CAUTION, NO CUTS AHEAD

Syllabus:

GS 3:

Indian Economy and issues relating to Planning, Mobilization of Resources.

Effects of Liberalization on the Economy.

Why in the News?

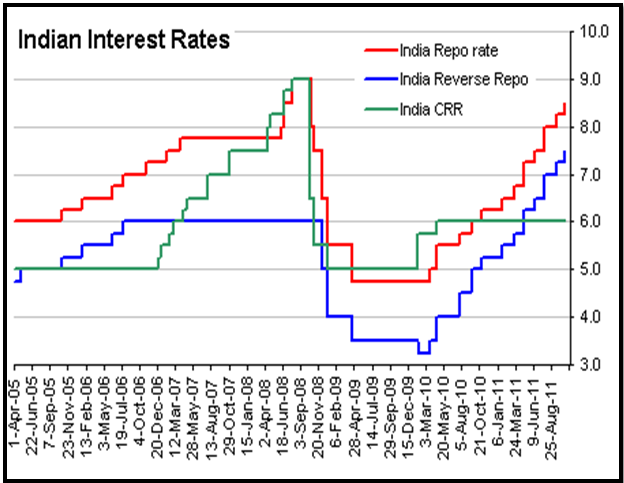

The Reserve Bank of India (RBI) is unlikely to lower interest rates before October due to persistent high inflation, despite strong economic growth. The RBI’s focus remains on achieving its medium-term inflation target, influenced by global rate hike trends and domestic inflationary challenges, particularly in food prices

Source: Urbanomics

Robust Growth and Inflation Concerns

- Strong Economic Growth: The Indian economy is showing robust growth, with GDP growth at 8.2% as per the National Statistical Office.

- Continued Momentum: The economic momentum has continued into the first two months of the fiscal year.

- Focus on Inflation: The Reserve Bank of India (RBI) and its Monetary Policy Committee (MPC) are focused on reducing inflation to the medium-term target of 4%.

- Policy Expectations: The consensus is that the MPC will not lower interest rates in the immediate future due to ongoing inflation concerns.

- Medium-Term Strategy: The RBI’s strategy emphasizes controlling inflation over short-term growth boosts.

Global Rate Hike Cycle and Its Implications

- Peak of Global Rate Hike Cycle: The global rate hike cycle appears to have peaked, with central bank actions becoming more asynchronous.

- Influence of Federal Reserve: The Federal Reserve’s actions significantly influence monetary policies in economies closely linked to the U.S.

- Diverse Economic Conditions: Differing local economic conditions and uneven growth spur varied rate actions across countries.

- Capital Flow and Volatility: Emerging markets, including India, face capital flow and currency volatility due to changing expectations in U.S. rate cuts.

- ECB and Peer Actions: The European Central Bank (ECB) and other central banks are cutting rates due to weak growth in their jurisdictions.

Domestic Inflationary Challenges

- Supply Shock in Agriculture: Persistent supply shocks in agriculture have kept food inflation high in India.

- Core Inflation: Core inflation, excluding volatile food and energy prices, stood at a multi-year low of 3.2% in April.

- Fuel Prices: Despite firmer crude oil prices, fuel prices were lower due to cuts in cooking gas prices.

- Monetary Policy Approach: The MPC tends to prioritize inflation control, especially when growth is strong, even in the face of supply-driven shocks.

- Vegetable Inflation: Inclement weather and pest attacks have contributed to high and volatile vegetable prices, impacting overall food inflation.

Understanding Inflation

Recent Trends

Types of Inflation and Causes: Demand-Pull Inflation

Cost-Push Inflation

Types of Inflation by Rate Low Inflation

Galloping Inflation

Hyperinflation

|

Factors Affecting Inflation Outlook

- Weather and Monsoon Impact: The early arrival of the monsoon in Kerala and predictions of above-normal rains could help moderate food inflation.

- High CPI Weight of Food: Food has a 39% weight in the Consumer Price Index (CPI), and persistent high readings can elevate inflationary expectations.

- Commodity Prices: Softer commodity prices have helped keep core inflation low by reducing input costs for companies.

- Global Commodity Trends: Heightened uncertainties in the Middle East are exerting upward pressure on prices of key commodities like oil and gold.

- Supply Chain Capacity: Supply chains operating near maximum capacity signal a better outlook for the manufacturing sector, keeping commodity demand healthy.

Strong Economic Indicators

- Revised Growth Estimates: The National Statistical Office revised fiscal 2024 growth estimates to 8.2%, up from 7.6%.

- GST Collections: GST collections in April were the highest ever at Rs 2.1 lakh crore, indicating strong economic activity.

- PMI Readings: The Purchasing Managers’ Index (PMI) for services and manufacturing remained strong in April, showing continued economic expansion.

- RBI’s Inflation Forecast: The RBI has maintained its inflation forecast for this fiscal at 4.5%.

- Optimistic GDP Forecast: The RBI revised its GDP growth forecast to 7.2%, reflecting increased optimism about economic performance.

Future Monetary Policy Expectations

- Moderation in Growth Projections: CRISIL projects GDP growth to moderate to 6.8%, anticipating the continued impact of monetary policy tightening.

- Credit Growth Trends: Growth in bank credit and credit card loans has already moderated, indicating the impact of previous rate hikes.

- Fiscal Consolidation: The government’s shift towards fiscal consolidation is expected to reduce the fiscal impulse to growth.

- Cautious Policy Stance: Central banks, including the RBI, are likely to maintain a cautious policy stance due to ongoing inflation concerns.

- Rate Cut Expectations: The MPC is expected to begin cutting rates by October at the earliest, with a revised expectation of two rate cuts this fiscal, down from the three previously anticipated.

Way Forward

- Maintain Vigilance on Inflation: The RBI should continue monitoring inflation trends closely, particularly in the volatile food and energy sectors, to ensure timely policy adjustments.

- Strengthen Supply Chains: Addressing supply chain disruptions, especially in agriculture, can help stabilize food prices and reduce inflationary pressures.

- Enhance Monetary Policy Communication: Clear and consistent communication from the RBI about its policy stance and future actions can help manage market expectations and reduce volatility.

- Support Economic Growth: While focusing on inflation, the RBI should also consider measures to support sustainable economic growth, ensuring that rate decisions do not stifle economic momentum.

- Monitor Global Developments: Keeping a close eye on global economic trends, including actions by major central banks like the Federal Reserve and ECB, will help the RBI align its policies effectively.

- Encourage Fiscal Prudence: Collaborate with the government to ensure fiscal policies complement monetary efforts, especially in achieving fiscal consolidation without hampering growth.

- Promote Financial Stability: Strengthen the financial system’s resilience to withstand external shocks and maintain investor confidence.

- Focus on Long-term Reforms: Implement structural reforms to improve productivity and efficiency across sectors, enhancing the economy’s overall stability and growth prospects.

Conclusion

The RBI’s cautious stance on interest rate cuts reflects its commitment to controlling inflation amidst robust economic growth and global monetary policy dynamics. As domestic and global factors continue to influence inflation, the RBI prioritizes economic stability over short-term rate adjustments.

Source:Indian Express

Mains Practice Question:

Discuss the implications of the Reserve Bank of India’s decision to delay interest rate cuts on the Indian economy. Analyze the factors influencing this decision and its potential impact on inflation, growth, and financial markets.

Associated Article:

https://universalinstitutions.com/rbi-likely-to-maintain-repo-rate-amid-persistent-food-inflation/