Preliminary Pointers.

Special Parliament Session

News: Special Parliament Session from 18th September, to hold discussion on Parliamentary Journey of 75years.

- A five-day Special Parliament Session is set to commence.

- On the first day, Lok Sabha will host a discussion on the Parliamentary Journey of 75 years, tracing its evolution from the Samvidhan Sabha, including achievements, experiences, memories, and lessons.

- The government’s legislative agenda for this session includes a Bill related to the appointment of the Chief Election Commissioner and other election commissioners.

- Additionally, scheduled for discussion during the session are The Advocates (Amendment) Bill, The Press and Registration of Periodicals Bill, and The Post Office Bill.

- It’s worth noting that The Advocates (Amendment) Bill and The Press and Registration of Periodicals Bill have already received approval from Rajya Sabha and are pending in Lok Sabha.

- Meanwhile, The Post Office Bill and The Chief Election Commissioner and Other Election Commissioners (Appointment, Condition of Service, and Term of Office) Bill have been introduced in Rajya Sabha.

What is a Special Session of Parliament?

- The term “special session” is not explicitly used in the Constitution.

- It can refer to sessions convened by the government for specific occasions or to commemorate important parliamentary or national milestones.

Summoning a Special Session

- The President, who normally summons regular parliamentary sessions, also summons special sessions.

- This authority is derived from Article 85(1) of the Constitution, which states that “The President shall from time to time summon each House of Parliament to meet at such time and place as he/she thinks fit.”

Chairing Special Sessions

- For both Houses of Parliament to conduct business during a special session, the Presiding Officers, such as the Speaker and Chairman, should oversee the proceedings.

- The Presiding Officers can determine the scope and limits of the session.

- Certain procedural devices, like the question hour, may not be available to Members of Parliament during a special session.

Hedge Fund

News: Lenders allege that Byjus hid $533 million in a hedge fund once run from Miami IHOP.

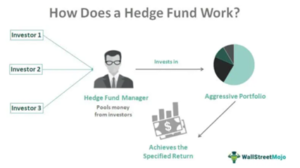

What is a ‘Hedge Fund’?

- Definition: A hedge fund is a private investment partnership and pooled fund that employs diverse and intricate proprietary strategies.

- It engages in trading or investments involving complex financial instruments, both listed and unlisted derivatives.

- Core Function: In essence, a hedge fund is a collective pool of capital that undertakes a wide range of financial activities.

- Objective: The primary goal of a hedge fund is to generate returns while minimizing risk to investors’ capital. The term “hedge” indicates its approach to mitigate or offset potential losses due to market volatility and adverse price movements.

- Regulatory requirements: Hedge funds in India do not need to be necessarily registered with the Securities and Exchange Board of India.

Types of Hedge Funds

- Domestic Hedge Funds: Exclusive to investors subject to the taxation laws of the fund’s home country.

- Offshore Hedge Funds: Established in a foreign, often low-taxation jurisdiction, open to global investors.

- Fund of Funds: These are essentially mutual funds that invest in multiple hedge funds rather than individual securities, providing diversification through hedge fund investments.

Capital Gains Tax

News: Tax tribunal allows capital gain exemption in case of house purchase.

Capital Gains Tax

- Definition: Capital gains tax is imposed on the profits realized from investments.

- Coverage: It encompasses gains from various sources, including real estate, gold, stocks, mutual funds, and a wide range of financial and non-financial assets.

Types

- Long-term Capital Gains Tax (LTCG): Applicable when the investment is held for an extended period.

- Short-term Capital Gains Tax (STCG): Applicable when the investment is held for a shorter duration.

- Uniform Tax Rates: Unlike income tax, the tax rate for capital gains remains consistent, regardless of your overall income tax bracket.

- Equity LTCG Tax: For equity investments, the LTCG tax rate is the same, whether the gains are ₹10 lakh or ₹10 crore, excluding surcharges.

- Special Deductions: Long-term capital gains also come with specific deductions that are not applicable to regular income.

- The 2022 budget has proposed a 30% tax on cryptocurrency, which is higher than capital gains tax in many cases

‘National Disaster’ Tag

News: Himachal CM requests ‘national disaster’ tag after heavy rains.

Assisting States During Natural Disasters

- No Official Category: There is no distinct category termed “national disasters.” Instead, they fall under the purview of the 2005 Disaster Management Act.

- Disaster Definition: The Act defines a “disaster” as an event arising from natural or man-made causes, accidents, or negligence, resulting in significant loss of life, human suffering, property damage, or environmental degradation. It must exceed the coping capacity of the affected community.

- National Disaster Management Authority (NDMA): The Act established the NDMA, led by the Prime Minister, to coordinate disaster management at the national level.

- State Disaster Management Authorities (SDMAs): Each state has its SDMA, headed by the respective Chief Minister, to manage disasters at the state level.

- District-Level Authorities: Alongside the SDMAs, district-level authorities are created to form an integrated Disaster Management setup in India.

- National Disaster Response Force (NDRF): The Act led to the formation of the NDRF, consisting of multiple battalions or teams responsible for on-ground relief and rescue efforts in various states during disasters.

