DOLLARISATION’S POTENTIAL IMPACT ON ECONOMIES: ARGENTINA’S CASE STUDY

Why in the News?

- Milei’s Presidency proposals includes the replacement of Argentina’s peso with the dollar.

- Argentina grappling with inflation over 100% and a poverty rate affecting two-thirds of the population due to eroding wages. canals.

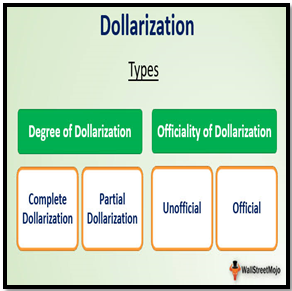

Source: Wall Street Mojo

Immediate Challenges and Policy Shifts

- President-Elect’s Stand: Milei’s initial plan to swiftly dollarise faces challenges due to scarce dollar reserves held by Argentina’s Central Bank.

- Policy Revisions: Walking back on immediate currency control removal, citing dollarisation as a “medium-term” objective.

Dollarisation’s Theoretical Benefits

- Economic Theory: Dollarisation aims to break the link between rising prices and increased money supply, potentially curbing inflation and consumer spending.

- Growth and Stability: Stable currency incentivizes export focus and encourages foreign investment, fostering long-term economic planning.

Potential Concerns and Challenges

- Policy Leverage Loss: Adapting the dollar restricts monetary policy maneuverability, limiting options for controlling money supply.

- Trade Implications: Dependence on export promotion, inability to rely on currency depreciation to boost exports, possibly requiring productivity-focused government interventions during downturns.

Ecuador’s Dollarisation Experience

- Success Story: Ecuador, post-2000 dollarisation, saw significant economic growth, poverty reduction, and stabilized inflation.

- Not Solely Dollarisation: Notably aided by oil and gas reserves, commodity booms, and strategic government policies driving social spending and debt restructuring.

Complex Policy Dynamics

- Diverse Factors: Successful economic outcomes rely on sustained policymaking, external circumstances, and effective utilization of resources.

- Greece’s Euro Adoption: Highlights limitations of adopting

external currency without independent fiscal and monetary policy, leading to austerity measures and dependency on external financial aid.

Implications for Argentina

- Milei’s Policies: Potential reduction in policy flexibility under Milei’s administration, with plans to slash government spending and abolish the Central Bank.

- Economic Gamble: Milei’s unconventional policies, impacting a suffering populace, await results in the realm of macroeconomics.

Source: Wall Street Mojo

Source: Wall Street Mojo