CHINA’S LENDING DOMINANCE AND ITS IMPLICATIONS

Syllabus:

GS 2 :

- India and its Neighborhood- Relations.

- Effect of Policies and Politics of Developed and Developing Countries on India’s interests

Focus:

China’s Role in Debt Surge: China’s significant lending activities, particularly in South Asia, Africa, and South America, have led to a surge in external debt in these regions, raising concerns about financial vulnerability and dependence on Chinese loans.

Source: TH

China’s Lending Dominance:

- Major Lender: China emerges as a primary lender for numerous countries, exerting significant influence in regions like South Asia, Africa, and South America.

- Debtor Nations: Analysis of the top 20 debtor countries reveals China’s dominant position, with many nations relying heavily on Chinese loans for their external debt.

- Regional Impact: China’s lending dominance extends beyond individual countries, influencing regional dynamics and economic policies, particularly in South Asia.

- Infrastructure Financing: Chinese loans predominantly fund large-scale infrastructure projects, such as roads and ports, aimed at fostering economic development and strengthening diplomatic ties.

- Diplomatic Leverage: China leverages its lending role to enhance diplomatic influence and advance strategic objectives, forming closer partnerships with debtor nations in exchange for financial support.

Understanding External Debt Stocks:

- Definition: External debt stock encompasses a country’s total debt owed to non-residents, including various types of obligations like public debt and private loans.

- Components: It includes public debt guaranteed by the government, private non-guaranteed debt, and publicly guaranteed debt, offering insights into a nation’s overall debt burden.

- Measurement Significance: External debt stocks serve as crucial indicators of a country’s financial health, influencing investor perceptions and credit ratings.

- Debt Sustainability: High levels of external debt raise concerns about a nation’s ability to manage debt obligations, leading to financial instability and potential reliance on external assistance.

- Impact on Development: Servicing external debt diverts resources from essential public expenditures, hindering long-term economic growth and social welfare initiatives.

Impact of China’s ‘Going Global Strategy’:

- Initiation and Objectives: China’s ‘Going Global Strategy’, launched in 1999, aims to expand overseas investments and lending activities to enhance economic influence and secure strategic resources.

- Debt Surge Driver: The strategy significantly contributes to the surge in debt levels, particularly in low- and middle-income countries, as China seeks to bolster its economic presence globally.

- Infrastructure Development: Chinese investments in infrastructure projects worldwide stimulate economic growth but raise concerns about debt sustainability and environmental impacts.

- Strategic Goals: Beyond economic benefits, the strategy serves strategic objectives, including geopolitical influence expansion and promotion of the Chinese yuan’s internationalization.

- Debt Diplomacy: Critics accuse China of engaging in “debt-trap diplomacy,” using loans to gain leverage over borrower nations and advance strategic interests, potentially compromising local governance and sovereignty.

Rise in External Debt:

- Surge in Debt Levels: South Asian, African, and South American countries witness a significant increase in external debt owed to China, reflecting a broader trend of rising indebtedness.

- Post-2010 Dynamics: China’s aggressive lending strategies post-2010, including initiatives like the Belt and Road Initiative, contribute to escalating debt levels in recipient countries.

- China’s Initiatives Impact: Projects like BRI and AIIB funding large-scale infrastructure projects in recipient countries drive the surge in external debt, raising concerns about debt sustainability.

- Borrowing Nations Concerns: While Chinese loans facilitate economic growth, concerns persist regarding debt sustainability and over-reliance on Chinese financing.

- Policy Responses: Borrowing nations reassess borrowing policies and seek diversified financing sources to mitigate risks associated with excessive indebtedness to China.

External Debt Stock:

It encompasses a nation’s financial obligations to non-residents, including public, publicly guaranteed, private non-guaranteed long-term, and short-term debts, repayable in various forms such as currency, goods, or services.

Case Study: Pakistan’s Debt Surge:

Pakistan’s external debt owed to China notably surged from $7.6 billion in 2016 to $26.5 billion in 2022, showcasing a rapid escalation.

Statistical Information:

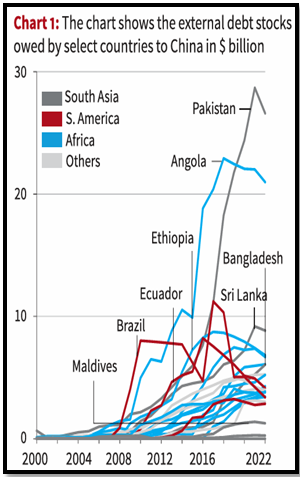

- Debt Overview: The provided chart illustrates external debt figures owed to China by specific countries, focusing on the top 20 debtor nations as of 2022.

