DECODING THE EU’S CARBON BORDER TAX

(A MATTER OF CONCERN FOR INDIA)

Syllabus:

- GS 2 : Global Groupings and Agreements involving India and/or affecting India’s interests.

- GS 3 : Conservation, Environmental Pollution and Degradation.

Focus:

- The European Union’s (EU) Carbon Border Adjustment Mechanism (CBAM) has sparked considerable apprehension in India.

- Envisioned to tax carbon-intensive imports, this policy poses challenges for India’s manufacturing sector.

- Understanding the CBAM’s nuances is crucial for India’s strategic response.

Source: EU

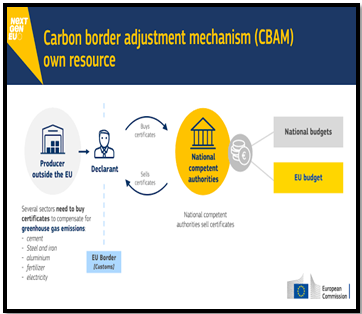

| Understanding Carbon Border Adjustment Mechanism (CBAM)

Overview: · CBAM is a pivotal component of the “Fit for 55 in 2030 package,” aligning with the EU’s commitment to reduce greenhouse gas emissions by 55% by 2030. · Aimed at enforcing equal carbon costs, CBAM ensures imported goods bear the same environmental expenses as those produced within the EU. · CBAM is a vital part of the European Green Deal to achieve this target. Implementation: · Transitional phase from October 2023, requiring reporting of GHG emissions in imports. · Definitive phase from January 2026, imposing import duty based on declared emissions. · Importers must annually declare imported goods quantity and associated Greenhouse Gas (GHG) emissions. · Offsetting these emissions involves surrendering CBAM certificates, priced based on the EU Emission Trading System (ETS) allowances’ weekly average auction price. Objectives: · Safeguarding climate objectives from carbon-intensive imports, CBAM promotes cleaner production globally. · Encourages non-EU countries to adopt stricter environmental regulations, contributing to a reduction in global carbon emissions. · Mitigates carbon leakage, preventing companies’ carbon-intensive production shift to countries with lax environmental regulations. Significance: · CBAM revenue supports EU climate policies, serving as a model for other nations to bolster green energy initiatives. · Acts as a catalyst for stringent environmental regulations adoption worldwide, fostering a global reduction in carbon emissions. · Similar to the EU’s Emission Trading System (ETS) but targets imports. |

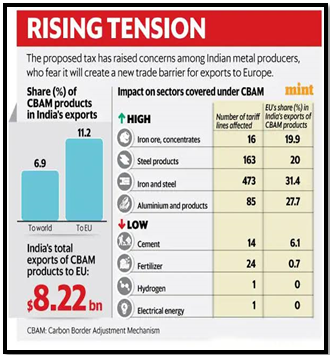

Impact on India:

Export Adversity:

- Extra scrutiny on India’s metal exports (Iron, Steel, aluminium) under CBAM.

- Major exports like iron ore and steel threatened with carbon levies from 19.8% to 52.7%.

Carbon Intensity and Tariffs:

- Indian products show higher carbon intensity than the EU and others.

- Coal-dominated energy consumption in India leads to elevated emissions and subsequent higher carbon tariffs.

Critical Industry Impact:

- India among the top eight countries adversely affected.

- Significant impact on core sectors like steel, with 27% of India’s exports in 2022 going to the EU.

Risk to Competitiveness:

- Sectors like steel, aluminium, cement, etc., initially affected, may expand to include various goods.

- Absence of domestic carbon pricing system in India poses a risk to export competitiveness, favouring countries with established schemes.

Source: Mint

Key Measures for India :

- Asserting Responsibilities:

- Asserting the concept of common but differentiated responsibilities in negotiations, safeguarding India’s interests and considering the impact on developing nations.

- Challenging CBAM’s compliance at the World Trade Organization under special and differential treatment provisions.

- Implementing the Carbon Credit Trading System (CCTS) under the amended Energy Conservation Act.

- Complementing CCTS with Green Credit Programme Rules, fostering environmentally proactive actions.

- Questioning CBAM’s alignment with common but differentiated responsibilities under the Paris Agreement.

- Clean Technologies Exchange:

- Engaging the EU in negotiations for acquiring clean technologies and financial mechanisms to enhance India’s carbon efficiency.

- Proposing a dedicated portion of EU’s CBAM revenue to support India’s climate commitments.

- Decarbonization Integration:

- Aligning national policies like the National Steel Policy and Production Linked Incentive (PLI) with the Decarbonization Principle.

- Emphasizing a comprehensive approach to reduce greenhouse gas emissions across various sectors.

- Advocating Against EU’s Tax Framework:

- Leveraging India’s leadership role in G-20 2023 to voice opposition against the EU’s carbon tax framework.

- Considering the broader impact on economically challenged countries heavily reliant on mineral resources.

- Negotiating Tax Equivalence:

- Initiating dialogues with the EU to acknowledge India’s energy taxes as a carbon price equivalent, minimizing susceptibility to CBAM.

- Showcasing the tax on coal as a strategic measure internalizing carbon emissions, thus equating to a carbon tax.

| Key Terms

1. Carbon Credit Trading System (CCTS): · CCTS aims to incentivize emission reduction actions by allowing entities to trade carbon credits. It operates under the amended Energy Conservation Act. · Implementing Agency: Governed by the Ministry of Power in India. 2. Green Credit Programme Rules: · These rules encourage environmentally proactive actions, complementing CCTS. They provide a market-based mechanism to promote sustainable practices. · Implementing Agency: Enforced by the Ministry of Environment in India. 3. Production Linked Incentive (PLI): · PLI is a government scheme promoting manufacturing by providing financial incentives. It encourages production in key sectors, fostering economic growth and competitiveness. · Implementing Agency: Overseen by various concerned ministries and departments, depending on the sector. |

Way Forward:

- The need for India to swiftly formulate carbon taxation measures aligned with Paris Agreement principles.

- Considering limited time available, immediate action is imperative to safeguard industries.

- Acknowledge other factors influencing production shifts, such as labour costs and production opportunities in different geographies.

- Monitor ongoing negotiations with the EU and responses to the CBAM.

- Propose that EU collects tax and reinvests funds in green technologies of affected countries.

Understanding the intricacies of the EU’s CBAM is essential for India to navigate its impact effectively. With challenges looming for key industries, India’s strategic response, both at domestic and international levels, becomes pivotal in safeguarding economic interests while aligning with global climate goals.

Source:

Mains Practice Question:

Critically analyze the potential ramifications of CBAM on India’s economy. Discuss the strategic options available to India in navigating this complex environmental and trade policy.

Source: EU

Source: EU Source: Mint

Source: Mint