CHALLENGES IN SOVEREIGN CREDIT RATING: CEA’S CALL FOR REFORM

Why in the News?

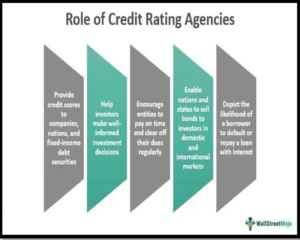

- Chief Economic Advisor’s office calls for urgent reforms in sovereign credit rating.

- Fitch, Moody’s, and S&P methodologies criticized for being subjective, especially toward developing countries.

- Over-reliance on non-transparent qualitative factors impacts India’s credit rating despite significant economic growth.

Source: WallStreetMojo

Impact on Developing Countries:

- Qualitative parameters weigh more than actual macroeconomic fundamentals.

- Improvements in economic parameters may not impact credit ratings if qualitative aspects are perceived as needing improvement.

- Developing nations face implications for accessing capital markets and borrowing at affordable rates.

Recommendations for Transparency and Reform:

- Proposed reforms advocate relying on a country’s debt repayment history to determine willingness to pay.

- Calls for greater transparency and reforms in the rating process.

Criticizes the opacity in rating agencies’ methodologies and emphasizes the need for authentic, verifiable information

Source: WallStreetMojo

Source: WallStreetMojo