CONSENSUS BUILDING AND ENERGY SECURITY IN REFORM AGENDA

Why in the News?

- Chief Economic Adviser V. Anantha Nageswaran emphasizes the need for fiscal policy to adapt as the economy gains momentum.

- Recommends periodic reviews of reforms like Goods and Services Tax (GST) and Insolvency and Bankruptcy Code (IBC) for effectiveness.

Source: Medium

Key Highlights:

- Emphasizes counter-cyclical fiscal policies to tackle economic downturns and withdraw stimulus gradually in recoveries.

- Government prioritizes financial inclusion and welfare schemes, maintaining a 5.1% GDP target for fiscal deficit.

- Highlights the need for reforms in health, education, MSME compliance, and energy security, especially in the context of energy transition and discom viability.

| About

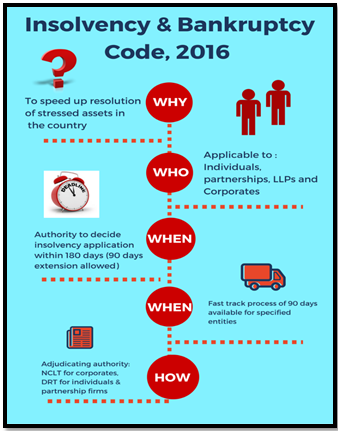

The Insolvency and Bankruptcy Code (IBC) · Enacted in 2016 amid rising Non-Performing Assets (NPAs) and debt defaults, the IBC aimed to revamp India’s corporate distress resolution framework. · Consolidated existing laws to establish a time-bound mechanism for resolving insolvency cases. Key Features: · Addressed the prolonged insolvency resolution period in India, which averaged 4.3 years, compared to 1-1.5 years in countries like the UK and USA. · Implemented through a parliamentary act. · When insolvency is triggered, the IBC offers two outcomes: resolution or liquidation. · Resolution attempts involve restructuring or change in ownership, with liquidation as the last resort if resolution efforts fail. · Companies must complete the entire insolvency process within 180 days under the IBC. · Extensions are possible with creditor consent, while smaller companies and startups with a turnover below Rs 1 crore must conclude insolvency proceedings within 90 days. |

Source: Medium

Source: Medium