CBDC: Future UPI Payment Revolution

Relevance

- GS Paper 3 Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

- Tags: #CBDC #UPI #RBI #DigitalCurrency #DigitalPublicInfrastructure #UPSC #CurrentAffairs #MintEditorial.

Why in the News?

Central Bank Digital Currencies (CBDCs) are becoming a global phenomenon, and India, known for its successful Unified Payments Interface (UPI), is poised to embrace this digital evolution. India’s UPI has set impressive benchmarks, and now the nation is gearing up to lead the CBDC race.

Rush for Cash 2.0 – Central Bank Digital Currencies (CBDCs)

Over 100 countries, comprising 95% of global GDP, are actively pursuing CBDC projects, with some already deploying digital currencies.

- This trend generates curiosity, confusion, and concerns, but the fear of falling behind drives this rapid development of Cash 2.0.

Central Banks Innovate: The Rise of ‘e’ Currencies

- In response to the popularity of cryptocurrencies among Millennials and Gen-Z, central banks are fast-tracking the development of next-gen payment solutions that combine the convenience of cash with crypto-like features.

- Many central banks are adopting the ‘e’ prefix for their currencies to enhance user familiarity and comfort.

India’s Strategic Position in CBDC Development

UPI Success on the Global Stage

- India boasts a remarkable success story with its Unified Payments Interface (UPI), a digital public infrastructure (DPI) launched in 2016.

- With over 10 billion transactions valued at nearly ₹8 trillion in August 2023, UPI has gained global recognition as a cutting-edge technology platform.

Global Recognition and Acceptance

- Countries like Singapore, Malaysia, the UAE, UK, and France have embraced UPI linkages, showcasing India’s prowess in financial regulation and technology capabilities on the world stage.

Expanding Offerings with RuPay

- India is further expanding its influence with offerings like RuPay, dominating the domestic debit card market with over 860 million transactions, totaling more than ₹1.6 trillion.

Promoting CBDC with Strategic Vision

- India’s efforts to promote its CBDC are rooted in a deep understanding of domestic financial dynamics and a commitment to establishing payment sovereignty on the international front.

Key Factors in Promoting CBDCs

First – Financial Inclusion

CBDCs serve as a crucial tool for expanding financial services to unbanked and under-banked populations, mirroring the success of UPI in India.

China’s Example

- China’s digital currency electronic payment system illustrates CBDCs’ potential in reaching marginalized communities, especially in remote areas.

- Where it has facilitated welfare distribution and provided unbanked individuals with access to banking services.

Simplicity for Adoption

- CBDCs aim to be even more user-friendly than UPI, offering easier understanding and operation, which can be a significant draw for a broader audience.

Finale of Financial Inclusion

- CBDCs represent the pinnacle of financial inclusion efforts, following initiatives like Jan Dhan and UPI, by offering simplicity and accessibility to a wider population.

Second – Reduced Transaction Costs

Cost Reduction

- CBDCs offer significant cost reductions due to their structural simplicity.

- This results in lower transaction fees and processing expenses, benefiting both merchants and consumers.

Speed and Cost Saving

- End-to-end digital payment processes become cheaper and faster with CBDCs, similar to the cost-saving benefits seen with UPI in India.

- Sweden’s e-krona project illustrates how CBDCs can provide cost-effective digital transactions, setting a model for others to follow.

Settlement Risk Reduction

- CBDC payments, being real-time, gross, and final, contribute to reduced settlement risk within the financial system, enhancing overall stability.

Third – Interoperability and Standardization

Seamless Transactions

- CBDCs, like India’s UPI, promote interoperability, allowing smooth transactions between digital wallets and payment systems.

Single Wallet Functionality

- CBDCs can also operate as a unified wallet, akin to India’s Jan Dhan initiative.

- When merchants embrace the CBDC ecosystem, transactions can occur without PIN requirements, making it ideal for cross-border transactions, merchant payments, peer-to-peer transfers, and remittances.

Support for Financial Intermediation

- Central banks are committed to minimizing CBDCs’ impact on financial intermediation and credit provision, ensuring stability.

Fourth – Efficiency and Speed

Near-Instant Transactions

- CBDCs enable nearly instant transactions, similar to UPI‘s real-time fund transfers.

