BUDGET 2024

Understanding the Budget

Constitutional Reference:

- Article 112: Budget is termed as the “Annual Financial Statement” in the Indian Constitution.

- The word ‘Budget’ itself is not mentioned in the Constitution.

Definition and Composition:

Divided into:

- Revenue Budget: Includes Tax and Non-Tax revenue receipts and expenditure.

- Capital Budget: Comprises capital receipts and payments.

Preparation Process:

- Responsible Body: Department of Economic Affairs, Ministry of Finance.

- Prepared by the Budget Division of the Department of Economic Affairs.

- Based on detailed estimates from various Departments/Ministries and subordinate authorities.

- Follows Cash Basis: Accounting for actual receipts and payments expected in the financial year.

Presentation in Parliament:

- Role of the President: Mandated to present the budget to both Houses of Parliament annually.

- Union Finance Minister: Presents the budget, comprising two parts:

Part A: Macroeconomic overview, government schemes, and sectoral allocations.

Part B: Finance Bill including taxation proposals like income tax revisions, indirect taxes.

Key Documents:

- Annual Financial Statement (Article 112).

- Demands for Grants (Article 113).

- Finance Bill (Article 110).

- Fiscal Policy Statements (FRBM Act):

- Macro-Economic Framework Statement.

- Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement.

Additional Documents:

- Expenditure Budget.

- Receipt Budget.

- Expenditure Profile.

- Budget at a Glance.

- Key Features of Budget 2024-25.

- Implementation of Budget Announcements, 2023-24.

- Union Interim Budget 2024-25.

INTERIM BUDGET 2024-25

- Context of 2024:

- Election Year: Normal budget replaced by an interim budget due to upcoming elections.

- Interim Budget:

- Definition: A temporary financial plan for government expenses during the pre-election period.

- Scope: Focuses primarily on anticipated revenues and expenses until a new government is in place.

- Comparison with Normal Budget:

- Normal Budget: Comprehensive coverage of government finances, including revenues, expenditures, allocations, and policy statements.

- Interim Budget: Limited to essential financial details.

- Vote-on-Account:

- Constitutional Basis: Article 116 of the Indian Constitution.

- Purpose: Provides advance funds from the Consolidated Fund of India for immediate expenses.

- Role in Interim Budget: Enables the government to continue its operations until the post-election budget.

- Document:

- Union Interim Budget 2024-25: The official financial statement for the interim period in 2024.

Part A

- Vision of Budget: By 2047, India envisions a thriving Bharat in perfect harmony with the natural world, boasting modern infrastructure, and providing opportunities for every citizen.

- Budget’s Development Mantra: “Sabka Saath, Sabka Vikas, and Sabka Vishwas” embody a unified approach that encompasses the entire nation’s efforts under the guiding principle of “Sabka Prayas.”

- Budget Philosophy: The overarching philosophy is to ensure inclusivity in all aspects. This encompasses social inclusivity, achieved by encompassing all societal strata, and geographical inclusivity, achieved through the comprehensive development of all regions across the country.

KEY ACHIEVEMENTS IN FOCUS AREAS:

Garib (Poverty Alleviation)

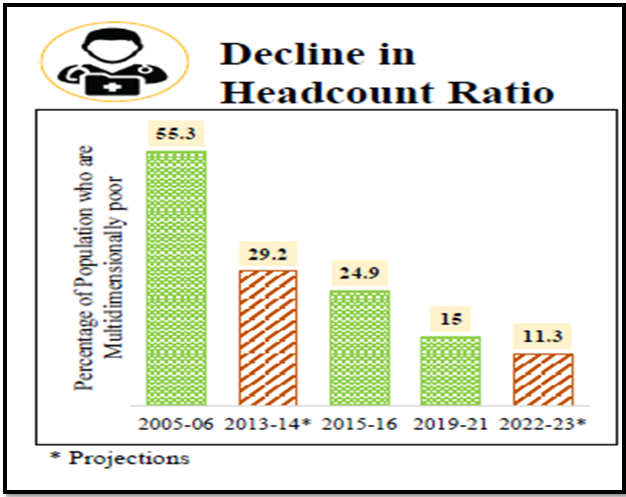

- Multi-dimensional Poverty: Reduction of poverty for 25 crore people.

- Direct Benefit Transfer (DBT):

- Utilized PM-Jan Dhan accounts.

- ₹34 lakh crore transferred, saving ₹2.7 lakh crore for the government.

- PM-SVANidhi Scheme:

- Credit assistance to 78 lakh street vendors.

- 2.3 lakh vendors received credit thrice.

- PM-JANMAN Yojana: Targeted support to particularly vulnerable tribal groups.

- PM-Vishwakarma Yojana: End-to-end support for artisans in 18 trades.

