BASICS OF ECONOMICS

Difference Between Economy and Economics

Economy

- The term economy encompasses the collective activities of individuals and institutions in a specific region or country as they engage in the production, distribution, exchange, and consumption of goods and services. These activities are fundamentally social in nature and involve the processes of buying, selling, or bartering. The economy operates within a framework that is influenced by factors such as cultural practices, government policies, and international trade agreements, aiming to facilitate the flow and allocation of resources and commodities to meet the needs and wants of the society.

Economics

- Economics, on the other hand, is the academic study of how economies operate. It is concerned with the analysis of economic activities, focusing on understanding how resources are allocated, how decisions are made, and how these decisions affect individuals, households, businesses, and governments. Economics delves into the principles and mechanisms that underpin the functioning of economic systems, aiming to address questions related to scarcity, efficiency, and welfare. Derived from the Greek words Oikos (meaning family, household, estate) and Nomos (meaning law or norms), economics is often described as the “science of scarcity,” as articulated by the British economist Lionel Robbins. This discipline seeks to comprehend and propose solutions to the challenges posed by limited resources and unlimited wants.

Economics and Its Subdivision

| Subdivision | Description | Key Concepts and Elements |

| Consumption | This is considered the starting point of economic activity because it creates demand for goods and services. Consumption patterns are influenced by consumer behavior, which includes preferences, income levels, and price sensitivity. Understanding consumption is crucial for analyzing how demand for various goods and services is generated and how it evolves over time. | · Consumer Behavior

· Demand · Diminishing Marginal Utility · Consumer Surplus |

| Production | Production involves the transformation of inputs (or resources) into outputs (goods or services) that can be consumed. This process is central to economic activity, as it determines how efficiently and effectively resources are used to meet consumer demand. | · Factors of Production (Land, Labour, Capital, Entrepreneurship)

· Input-Output Relationship · Productivity |

| Exchange | Exchange refers to the processes and mechanisms through which goods and services are traded. It includes the determination of prices and the organization of markets, which can vary widely in form, from perfectly competitive to monopolistic. | · Price Determination

· Market Forms (Perfect Competition, Monopoly, etc.) · Trade and Commerce |

| Distribution | Distribution focuses on how the income or output generated from production is allocated among the factors of production. This involves determining the rewards for each factor, such as rent for land, wages for labor, interest for capital, and profits for entrepreneurship. | · Factors of Production Rewards (Rent, Wages, Interest, Profits)

· Allocation of Income · Equity and Efficiency in Distribution |

Macro, Micro and Mesoeconomics

Division of Economics Post-Great Depression

Background: The Great Depression in the 1930s catalyzed the division of economics into two primary domains: macroeconomics and microeconomics. This period highlighted the necessity to understand economic phenomena at both the individual (micro) and aggregate (macro) levels.

Key Figure: John Maynard Keynes emerged as the father of macroeconomics, focusing on economic issues at a broader scale.

Analogy for Understanding

- Microeconomics: Analogous to a single tree within a vast forest, focusing on the specific details.

- Macroeconomics: Comparable to viewing the forest as a whole, understanding the system’s overall functioning.

Importance of Studying Micro and Macroeconomics

Microeconomics

- Operational Understanding: Offers insights into the functioning of economies on a small scale.

- Policy and Decision-Making: Provides tools for effective policy-making, such as price determination.

- Economic Welfare: Helps gauge the level of economic welfare within an economy.

- Resource Allocation: Aids in the efficient allocation and utilization of resources.

- Predictive Value: Facilitates predictions based on individual and firm-level studies.

Macroeconomics

- Broad Functioning Insights: Gives an understanding of the economy at a macro level.

- Strategy Development: Assists in creating strategies to address fundamental economic issues.

- Future Preparations: Enables anticipation of future problems and strategizing accordingly.

- Economic Indicators Analysis: Facilitates the comparison and analysis of various economic indicators.

- Crisis Prevention and Prediction: Helps in avoiding and predicting potential future economic crises.