- CBDCs like the Eastern Caribbean Central Bank’s DCash facilitate swift cross-border payments.

Customization for Different Sectors

- CBDCs can be tailored for specific sectors like retail or for wholesale domestic and cross-border payments, ensuring efficiency and speed aligned with user needs.

Cross-Border Settlements

- CBDCs can overcome challenges such as varying laws, processes, due diligence requirements, and time-zone differences in cross-border payment settlements through institutional and regulatory coordination.

Fifth – Enhanced Security

Robust Security Measures

- CBDCs can integrate robust security mechanisms to enhance financial stability, reduce fraud risk, and withstand Cyberattacks.

Trust and Adoption

- Security features, such as those employed by the Bahamas’ Sand Dollar CBDC, include modern encryption and authentication techniques, fostering trust and user adoption.

Resilience in Calamities

- CBDCs can serve as alternatives for individuals prone to financial instability due to natural disasters, ensuring continued access to financial services, much like UPI’s secure transactions.

Addressing Privacy Concerns

- Global concerns over privacy and confidentiality with CBDCs have surfaced.

- CBDCs offer features like access options, varying levels of anonymity, and availability choices, addressing these concerns effectively.

The International Monetary Fund emphasizes that CBDC success hinges on trust. India, with its successful UPI platform, can replicate this trust-building process with the adoption of e-rupee. Just as the UPI faced initial skepticism in India, CBDCs may encounter similar doubts. However, building trust in central banks is pivotal for CBDC success, a lesson learned from UPI’s journey to acceptance.

|

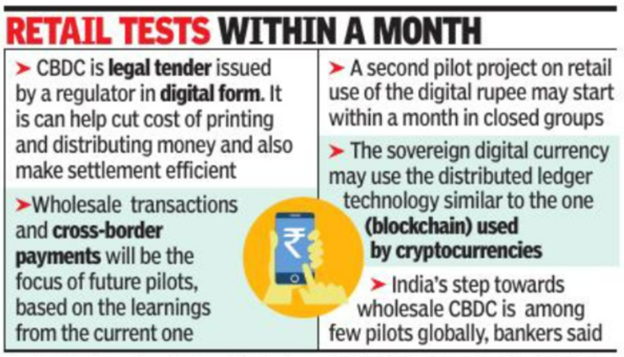

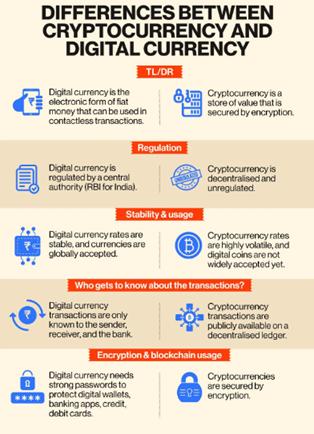

Central Bank Digital Currency In 2022 budget announced the introduction of a digital rupee as a CBDC. · The Reserve Bank of India (RBI) has been empowered by an amendment to the RBI Act, 1934, to issue the digital rupee. What is a CBDC? · A CBDC, or Central Bank Digital Currency, is a digital representation of a nation’s fiat currency issued by its central bank. · Unlike cryptocurrencies, CBDCs are considered legal tender and are not backed by physical assets like gold or silver. · Instead, their value is guaranteed by the central bank’s trustworthiness. Objectives of CBDCs (Central Bank Digital Currencies) · Financial Inclusion: CBDCs promote financial inclusion by offering digital payment access to individuals without traditional banking services. · Efficiency: They enhance payment system efficiency by reducing transaction costs and processing times. · Security: CBDCs bolster payment system security, reducing the risks associated with fraud and counterfeiting. · Cross-Border Transactions: Facilitating cross-border transactions and reducing reliance on intermediaries. How CBDCs Operate? CBDCs are stored in digital wallets and can be used for various transactions, both online and offline. They offer two primary categories: · Retail CBDCs: Aimed at the general public, these CBDCs facilitate everyday payments, enhancing financial inclusion. · Wholesale CBDCs: Intended for financial institutions, they facilitate large-value transactions within the banking sector. |

Source: Live Mint

Mains Question

What are the potential benefits of CBDCs for cross-border transactions and financial stability, Analyze the role of CBDCs in strengthening the international financial system?