Mahilayen (Women)

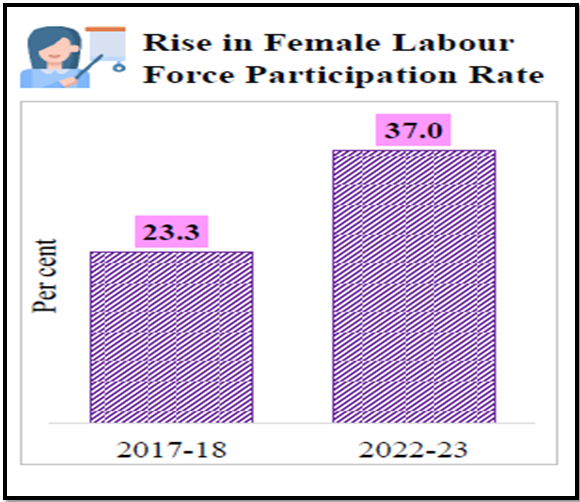

- Mudra Yojana: 30 crore loans to women entrepreneurs.

- Higher Education: 28% increase in female enrolment over ten years.

- STEM Education: Women constitute 43% of enrolment.

- Empowerment Measures:

- Outlawing ‘Triple Talaq’.

- Reservation of one-third seats in Lok Sabha and State Assemblies.

- Over 70% of PM Awas Yojana rural houses to women.

Yuva (Youth)

- National Education Policy 2020: Transformational reforms.

- PM SHRI Schools: Quality education and holistic development.

- Skill India Mission:

- Trained 1.4 crore youth.

- Established 3000 new ITIs.

- Higher Education Expansion: New IITs, IIITs, IIMs, AIIMS, and universities.

- PM Mudra Yojana: 43 crore loans totaling ₹22.5 lakh crore.

- Start-Up Initiatives: Fund of Funds, Start Up India, and credit schemes.

- Sports: Record medals in Asian Games, Chess achievements.

Annadata (Farmers)

- PM-KISAN SAMMAN Yojana: Financial assistance to 11.8 crore farmers.

- PM Fasal Bima Yojana: Crop insurance for 4 crore farmers.

- E-National Agriculture Market: Integrated 1361 mandis, aiding 1.8 crore farmers.

- Farmer-Centric Policies: Income support, risk coverage, and promotion of innovations.

STRATEGY FOR AMRIT KAAL

Net Zero Commitment by 2070

- Goal: Achieving ‘Net Zero’ carbon emissions.

Renewable Energy Support

- Wind Energy: Viability gap funding to promote wind energy projects.

- Coal Gasification and Liquefaction: Development of cleaner coal technologies.

Alternate Fuel Use

- Fuel Blending: Mandatory blending of CNG, PNG, and compressed biogas.

- Biomass Utilization: Financial support for biomass aggregation machinery procurement.

Solar Energy Promotion

- Rooftop Solarization: Providing up to 300 units of free electricity monthly for 1 crore households.

Public Transport Enhancement

- E-Buses: Adoption in public transport networks.

- E-Vehicle Ecosystem: Support for manufacturing and charging infrastructure.

Biotechnology Initiatives

- Bio-manufacturing and Bio-foundry Scheme: Launch of new schemes for eco-friendly alternatives.

Facts

- The Prime Minister Ujjwala Yojana (PMUY) has facilitated the distribution of 10 crore LPG connections to households.

- A total of 36.9 crore LED bulbs and 72.2 lakh LED tube lights have been successfully distributed to promote energy-efficient lighting.

- The UJALA initiative has led to the distribution of 23.6 lakh energy-efficient fans, contributing to reduced energy consumption.

- The Street Lighting National Programme (SNLP) has seen the installation of 1.3 crore LED street lights for enhanced energy efficiency.

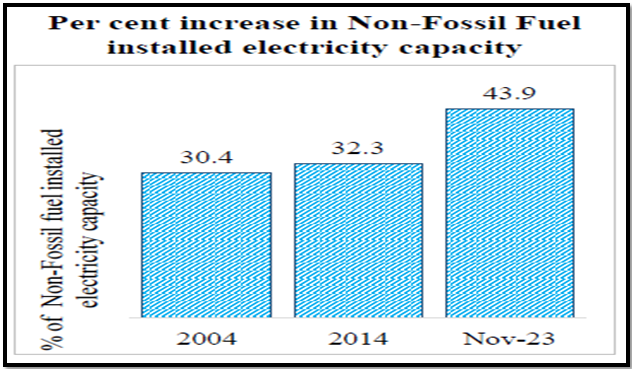

- The non-fossil fuel-based energy capacity has witnessed remarkable growth, surging from 30.4% in 2004 to 43.9% in 2023, indicating a significant shift towards cleaner and renewable energy sources.