Difference between Micro and Macroeconomics

| Aspect | Microeconomics | Macroeconomics |

| Scope | Focuses on small components of the economy. | Studies the economy as a whole. |

| Approach | Bottoms-up approach. | Top-down approach. |

| Alias | Known as ‘Price Theory’. | Known as ‘Income Theory’. |

| Examples | Consumer choices, producer decisions. | National income, inflation, international trade. |

| Evolution | Derived from theories of price determination. | Based on empirical observations beyond theoretical explanations. |

| Schools of Thought | Lacks competing schools of thought. | Has competing schools, such as New Keynesian and classical economics. |

Interdependence and Complementarity

- Both micro and macroeconomics are interdependent, addressing many overlapping issues. For instance, inflation impacts raw material costs, affecting prices for consumers, demonstrating the interconnectedness of micro-level decisions and macro-level phenomena.

Meso-economics

- Definition: Focuses on the intermediate level of economics, bridging micro and macro aspects. Examples include studies on specific sectors like the auto industry or infrastructure.

- Diversity of Thought: Encompasses various schools of thought, including behavioral economics, welfare economics, and sustainability, highlighting the discipline’s evolving nature and the importance of considering a range of perspectives in economic analysis.

Different Approaches to Studying Economics

Studying economics can be approached from various angles, each with its unique perspective on how economic activities are intertwined with other societal factors.

Political Economics

Integrates politics and economics to comprehensively understand public policy directions. This approach acknowledges that political actions directly influence economic outcomes and vice versa.

- Integration with Politics: It considers how political ideologies and decisions shape economic policies. For example, land reforms often stem from political motivations but profoundly affect the economic landscape in terms of agriculture, investment, and livelihood.

- Understanding Decision-Making: This perspective aids in comprehending the rationale behind specific economic decisions within their political context. The adoption of liberalization, privatization, and globalization in many countries following the collapse of the USSR illustrates how political shifts can precipitate significant economic reforms.

- Influence on Policies: In systems like China’s, the political framework dictates economic priorities, illustrating a direct link between political authority and economic direction.

Liberal and Neo-liberal Economics

Liberal Economics

Initiated by Adam Smith’s concept of the “invisible hand,” posits that individual self-interest inadvertently promotes societal benefits.

- Economic Rationality: It is premised on the belief that individuals make rational decisions aimed at personal benefit, which collectively contributes to the common good.

- Limited State Role: Advocates argue that the government should confine its role to providing essential services like infrastructure, defense, and the judiciary, promoting a laissez-faire market environment.

- Market Forces: Emphasis is on allowing market dynamics to dictate economic activities, exemplified by the early 20th-century US and the UK and India following neoliberal reforms.

Features of a Capitalistic Economy

Capitalism emphasizes private ownership and the free market. Here’s an overview of its key characteristics, alongside its merits and demerits.

- Private Ownership: Resources are owned privately, with owners having the right to utilize, sell, or bequeath them.

- Freedom of Enterprise: Individuals have the liberty to pursue any occupation and engage in trade freely.

- Profit Motivation: The primary objective is profit maximization, driving economic activity.

- Free Competition: The government exerts minimal control over market transactions, fostering competition.

- Price Mechanism: Prices are determined by demand and supply dynamics.

- Limited Government Role: The government’s involvement is restricted to providing fundamental services.

- Income Inequality: A notable consequence is the widening gap between the rich and the poor.

- Merits include efficient resource utilization, incentivization of hard work, economic progress, consumer prioritization, high capital formation rates, and technological advancement. Demerits encompass an overarching focus on profit maximization potentially at societal and environmental costs, market failures, information asymmetry, resource wastage, and societal stratification.

Keynesian Ecxonomics

Keynesian Economics is a school of thought in economic theory that emphasizes the importance of total spending in the economy (aggregate demand) and its effects on output and inflation. Developed by the British economist John Maynard Keynes during the 1930s in an attempt to understand the Great Depression, Keynesian economics diverges from classical economics by advocating for government intervention in the economy.

Principles of Keynesian Economics

- Government Intervention: Keynesianism argues for active government intervention in the economy, especially during recessions. Unlike classical and neoclassical theories, which advocate for minimal government role, Keynesian economics sees the government’s role as crucial to stabilizing the economy by managing aggregate demand.

