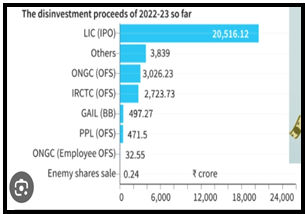

DISINVESTMENT STRATEGY SHIFT

Focus:

- The government didn’t set disinvestment targets in the Interim Budget for 2024-25.

- This shift aims to adopt a broader approach to disinvestment beyond fiscal deficit management.

Source: IE

New Paradigm Highlighted:

- Disinvestment should focus on proper public enterprise management, not just fiscal deficit reduction.

- Strategic disinvestment and stake dilution through market listing are key strategies.

- Administrative ministries’ reluctance to let go of PSUs is a hurdle.

- Timeline unpredictability due to the learning curve in executing strategic disinvestment.

| About Disinvestment

· Definition: o Disinvestment entails the government selling its stake in public sector enterprises to strategic or financial buyers. o Sales occur either through stock exchanges or direct transactions. · Utilization of Proceeds: Revenue generated funds social and infrastructure projects and aids in reducing the government’s fiscal deficit. · Approaches: o Minority Disinvestment: Government retains over 51% stake, ensuring management control. o Majority Divestment: Government cedes control while retaining some ownership. o Complete Privatisation: Entire company ownership is transferred to the buyer. · Execution: o Conducted by the Department of Investment and Public Asset Management (DIPAM), under the Ministry of Finance. o DIPAM oversees government equity disinvestment in public sector enterprises. o Proceeds are channeled into the National Investment Fund (NIF), established in 2005. |

Source: IE

Source: IE