ANGEL TAX

Why in the news?

- The Department for Promotion of Industry and Internal Trade (DPIIT) backs the removal of angel tax.

- Secretary Rajesh Kumar Singh emphasised the recommendation based on startup ecosystem discussions.

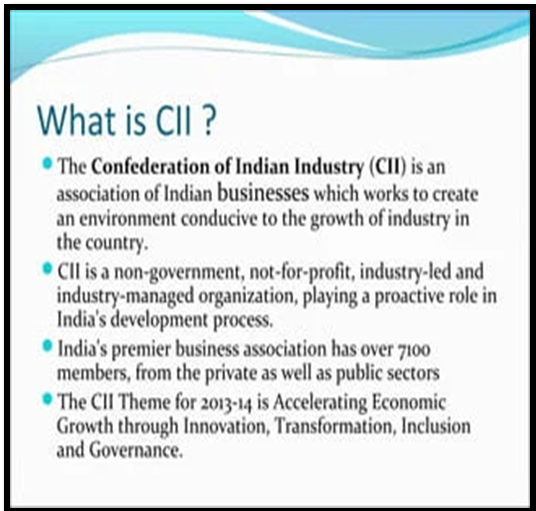

- The Confederation of Indian Industry (CII) supports this move to boost capital formation.

source:slideshare

About Angel Tax:

- Definition: Tax on capital raised via shares by unlisted companies above fair market value, treated as income.

- Rate: 30.9% on excess net investments.

- Origin: Section 56(2)(viib) of the Income Tax Act, introduced in 2012.

- Objective: Deter unaccounted money generation.

- Exemptions: Startups recognized by DPIIT, with conditions on capital and investor net worth.

- 2023 Update: Extended to non-resident investors.

About Central Board of Direct Taxes (CBDT):

What are Unlisted companies?

Associated Article: |