Central Employees Must Choose Between UPS and NPS

Why in the News ?

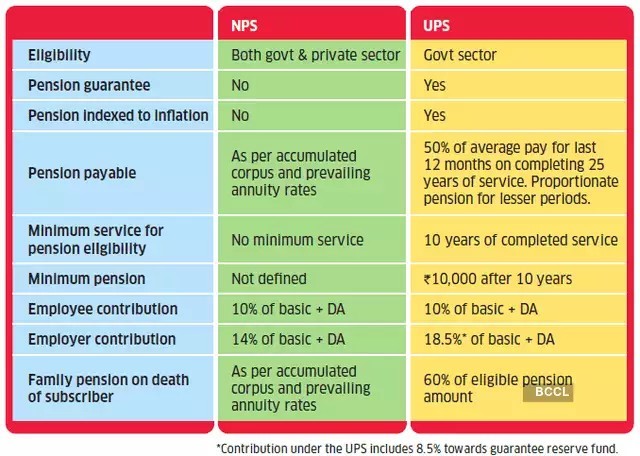

The government has introduced the Unified Pension Scheme (UPS) as an alternative to the existing National Pension System (NPS), requiring central government employees to choose between the two by June 2025, based on service tenure, returns, and flexibility.

Understanding UPS and NPS :

- Central government employees must choose between Unified Pension Scheme (UPS) and National Pension System (NPS) by June 2025.

- UPS is a defined benefit scheme with inflation-linked guaranteed pension; NPS is a market-linked contribution-based system.

- UPS assures 50% of last 12 months’ average basic pay + DA as pension after 25 years of service, with 60% to the spouse after death.

- In NPS, employees can withdraw 60% of the corpus tax-free and use 40% for annuity, allowing more investment flexibility.

Contributions, Returns & Payouts:

- UPS: 10% employee + 10% govt contribution; additional 5% to a central pool for guaranteed pension.

- NPS: 10% employee + 14% govt contribution.

- Both allow equity exposure up to 50%, defaulting to 25%.

- If the individual corpus under UPS is below the benchmark, pension is reduced; if above, excess is paid to the employee.

- Example: After 25 years, UPS offers ₹84,658/month pension; NPS may yield ₹86,250/month assuming 10% CAGR and annuity return.

Suitability & Key Differences between UPS and NPS :● UPS suits those seeking stability, long-term government service, and guaranteed pension. |