CENTRAL TRANSFERS — ARRESTING THE DECLINE IN SHARES OF SOME STATES

Relevance: GS 2 – Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein.

Why in the News?

- The Sixteenth Finance Commission faces numerous challenges.

- Among these challenges, the review of the Income Distance Criterion is imperative.

- Additionally, the assessment of cesses and surcharges requires careful scrutiny.

- These areas demand thorough examination and potential revision by the commission.

Issue at Hand

- The focal point of this article revolves around a specific concern raised by several states, predominantly those situated in southern India.

- The complaint centers on the diminishing share of resources transferred from the Centre to the States, observed from one Finance Commission to another.

Key Areas for Examination:

- Identification of Gaining and Losing States: It’s essential to discern which states have experienced an increase in their share and which ones have witnessed a decline over successive Finance Commissions.

- Analysis of Horizontal Distribution Criteria: The criteria employed for horizontal distribution merit close examination, particularly regarding its impact on states consistently losing their share.

- Proposals to Reverse the Trend: Exploring potential measures to counteract this trend is imperative, focusing on strategies to restore balance and equitable resource allocation among the states.

Overview of Share Changes

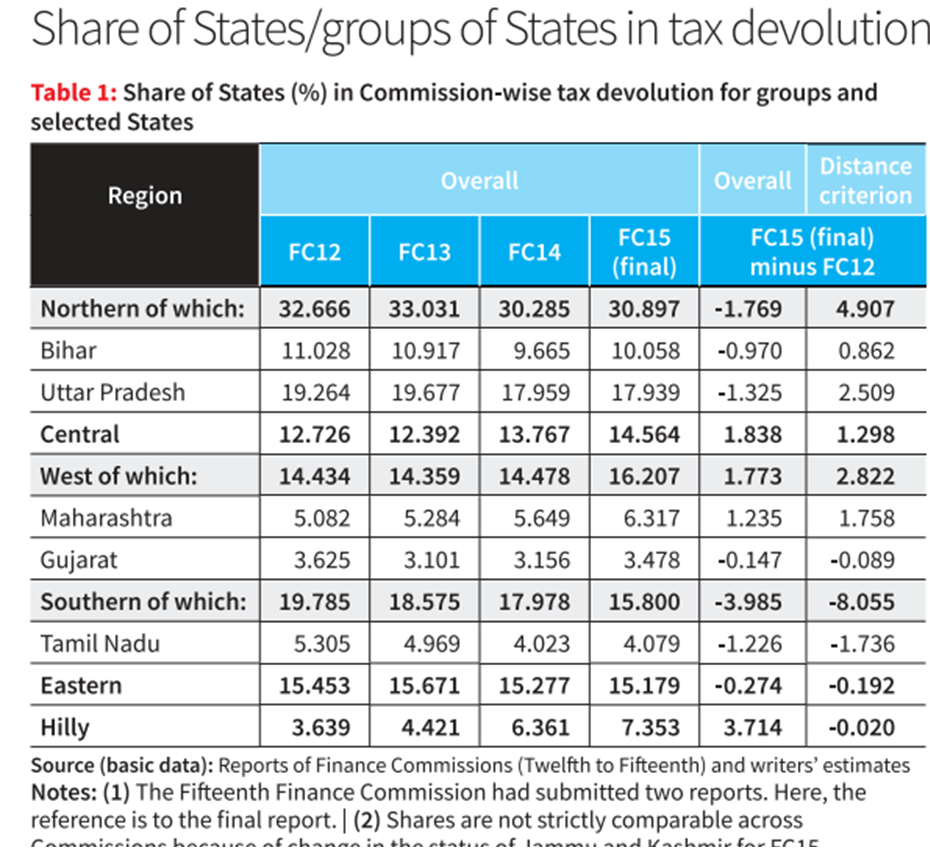

- Table 1 illustrates the share distribution among groups of states and selected states, spanning from the Twelfth Finance Commission to the Fifteenth Finance Commission’s final report.

- Trend Analysis:

- Notably, southern states have experienced a consistent decline in their share, plummeting from 785% to 15.800%.

- This comparison reveals that northern and eastern states have also witnessed a reduction in their shares.