- Pump Priming: This involves the government injecting money into the economy to stimulate demand. The idea is that during periods of low economic activity (recessions or slowdowns), increased government spending can help kickstart growth. For example, the Government of India’s Atma Nirbhar Bharat package aimed to revive economic activity through substantial fiscal stimulus.

- Fiscal Policy: Keynesians advocate for using fiscal policy – government spending and taxation – as a tool to manage economic cycles. During downturns, they recommend increased government spending and lower taxes to boost demand; during booms, they suggest reducing spending and increasing taxes to cool off the economy.

- Monetary Policy: Alongside fiscal policy, Keynesian economics supports the use of monetary policy – controlling the supply of money and interest rates – to influence economic activity. Lower interest rates can encourage borrowing and investing, thereby stimulating demand.

- Multiplier Effect: Keynesian theory emphasizes the multiplier effect, where initial government spending leads to increased income, leading to more spending and further economic activity, thus multiplying the initial stimulus effect.

- Counter-Cyclical Policies: Keynesians believe in counter-cyclical policies, meaning that the government should act against the tide of the business cycle – spending more during recessions and cutting back during expansions – to smooth out economic fluctuations.

Examples of Keynesian Economics

- The Atma Nirbhar Bharat package in India, aimed at providing economic stimulus during a slowdown.

- Government programs like the PM Gram Sadak Yojana and MGNREGA in India, which are designed to create jobs and stimulate economic activity.

- The global response to the 2008 financial crisis, where many countries adopted stimulus packages to boost demand and mitigate the recession’s effects.

Socialist and Communist Economics:

Socialist and Communist economics represent economic theories and practices where the means of production, distribution, and exchange are owned or regulated by the community as a whole or the state. These approaches aim to achieve a more equitable distribution of wealth and to reduce or eliminate the class system.

Features of Socialist Economy

- Public Ownership: The means of production are owned by the public or the state, eliminating private ownership in key sectors.

- Central Planning: Economic decisions are made by a central authority, which plans production and distribution according to societal needs, not market forces.

- Social Welfare: The primary goal is to maximize social benefits rather than profits, with wealth distribution taking precedence over wealth creation.

- Equality: Socialist economies strive for equality of income and opportunity, providing free access to essential services like health and education to ensure equal chances for all.

- Absence of Competition: With the state controlling production and distribution, the competitive market mechanism is absent, leading to limited consumer choices.

Merits of Socialist Economy

- Reduction in Inequalities: Wealth and resources are distributed more equitably, reducing exploitation and disparities.

- Rational Allocation of Resources: Central planning aims to use resources efficiently, minimizing waste.

- Social Welfare: Emphasis on wealth distribution promotes overall societal well-being.

- Stability: Central planning can lead to fewer economic fluctuations and a more stable economy.

Demerits of Socialist Economy

- Bureaucratic Inefficiencies: Central planning can result in delays, corruption, and inefficiency.

- Lack of Incentives: With little room for personal profit and competition, motivation to excel or innovate can be lower.

- Limited Choices: State control over production and distribution restricts consumer and producer choices.

- Concentration of Power: Centralized control can lead to a lack of local empowerment and representation.

Mixed Economy

A mixed economy combines elements of capitalism and socialism, aiming to harness the advantages of both systems while mitigating their disadvantages. In this economic structure, both the private and public sectors operate in the economy, playing significant roles in achieving economic development and social welfare.

Features, Merits, and Demerits of a Mixed Economy

| Aspect | Features | Merits | Demerits |

| Ownership | Both public and private sectors own the means of production. The state often plays a key role in decision-making. | Encourages rapid economic growth by fulfilling public welfare goals alongside private sector profit motives. | Lack of coordination due to differing objectives of the public and private sectors. |

| Sectoral Coexistence | The private sector focuses on profit-driven industries, while the public sector targets welfare-oriented sectors. | Promotes balanced growth across different sectors, ensuring both are adequately developed. | Competitive rather than cooperative interactions between the government and private sector. |

| Economic Planning | Involves national-level planning encompassing both the public and private sectors. | Enables proper utilization of resources by controlling private sector expansion and allowing state intervention where necessary. | Bureaucratic inefficiency and corruption can hinder economic efficiency. |

| Economic Problem Solving | Solved through both price mechanisms and state intervention, addressing issues of production, distribution, and allocation. | Ensures economic equality with progressive taxation and better wealth distribution. | Fear of nationalization may deter private sector investment in technology and large-scale projects. |

| Freedom and Control | The state determines the extent of freedom the private sector enjoys, balancing control with economic liberty. | Supports the protection of the poor and weaker sections through labor laws, taxation, and subsidies. | Can lead to widening inequality as laws of inheritance and private property favor wealth accumulation in certain segments. |

Key Takeaways

- Ownership and Control: A mixed economy fosters a dual system where both state and private enterprises have significant stakes, with the state often guiding the economic direction through policy and regulation.