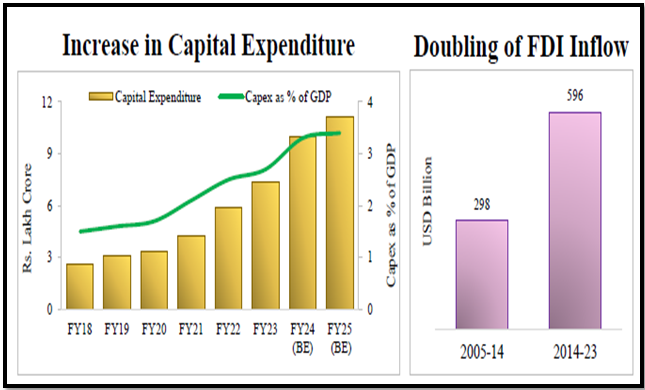

Infrastructure and Investment Initiatives:

- Implementation of Three Key Railway Corridor Programs under PM Gati Shakti:

- Executing three major railway corridor programs as part of PM Gati Shakti to enhance logistics efficiency and lower transportation costs.

- Facilitation of Foreign Investment through Bilateral Investment Treaties:

- Encouraging foreign investment by engaging in negotiations for bilateral investment treaties.

- Expansion of Airports and Comprehensive Development under UDAN Scheme:

- Expanding existing airports and undertaking comprehensive development of new airports as part of the UDAN scheme to bolster air connectivity and accessibility.

- Promotion of Urban Transformation through Metro Rail and NaMo Bharat:

- Fostering urban transformation through the implementation of Metro rail projects and the NaMo Bharat initiative, aimed at enhancing urban infrastructure and mobility.

Inclusive Development Highlights:

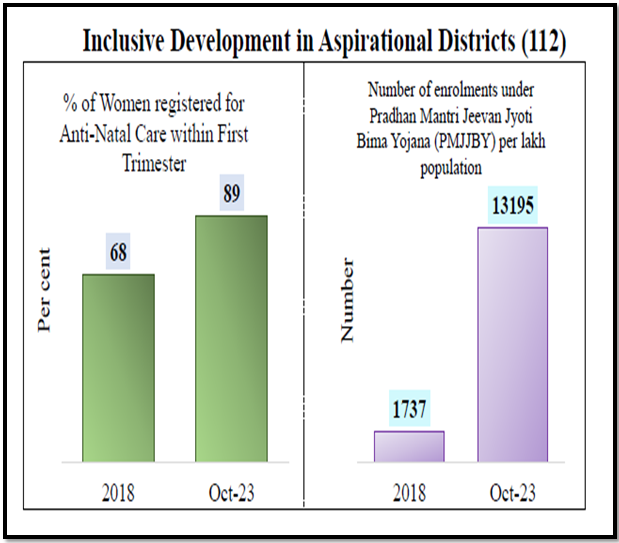

- Aspirational Districts Programme: Aids states in rapid development and job creation.

- Development of the East: Empowering the eastern region for India’s growth.

- 2 crore additional houses targeted under PM Awas Yojana (Grameen) in the next 5 years.

- Housing for the Middle Class: Launching a scheme to encourage middle-class homeownership.

- Expansion of Medical Education: Establishment of more medical colleges using existing hospital infrastructure.

- Cervical Cancer Vaccination: Offered to girls aged 9 to 14 years.

- Maternal and Child Health Care: Streamlining various schemes into a comprehensive program.

- Upgrading Anganwadi Centers: “Saksham Anganwadi and Poshan 2.0” for improved nutrition and early childhood care.

- U-WIN Platform: Rolled out for efficient immunization management and intensified Mission Indradhanush efforts.

- Ayushman Bharat Extension: Expanding the scheme to cover ASHA workers, Anganwadi Workers, and Helpers.

Agriculture and Food Processing Initiatives:

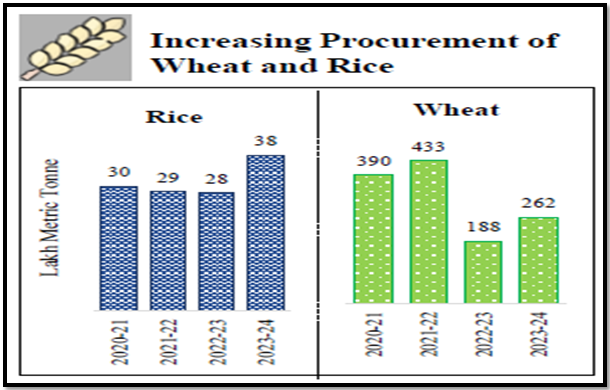

- Encouraging Investment in Post-Harvest Activities:

- Promoting both private and public investment in post-harvest activities, including aggregation, modern storage, efficient supply chains, primary and secondary processing, as well as marketing and branding.