Crimea

News Russia claims that Ukraine launched missile attack on Crimea shipyard.

- Russia reports Ukraine launching 10 missiles and three unmanned boats in an attack on its Black Sea fleet’s home in Crimea.

- Russia’s Defence Ministry reveals the Sevastopol Shipyard in Crimea was ablaze, with two ships damaged in the early Wednesday attack.

- Russia’s air defense systems intercepted and downed seven of the missiles, and a patrol ship destroyed all three boats.

- The shipyard, located in Crimea, annexed by Russia from Ukraine in 2014, plays a vital role in building and repairing ships and submarines for the Russian Black Sea Fleet.

- The Russian Black Sea Fleet has previously launched drone and missile attacks on Ukraine.

Invasion of Crimea

- Historic Annexation: Russia’s seizure of Crimea from Ukraine marked the first instance of a European nation annexing territory from another since World War II.

- Context: The annexation of Crimea followed a Russian military intervention that occurred after the 2014 Ukrainian revolution. It was part of broader unrest in southern and eastern Ukraine.

- Strategic Significance: The invasion and annexation of Crimea have provided Russia with a significant maritime advantage in the region.

Carbon Border Adjustment Mechanism (CBAM)

News: Indian government will shield industry from EU’s Carbon Border Adjustment Mechanism adverse effects, assures Piyush Goyal.

- The CBAM requires reporting of carbon emissions for specific exports to Europe starting from October 1.

- It is aimed at carbon-intensive industries such as cement, iron and steel, aluminum, fertilizers, and electricity imports, with additional import levies to be imposed on such products from 2026.

- CBAM aims to stop carbon leakage by deterring companies from relocating to lower climate regulation regions.

- Indian steel exports to Europe may be significantly affected by CBAM due to the higher carbon intensity of production processes compared to competitors like China.

- Reporting under CBAM will begin in October, but taxes will not be levied until 2026.

- During this period, India is actively discussing a free trade agreement with the EU.

Potential benefits

- Reduce carbon emissions from imported goods.

- Level the playing field for EU businesses.

- Encourage other countries to adopt similar carbon pricing policies.

Potential drawbacks

- Increase costs for businesses and consumers.

- Harm competitiveness of EU businesses.

- Lead to trade disputes.

Cloning Pioneer Ian Wilmut Passes Away

News: Cloning pioneer Ian Wilmut, instrumental in Dolly the Sheep’s creation, Passed away at 79, says University of Edinburgh.

- Wilmut’s team at the University of Edinburgh’s Roslin Institute successfully cloned a lamb, later named Dolly, in 1996.

- Dolly’s cloning was groundbreaking because it used an adult cell nucleus to create a genetically identical animal.

- While some celebrated this achievement, it raised ethical concerns and prompted discussions about cloning’s ethics.

- US President Bill Clinton imposed limits on federal funds for human cloning research after Dolly’s creation.

- Dolly’s cloning led to experiments with cloning other animals and discussions about cloning humans and extinct species.

- Wilmut’s later work focused on using cloning techniques to create stem cells for regenerative medicine.

- He was knighted in 2008, retired in 2012, and continued research on Parkinson’s disease.

- The legacy of Dolly’s cloning continues to influence advances in regenerative medicine.

Hindi Diwas: Celebrating India’s Language

News: Every year, Hindi Diwas is celebrated on September 14 to commemorate the importance of the Hindi language.

- 14 September 1949: Hindi adopted as official language by Constituent Assembly.

- 26 January 1950: Incorporated into Indian constitution on January 26, 1950.

- 14 September 1953: First Hindi Diwas celebrated on September 14, 1953.

- Hindi ranks fourth globally in terms of the number of speakers, following English, Spanish, and Mandarin.

- It is widely spoken as a mother tongue in North India.

- The President of India presents Rajbhasha awards to individuals for their contributions to the Hindi language during a ceremony in Delhi.

- Hindi is an Indo-Aryan language, written in the Devanagari script, and is the official language of India.

- It is one of the Union government’s official languages, along with English, and one of India’s 22 scheduled languages.

- Hindi Diwas aims to promote and propagate the official language of India while fostering unity among its diverse population.

Nyoma Airbase

News: Defence Minister Rajnath Singh Virtually Lays Foundation Stone for Nyoma Airfield Near Line of Actual Control.

- Nyoma is situated at an altitude of approximately 13,700 feet near the Line of Actual Control (LAC) in eastern Ladakh.

- The airfield’s runway will be expanded to over 9,000 feet to accommodate fighter jets.

- The development of Nyoma airfield is estimated to cost around ₹200 crore.

- It aims to enhance air infrastructure in Ladakh and strengthen the Indian Air Force’s (IAF) capabilities along the Northern border.

- The IAF is modifying fighter jet engines to start in high-altitude regions.

- Existing IAF facilities in Ladakh include airfields in Leh and Thoise, as well as advanced landing grounds (ALGs) at Daulat Beg-Oldie (DBO) and Fukche.

- Nyoma offers more stable weather conditions compared to other airfields, supporting smoother operations.

- The airfield will be crucial for troop support, surveillance, and intelligence gathering in forward areas.