BOOSTING THE MIDDLE CLASS: KEY TAX BREAKS AND FINANCIAL REFORMS FOR INDIA

Syllabus:

- GS-3- Middle class and related tax breaks ,economic implications in India

Focus :

- The article focuses on proposed tax breaks and financial reforms aimed at benefiting India’s middle class, particularly the salaried and retired segments. It highlights suggestions for exempting bank deposit interest from tax, making health insurance more affordable, and increasing the Public Provident Fund (PPF) limit, aiming to enhance the financial stability and well-being of the middle class.

Source - ET

Introduction

- The upcoming full budget for the remaining period of the current fiscal year presents an opportunity for the Finance Minister to address the needs of the middle class, which primarily includes the salaried and pensioner population.

- Despite benefits provided in previous budgets, the middle class continues to expect more financial relief. This article explores several middle class-friendly proposals related to the financial sector that the Finance Minister may consider.

Bank Deposits

Socio-Economic Challenges:

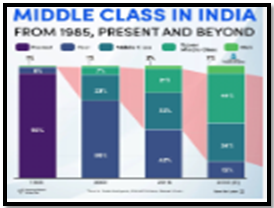

- The middle class in India faces complex socio-economic challenges and daily struggles.

- Post-retirement, middle-class parents often continue to support their children due to limited employment opportunities.

Risk-Averse Investment Preferences:

- Retirees prefer to invest their retirement benefits in low-risk fixed deposits (FDs) of public sector banks, which are perceived as safer.

Proposed Tax Exemption:

- It is proposed that the Finance Minister exempts the entire interest income from retail bank FDs from income tax under Section 80TTA of the Income Tax Act.

- Currently, senior citizens can claim a deduction of up to ₹50,000 on interest income from several types of deposits.

Interest Rate Adjustments:

- Senior citizens receive an additional interest rate (25-100 basis points) on FDs, which has remained static.

- The Reserve Bank of India (RBI) should evaluate the deregulation of the Savings Bank (SB) interest rate introduced in 2011.

Unclaimed Deposits and Inheritance Laws:

- Despite efforts, unclaimed deposits remain a significant issue.

- The budget should direct the Ministry of Law and Justice to collaborate with banks’ law departments to find solutions, including incentivizing banks to address this at the ground level.

Health Insurance

- Increased Health Consciousness:Post-pandemic, people have become more health-conscious, leading to a higher demand for health insurance.

- Rising Premiums:The cost of health insurance premiums, especially for critical illnesses, has increased significantly.

- Proposed Reforms:

- Increase the income tax exemption limit for premiums paid.

- Reduce Goods and Services Tax (GST) on health insurance premiums.

- Introduce a ‘no claim bonus’ system for insured individuals who do not make any claims in a year.

Credit Card Loyalty Points:

- Currently, GST is charged on the encashment of accumulated loyalty points on credit cards.

- It is proposed to eliminate GST on such encashments, as they are merely accounting entries.

Public Provident Fund (PPF)

Current Limit:

- The PPF limit has remained stagnant at ₹1.5 lakh per year for a long time.

Role of PPF:

-

- PPF serves as a crucial safety net for the salaried class, particularly after retirement.

Proposed Increase:

-

- It is proposed to raise the PPF limit to ₹2 lakh per year to provide better financial security for the middle class.

Additional Proposals

Deposit Insurance Reform:

- The Deposit Insurance System in India, introduced in 1961, needs to be overhauled to make it relevant for modern banking.

- Introduce a risk-adjusted premium system where Domestic Systemically Important Banks (D-SIBs) and other perceived Too-Big-To-Fail (TBTF) banks pay lower premiums than smaller, riskier banks.

Encouraging Digital Banking:

- Digital banking is progressing impressively, and there should be measures to ensure sufficient balances in SB accounts for routine bill payments.

- The RBI should continue to promote digital banking while ensuring the protection of depositor money.

Conclusion

- The middle class, especially the salaried and retired segments, deserves targeted tax breaks and financial reforms to enhance their financial stability and well-being.

- Exempting bank deposit interest from tax, making health insurance more affordable, and increasing the PPF limit are crucial steps in this direction.

- These measures will not only provide immediate relief but also contribute to the long-term financial security of the middle class, aligning with the broader goals of economic stability and growth.

Recommendations for Policy

Exempt Bank Deposit Interest from Tax:

- Implement a complete tax exemption on interest income from retail bank FDs for all depositors, particularly benefiting senior citizens.

Reduce Health Insurance Premiums:

- Lower GST on health insurance premiums and increase the tax exemption limit for premiums paid.

- Introduce incentives for policyholders who do not make claims, promoting a healthier population.

Increase PPF Limit:

- Raise the PPF contribution limit to ₹2 lakh per year, providing a more substantial safety net for the middle class.

Reform Deposit Insurance:

- Overhaul the Deposit Insurance System to introduce risk-adjusted premiums, ensuring that larger, more stable banks pay lower premiums, benefiting retail depositors.

Promote Digital Banking:

- Continue to advance digital banking initiatives while ensuring the safety and security of depositor funds through robust regulatory measures.

Source:The Business Line

Associated article

https://universalinstitutions.com/indias-economy-offers-global-hope/

Mains Practice Question :

GS-3

- “Discuss the importance of tax breaks and financial reforms for the middle class in India. How can measures such as exempting bank deposit interest from tax, making health insurance more affordable, and increasing the Public Provident Fund (PPF) limit contribute to their financial stability?.”(250 Words)