- Increasing Debt Trends: Post-2010, South Asian, African, and South American nations witness notable escalations in debt owed to China, highlighting China’s growing lending influence.

- Reasons for Surge: China’s ‘Going Global Strategy’ post-1999 significantly contributes to rising debt levels, aiming to expand global economic presence and investments.

- Cumulative Debt: Low- and middle-income countries owe China a substantial $180 billion collectively by 2022, prompting concerns about debt sustainability and financial stability.

- Lending Focus Shift: China redirects loans towards neighbouring nations, reducing lending to African and South American economies, affecting debt dynamics in these regions.

- Impact on Other Nations: Sri Lanka’s debt nearly doubles from $4.6 billion to $8.8 billion, reflecting China’s intensified lending activities, influencing debt dynamics in Bangladesh, Maldives, and Nepal.

China’s Shifting Loan Patterns:

- Evolution: Chinese lending patterns evolve, with increased focus on neighbouring countries, reflecting efforts to enhance regional connectivity and economic integration.

- Sectoral Allocation:

Infrastructure projects predominantly receive Chinese funding, addressing critical gaps but raising concerns about debt sustainability.

- Economic Realities: Overall lending experiences a slowdown due to domestic economic challenges and project viability concerns, impacting China’s global lending patterns.

Debt Default Challenges:

- Sri Lanka’s Default: Sri Lanka’s default in 2022 amidst economic crises highlights challenges in servicing debt burdens, necessitating debt restructuring and relief measures.

- Fiscal Pressures: Servicing external debt strains government finances, limiting resources for essential public services and development initiatives, posing fiscal challenges.

- South Asian Economies: Debt servicing burdens pose challenges to fiscal sustainability and long-term growth in South Asian economies like Pakistan, Sri Lanka, and Bangladesh.

- Diplomatic Repercussions: Debt defaults may strain bilateral relations and compromise sovereignty, underscoring the need for international cooperation in debt management.

- Calls for Restructuring: Borrowing nations advocate debt restructuring to alleviate fiscal strains, emphasizing multilateral solutions for sustainable debt management.

Concerns for India:

- Regional Debt Trap: India’s neighbours falling into China’s debt trap pose strategic challenges, threatening India’s regional influence and security interests.

- Sovereignty Issues: Projects like CPEC challenge India’s sovereignty, impacting territorial integrity and strategic positioning in South Asia.

- Perception Shift: China’s investments alter perceptions in neighbouring countries, prioritizing ties with China over historical partnerships with India.

- Indo-Pacific Stability: China’s debt trap strategy threatens Indo-Pacific stability, bolstering Chinese influence contrary to India’s strategic vision.

- Economic Dependency: Increased indebtedness fosters economic dependency on China, undermining India’s regional economic integration efforts and strategic interests.

Way Forward:

- Diversify Financing Sources: Seek support from multilateral institutions and attract foreign investment to reduce reliance on Chinese loans.

- Enhance Debt Management: Implement transparent accounting, conduct debt sustainability assessments, and negotiate favourable terms with creditors.

- Promote Responsible Lending: Encourage transparency, accountability, and adherence to international debt sustainability guidelines among lenders.

- Capacity Building: Invest in financial literacy and capacity-building programs for governments and citizens to improve debt management practices.

- Regional Collaboration: Strengthen cooperation mechanisms among neighbouring countries to address common debt challenges and coordinate debt management efforts.

- Engage with China: Advocate for fair lending terms, transparency in project appraisal, and adherence to environmental and social safeguards.

- Invest in Sustainable Development: Prioritize investments in sustainable projects aligned with environmental, social, and governance criteria.

- International Support: Foster global cooperation for debt relief initiatives, concessional financing, and financial assistance for vulnerable countries.

- Policy Coordination: Harmonize debt management strategies, fiscal policies, and development priorities at national and regional levels.

- Risk Mitigation: Develop contingency plans and fiscal buffers to cushion against debt-related shocks and ensure fiscal resilience.

Conclusion:

Balancing the benefits and risks of external debt is crucial for sustainable development. By diversifying financing sources, enhancing debt management practices, and promoting responsible lending, nations can navigate the challenges posed by rising indebtedness and ensure long-term economic stability.

Source:The Hindu

Mains Practice Question:

Discuss the implications of rising external debt owed to China by South Asian nations. Evaluate potential strategies for these countries to mitigate debt-related risks and promote sustainable development.

Associated Article:

India – China – Srilanka – Universal Group Of Institutions (universalinstitutions.com)