CLIMATE FINANCING

Relevance:

- GS 3: Climate Change : Conservation, Environmental Pollution and Degradation, Environmental Impact Assessment.

Why in the News ?

The Organization for Economic Cooperation and Development (OECD) recently released a report on climate finance, revealing key insights into the contributions and challenges faced by economically developed countries in meeting climate-related financial commitments

Source: UNFCCC

Shortfall in Financial Commitments

- Missed Targets:

- In 2021, economically developed countries fell short of their commitment to mobilize $100 billion annually for climate mitigation and adaptation in developing countries.

- The reported mobilization was $89.6 billion, exacerbating concerns about global efforts.

- Adaptation Funding Decline:

- The OECD report highlights a disconcerting 14% decrease in adaptation finance in 2021 compared to the previous year, impacting the resilience of developing nations against climate-related challenges.

Significance of OECD Report

- Rich Country Perspectives:

- As a conglomerate of affluent nations including the S., U.K., Germany, France, and Canada, the OECD report provides insights into the perspectives and actions of economically powerful countries regarding climate finance.

- COP28 Context:

- The report gains significance in anticipation of COP28 climate talks in the UAE, where climate finance is poised to be a contentious issue. It sets the stage for discussions and negotiations among nations.

Accounting for Climate Finance

- Loan Composition:

- A substantial portion of climate finance is presented as loans.

- Of the $73.1 billion mobilized in 2021, $49.6 billion was in the form of loans.

- This raises concerns about the financial burden on developing countries and the potential exacerbation of debt-related stress.

- Debt Stress Critique:

- The report is critiqued for considering loans at face value, not accounting for grant equivalents.

- This approach obscures the actual financial assistance provided, leaving developing countries grappling with repayments and interest burdens

Understanding Additionality

- New and Additional Finance:

- The UNFCCC mandates developed countries to provide “new and additional financial resources” to meet obligations.

- The report underscores the importance of avoiding cuts in overseas development assistance (ODA) to redirect funds to climate needs.

- Double-Counting Issues:

- Developed nations often double-count funding, allocating it to both ODA and climate finance, contrary to UN Convention guidelines.

- This practice compromises the authenticity of climate finance contributions and creates challenges in tracking actual flows.

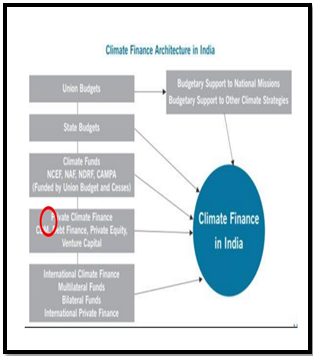

| India’s efforts towards Climate Financing

· India’s new loss and damage fund will aid in the transition to low-carbon agriculture. · India has excluded agriculture transition from its Nationally Determined Contributions (NDCs) to avoid burdening farmers. · The fund will assist farmers in adopting climate-resilient farming practices. · India issued Sovereign green bonds in its 2022-23 Union Budget to mitigate climate change. · The funds raised will be invested in projects that reduce the economy’s carbon intensity. |

Source: UNFCCC

Ambiguity in Climate Finance Definition

- Lack of Definition:

- The report highlights the absence of a universally agreed-upon definition for ‘climate finance.’

- Discussions at COP27 and COP26 were marred by attempts to avoid defining the term, creating ambiguity.

- This lack of clarity allows developed countries to categorize diverse funding, including high-cost loans and ODA, as climate finance.

- Instances of funding, like supporting chocolate stores or hotel expansions, being labeled as climate finance underscore the need for clarity in defining eligible expenditures.

- Strategic Ambiguity:

- Developed countries, including the U.S., have actively resisted efforts to establish a common definition.

- This strategic ambiguity benefits richer nations, allowing them flexibility in categorizing various expenditures as climate finance.

Unmet Financial Needs of Developing Countries

- Scepticism on Goal Achievement:

- The report cautiously suggests that the $100 billion goal might have been met in 2022, but scepticism arises due to preliminary and unverified data.

- The inadequacy of this goal is emphasized, given estimates indicating developing countries’ annual climate investments reaching $1 trillion by 2025.

- Growth in Financial Requirements:

- The $100 billion goal is dwarfed by the estimated annual climate investments required by developing countries, reaching $24 trillion between 2026 and 2030.

- The unmet financial needs pose challenges to addressing climate mitigation and adaptation adequately.

| India’s Intended Nationally Determined Contribution (INDC)

India’s Intended Nationally Determined Contribution (INDC) is a set of climate change mitigation and adaptation goals submitted by India to the United Nations Framework Convention on Climate Change (UNFCCC) in 2015. It also includes a number of adaptation measures to address the impacts of climate change. Key highlights of India’s INDC: Reduce the emissions intensity of GDP by 45% below 2005 levels by 2030. · Achieve 50% of its installed electricity capacity from non-fossil fuel sources by 2030. · Increase forest cover by 5 million hectares by 2030. · Create an adaptation fund to support climate-resilient infrastructure. · COP 26:India’s ‘Panchamrit’ climate goals strengthen its Nationally Determined Contributions and support its net-zero target by 2070. |

Role of the Private Sector

- Expectations vs. Reality:

- Despite optimism from figures like U.S. climate envoy John Kerry and World Bank President Ajay Banga regarding the private sector’s role, the OECD report reveals a decade-long stagnation in private financing for climate action.

- De-Risking Strategies:

- The report suggests interventions like de-risking with government involvement to encourage private sector participation.

- However, challenges persist, particularly in climate adaptation, where returns are not as lucrative as in the mitigation sector.

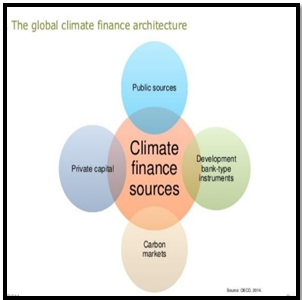

Primacy of Public Funding

- Government and MDBs’ Role:

- Acknowledging the limited interest of the private sector, the report emphasizes the critical role of governments and multilateral development banks (MDBs) in enabling climate action.

- Public funding remains integral to achieving climate finance goals.

- Public Funding as Enabler:

- The report challenges the notion that private sector scaling is imminent, emphasizing that governments and MDBs are key enablers for effective climate action, and their proactive involvement is vital for success.

The OECD report unravels complexities surrounding climate finance, shedding light on discrepancies, challenges, and the critical role of public funding in addressing the global climate crisis. It sets the stage for informed discussions and policy considerations at upcoming climate talks and emphasizes the urgency of aligning financial commitments with the growing needs of developing nations.

Mains Practice Question

Critically analyze the shortcomings of economically developed countries in meeting their climate finance commitments. Propose measures to enhance transparency and accountability in climate finance flows.

Source: UNFCCC

Source: UNFCCC Source: UNFCCC

Source: UNFCCC