- Sectoral Balance: By allowing private enterprises to operate freely in profit-oriented sectors and the government to manage welfare-centric areas, a mixed economy strives for a balance between efficiency and social welfare.

- Economic Planning and Intervention: Strategic planning and intervention by the state aim to correct market failures, ensure resource allocation efficiency, and promote economic stability and growth.

- Social Welfare and Equality: Through progressive taxation and social welfare programs, a mixed economy aims to reduce income disparities and protect vulnerable societal groups.

- Challenges and Criticisms: Despite its advantages, a mixed economy can face challenges like bureaucratic inefficiency, coordination issues between the public and private sectors, and the potential for increased inequality due to the coexistence of private wealth and public welfare objectives.

Gandhian Economics

Gandhian Economics is a unique approach to economic principles and practices derived from the thoughts and teachings of Mahatma Gandhi. It represents a blend of ethical, sustainable, and socio-economic considerations aimed at promoting equity, self-sufficiency, and harmony within communities.

Principles of Gandhian Economics

- Decentralized Economic Development: Gandhian economics advocates for a decentralized model of development, focusing on the empowerment of local communities to utilize local resources to meet their needs. This model emphasizes self-sufficiency and the equitable distribution of wealth.

- Labour and Moral Values: It places a high value on labor, arguing for equal participation and the dignity of manual labor. Gandhi’s perspective was influenced by Leo Tolstoy and John Ruskin, emphasizing that every individual should engage in labor to earn their livelihood, respecting manual work.

- Appropriate Use of Technology: While not opposing technology outright, Gandhian economics is critical of technologies that displace human labor. The emphasis is on adopting technologies that complement human effort rather than replace it.

- Trusteeship: A notable concept in Gandhian economics is trusteeship, which suggests that wealth beyond one’s personal need should be held in trust for the benefit of society. This principle aims at reducing inequality and ensuring the welfare of the poorest members of society.

Developmental Economics

Developmental Economics is a branch of economics that examines the economic, social, and institutional mechanisms necessary for improving the economic conditions of countries classified as low-income, developing, or underdeveloped. It emerged prominently in the aftermath of World War II, addressing the needs of newly independent nations facing challenges of poverty, lack of infrastructure, and underdeveloped private sectors.

Core Areas of Focus

- Economic Well-being: Beyond mere economic growth, developmental economics looks at structural changes within economies and the overall well-being of the population, encompassing health, education, and employment.

- Holistic Development: Considers a broad range of factors contributing to the development, including social, cultural, and political aspects, alongside economic indicators.

- Human Development Index (HDI) and Happiness Index: Uses comprehensive measures such as HDI and the Happiness Index to assess the progress of nations beyond per capita income, incorporating aspects like life expectancy, education level, and subjective well-being.

Beijing Consensus or State Capitalism or Chinese Model of Development

The Beijing Consensus, also known as State Capitalism or the Chinese Model of Development, is a term that came into prominence in the early 21st century, specifically in 2004 when Joshua Cooper Ramo introduced it. This concept outlines the economic policies adopted by China under the leadership of Deng Xiaoping starting in 1978. These policies marked a significant departure from the orthodox economic models, presenting an alternative to the Washington Consensus which had been prevalent in the global economic discourse.

Origins and Ideology

The Beijing Consensus is rooted in the economic reforms and open-door policies initiated by Deng Xiaoping. Unlike the Washington Consensus, which advocates for free-market principles, deregulation, and a diminished role for the state in the economy, the Beijing Consensus combines market economy mechanisms with strong state control. It reflects China’s unique approach to development, emphasizing the state’s role in guiding economic growth and maintaining stability.

