CBIC RESTORES 10% DUTY ON LAB CHEMICALS

Why in the news?

- CBIC has reinstated a 10% import duty on chemicals for laboratory use, reversing a previous hike announced in the Union budget for FY25.

- The new duty applies to genuine lab users, effective from August 1, 2024.Importers must declare the end use to qualify for this rate.

Key Exclusions and Compliance by CBIC:

- Ethyl Alcohol: Undenatured ethyl alcohol is excluded from the 10% duty and is subject to a 150% duty due to misuse concerns.

- Compliance Requirement: Non-compliance with end-use declarations will result in ineligibility for the concessional rate.

Tariff Classification:

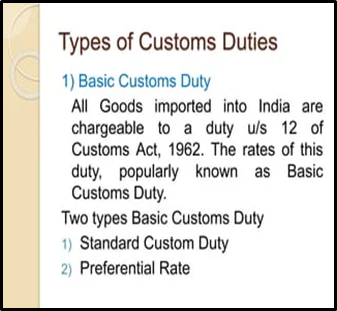

- Current Tariffs: Chemicals generally attract import duties ranging from 2.5% to 10% under the Customs Tariff Act.

- Special Classification: Chemicals imported in packages not exceeding 500ml or 500g for laboratory use are specifically classified with a 10% duty.

source:researchgate

About Central Board of Indirect Taxes and Customs (CBIC):

|