- Identification of Gainer States:

- Conversely, the ‘gainer states’ comprise hilly, central, and western states, with Maharashtra notably among them. These states have observed an increase in their share allocations over the mentioned Finance Commission periods.

The Importance of the Distance Criterion

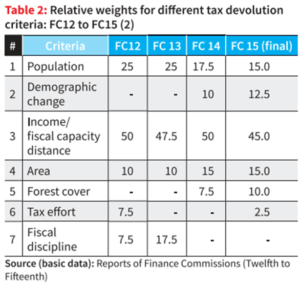

- Tax devolution shares for individual states are determined by various criteria and their corresponding weights set by different Finance Commissions.

- Table 2 outlines the evolution of criteria weights utilized by Finance Commissions from the Twelfth to the Fifteenth.

- The distance criterion has consistently held significant importance, with its weight diminishing from 50% to 45% between the Thirteenth and Fifteenth Finance Commissions.

- The Eleventh Finance Commission previously assigned the distance criterion the highest weight of 62.5%.

- The principle of equalization, pivotal for distribution, is upheld in India and globally due to its alignment with economic and social justice principles.

Impact of the Distance Criterion on Southern States

- The decline in shares experienced by southern states, as indicated in Table 1, can be attributed primarily to the income distance criterion.

- Under the distance criterion, states further away from the highest income state receive a higher share.

- The southern states’ loss due to the distance criterion between the two mentioned Finance Commissions amounted to 8.055% points, contributing significantly to their overall loss of 3.985% points.

- It’s worth noting that despite gains in other criteria, the impact of the distance criterion outweighs these gains for the southern states.

Effect on Low-Income States

- Low-income states such as Bihar and Uttar Pradesh have gained over time due to the distance criterion.

- However, these states have experienced losses under other criteria, leading to an overall decrease in their shares.

- Bihar and Uttar Pradesh, in terms of their overall share, exhibit losses of 0.970% points and 1.325% points, respectively.

Population Criterion and Controversy

- The use of population as a criterion has sparked controversy, especially regarding the data utilized.

- Until the Fourteenth Finance Commission, population data from 1971 was employed for calculations.

- However, for the Fifteenth Finance Commission, data from 2011 was utilized instead.

Demographic Change Criterion

- To prevent the penalization of states demonstrating improved performance in reducing fertility rates, the demographic change criterion was introduced.

- This criterion aims to mitigate the adverse effects on states with declining fertility rates.

Joint Impact on States

- The combined effect of transitioning to 2011 population data and the introduction of the demographic change criterion has had minimal repercussions across all state groups.

- For Tamil Nadu specifically, the joint impact was marginally positive, indicating a favorable outcome resulting from these changes.

Proposed Steps for the Sixteenth Finance Commission

- Adjusting Weight Distribution of Criteria:

- Recognizing the necessity of retaining the income distance criterion while acknowledging concerns about its long-term sustainability.

- One potential approach is to decrease the weight of the income distance criterion by 5% to 10% points.

- Correspondingly, the weights allocated to other criteria could be increased to maintain a balanced and equitable distribution.

- Recognizing the necessity of retaining the income distance criterion while acknowledging concerns about its long-term sustainability.

- Addressing Divisible Pool Size:

- Despite the acceptance of the Fourteenth Finance Commission’s recommendation to raise states’ share to 42%, the increase in cesses and surcharges by the Centre has diminished the size of the divisible pool.

- To counteract this, the commission may consider imposing a limit on the share of cesses and surcharges to ensure the stability and growth of the divisible pool.

- One potential option could be capping the share of cesses and surcharges at 10% of the Centre’s gross tax revenues.

- Ensuring Fair Distribution:

- The declining shares of certain states necessitate addressing the underlying issues.

- While the income distance criterion remains indispensable for fair distribution, modifications to its weight and the regulation of cesses and surcharges are essential to maintain equity among states.

- Despite potential adjustments, it’s crucial to ensure that any changes uphold the principles of economic and social justice embedded in the distribution framework.

Mains question

Discuss the impact of income distance criterion on state shares, propose reforms for the Sixteenth Finance Commission, and evaluate the role of population criteria. (250 words)