The Beijing Consensus is founded on three main pillars:

- Constant Experiments and Innovation: This principle underscores the importance of flexibility in policy-making. China’s approach involves trial and error, allowing for regional experiments before national implementation. This method has enabled China to adapt swiftly to changing economic conditions and to innovate continuously.

- Peaceful, Distributive Growth with Slow Gradual Reforms: Unlike the shock therapy seen in some transition economies, China advocates for gradual reforms. This steady pace aims to ensure that economic growth does not lead to social upheaval. The emphasis is on distributive growth to avoid large disparities that could lead to social tension.

- Self-determination with the Inclusion of Selective Foreign Ideas: While open to learning from the outside world, China places a strong emphasis on sovereignty and the selective adoption of foreign ideas. This principle allows China to tailor global practices to fit its national context and priorities.

Economic Characteristics and Success

- The Beijing Consensus highlights the role of the authoritarian state in managing the economy, allowing for market mechanisms within a framework of state oversight. This model has been characterized by significant state ownership in key sectors, strategic planning, and guidance from the government.

- China’s economic model under the Beijing Consensus has attracted global attention, especially during periods when Western economies faced challenges, and China showcased robust growth. It presented a viable development path that diverged from neoliberal norms, emphasizing state-led capitalism imbued with Chinese characteristics.

Criticism and Caution

However, the model has not been without its critics. Some argue that what worked for China might not be applicable universally, cautioning against the wholesale adoption of the Beijing Consensus. Critics have also pointed to the rise of protectionism and a decline in globalization as negative consequences of countries trying to emulate China’s growth model. Additionally, with the slowdown in China’s economic growth, there are calls for caution in following this model blindly.

Washington Consensus

The Washington Consensus is a term that refers to a set of policy recommendations initially advocated by major international financial institutions such as the International Monetary Fund (IMF), World Bank, and the US Treasury Department. The concept was first introduced by John Williamson, an economist based in the United States, in 1989. The primary aim of these recommendations was to guide developing countries in need of economic assistance through structural reforms that would increase the role of market forces in their economies in exchange for immediate financial support.

Policy Prescriptions

The Washington Consensus outlined a 10-point reform policy aimed at promoting economic stability and growth:

- Fiscal Discipline: This involved maintaining a balanced budget to avoid fiscal deficits that could lead to economic instability.

- Public Expenditure Priorities: Focusing government spending on areas that would yield high economic returns and potentially improve income distribution, such as primary healthcare, primary education, and infrastructure.

- Tax Reform: Simplifying the tax system to reduce marginal rates and broaden the tax base, making it more efficient and less burdensome.

- Interest Rate Liberalization: Allowing interest rates to be set by the market to encourage savings and investment.

- Competitive Exchange Rate: Maintaining an exchange rate that would favor international competitiveness.

- Trade Liberalization: Reducing trade barriers to allow for freer exchange of goods and services.

- Liberalization of Foreign Direct Investment (FDI) Inflows: Encouraging foreign investment by reducing restrictions.

- Privatization: Transferring ownership of state-owned enterprises to the private sector to improve efficiency.

- Deregulation: Reducing government regulations to encourage business activity and competition.

- Secure Property Rights: Ensuring legal protection for property rights to encourage investment and economic development.

Impacts and Criticism

The Washington Consensus had a profound impact on the global economic landscape, leading to the processes known as Liberalization, Privatization, and Globalization. However, it also faced significant criticism:

- One-Size-Fits-All Approach: Critics argue that the Washington Consensus failed to account for the unique economic conditions and needs of individual countries, leading to policies that were not always suitable for every economy.

- Impact on Domestic Industries: Free trade policies advocated by the consensus could harm countries whose domestic industries were not competitive on the international stage.

- Privatization and Social Needs: Premature privatization, especially in essential services like water, could lead to accessibility issues, as seen in Bolivia, where many people could no longer afford water after privatization.

- Increased Vulnerability: Deregulation was blamed for making economies more susceptible to financial crises, as evidenced by the 2008 sub-prime crisis and the Southeast Asian economic crisis of the 1990s.