- Expansion of Nano DAP Application:

- Expanding the application of Nano DAP (Diammonium Phosphate) on various crops across all agro-climatic zones.

- Atmanirbhar Oilseeds Abhiyaan:

- Developing a strategy to achieve self-sufficiency in oilseeds production.

- Comprehensive Dairy Development Program:

- Formulating a comprehensive program for dairy development aimed at controlling foot and mouth disease and increasing the productivity of dairy animals.

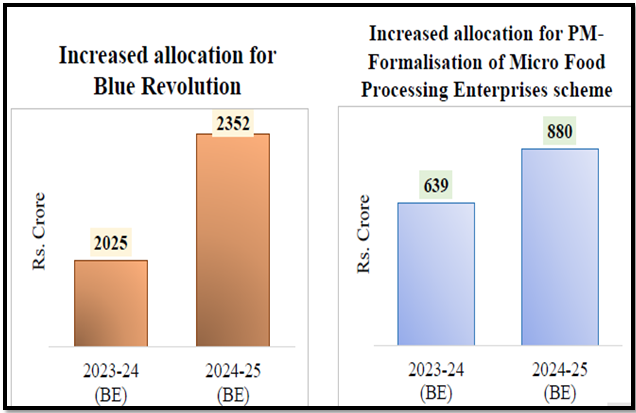

- Boosting Pradhan Mantri Matsaya Sampada Yojana:

- Accelerating the implementation of the Pradhan Mantri Matsya Sampada Yojana to enhance aquaculture productivity, double exports, and create more employment opportunities.

- Integrated Aquaparks:

- Establishing five integrated aquaparks to bolster the aquaculture sector.

- Promotion of Blue Economy 2.0:

- Launching a scheme for restoration and adaptation measures, along with the development of coastal aquaculture and mariculture, fostering the growth of Blue Economy 2.0.

Part B

DIRECT AND INDIRECT TAXES

|

Direct Tax |

Indirect tax |

| · Remarkable Growth in Tax Collections:

o Tax collections have more than tripled over the past decade. · Surge in Return Filers: o The number of return filers has increased by 2.4 times. · Streamlined Processing: o Average processing time for returns has been significantly reduced from 93 days in 2013-14 to just 10 days in 2023-24. · Rationalized Tax Regime: o The new tax regime has led to reduced and rationalized tax rates. · Tax Relief for Lower Incomes: o Taxpayers with incomes up to ₹7 lakh no longer have a tax liability. · Enhanced Presumptive Tax Threshold: o The threshold for presumptive taxation for retail businesses has been raised from ₹2 crore to ₹3 crore. · Corporate Tax Reduction: o Corporate tax rates have been reduced from 30% to 22% for existing companies and to 15% for new manufacturing companies. · Improved Taxpayer Services: o Enhanced services through Faceless Assessment and Appeal, along with the introduction of a new Form 26AS and prefilling of tax returns. |

· Impressive Growth in GST Collections:

o Average monthly Gross GST collections have doubled, reaching 21.66 lakh crore in FY24. · Improved State Revenue Tax Buoyancy: o The tax buoyancy of State revenue has increased from 0.72 (2012-16) to 1.22 in the post-GST period (2017-23). · Cost Reduction and Price Benefits: o Reduced logistics costs and lowered prices for most goods and services. · Efficiency in Import Release Time: o A notable decrease in import release time since 2019, with reductions of 47% at Inland Container Depots, 28% at Air Cargo complexes, and 27% at Sea Ports. · Supply Chain Optimization: o Optimization of the supply chain by eliminating tax arbitrage and octroi.

|

Tax Proposals Summary:

- Continuation of Tax Benefits:

- Tax benefits for Start-ups and investments by sovereign wealth funds/pension funds will be extended. Tax exemption for certain IFSC units, previously set to expire on 31.03.2024, will now continue until 31.03.2025.

- Withdrawal of Outstanding Direct Tax Demands:

- Outstanding direct tax demands up to ₹25,000 for fiscal year 2010 and up to ₹10,000 for fiscal years 2011-2015 will be withdrawn, providing relief to around 1 crore taxpayers.

- Unchanged Tax Rates:

- The existing tax rates will be retained, including those for direct and indirect taxes, including import duties.

- Corporate Taxes will remain at 22% for existing domestic companies and 15% for specific new manufacturing companies.

- Taxpayers with incomes up to ₹7 lakh will continue to have no tax liability under the new tax regime.

Source:

- Images used are from Key Features of Budget 2024-2025 documents.

- FM Budget speech; PIB