India and the Washington Consensus

- India’s approach to the Washington Consensus has been cautious, focusing on maintaining fiscal discipline and macroeconomic stability. The Fiscal Responsibility and Budget Management Act of 2003 (FRBM Act) was a significant step in this direction, mandating legal adherence to fiscal consolidation principles. However, the global pandemic necessitated a shift towards expansionary fiscal policies, with the IMF and World Bank advising countries, including India, to increase spending to stimulate economic growth. India responded by implementing significant spending measures aimed at boosting the economy, demonstrating a flexible approach to the principles of the Washington Consensus in the face of unprecedented global challenges.

Santiago Consensus

- Economic and Social Inclusion: Unlike the Washington Consensus, which primarily focused on market liberalization, privatization, and fiscal discipline, the Santiago Consensus advocates for policies that ensure the benefits of economic growth are widely distributed across society. This includes measures to improve access to education, healthcare, and social protection services.

- Utilization of Global Best Practices and Technology: The World Bank under the Santiago Consensus encourages the adoption of global best practices and the strategic use of information technology. The goal is to tailor these practices and technologies to meet local conditions and challenges, enhancing their effectiveness in promoting sustainable development.

- Focus on Socioeconomic Development: Governments are urged to prioritize comprehensive socioeconomic development strategies under this consensus. This involves focusing on both the economic fundamentals and the social factors that contribute to inclusive growth. The approach has been visible in countries like India, where policies have increasingly aimed at bridging the gap between economic growth and social equity.

Mercantilism

Mercantilism is an economic doctrine that advocates for government intervention in promoting export-led growth. This theory posits that a nation’s wealth can be augmented through a positive balance of trade, particularly by increasing exports and limiting imports to accumulate precious metals like gold and silver.

Characteristics and Historical Context

- Promotion of Exports: Mercantilism suggests that governments should adopt policies to encourage exports, as a means to increase national wealth and power.

- Build-up of Forex Reserves: By accumulating foreign exchange reserves through a trade surplus, nations can enhance their investment capacity, reduce the cost of borrowing, and reap various other economic benefits.

- Dominance in the 16th to 18th Centuries: This ideology was prevalent in Europe during the early modern period, where the accumulation of gold was seen as the cornerstone of national strength.

Behavioral Economics

Behavioral Economics challenges the traditional economic assumption of rational decision-making by incorporating insights from psychology and other disciplines to understand human behavior in economic contexts.

Key Concepts

- Challenging Rationality: Contrary to Adam Smith’s notion of the “invisible hand” guiding rational self-interest, behavioral economics posits that human decisions often deviate from rationality due to various biases and cognitive limitations.

- Nudges: Proposed by Richard Thaler, the concept of “nudges” refers to subtle policy shifts that can significantly influence behavior in positive ways, affecting both macroeconomic and microeconomic outcomes.

Green Economics

- Recognition of Environmental Costs: It highlights the environmental degradation associated with unchecked economic activities, including air, water, and soil pollution, and its long-term impacts on human health and ecological balance.

- Sustainable Growth: The school argues for a model of growth that is sustainable over the long term, avoiding practices that lead to environmental destruction and instead promoting those that are in harmony with nature.

- Holistic Well-being: It supports the advancement of economic, social, and environmental well-being in tandem, suggesting that true progress can only be achieved when all three domains are considered and advanced collectively.

Health Economics

Health Economics is a specialized field of economics that focuses on the analysis and implementation of efficient and effective healthcare services. It encompasses a wide range of issues related to health and healthcare, including the allocation of resources to health services, the economic impacts of health behaviors, and the efficiency of healthcare delivery.

Sectors and Types of Economies

- As per economic activity; there are the following sectors in an economy:

| Sector | Description | Sub-Sectors/Examples | Economic Type |

| Primary | Involves exploiting natural resources. | Agriculture, mining, oil exploration, etc. | Agrarian Economy (when agriculture contributes ≥50% to national income and livelihood) |

| Secondary | Involves processing of raw materials from the primary sector. | Manufacturing (a large job-providing sector) | Industrial Economy (when manufacturing contributes ≥50% to national income and employment) |

| Tertiary | Dominated by services-led activities. | Education, banking, healthcare, etc. | Services Economy (when dominated by service sector activities) |

| Quaternary | Decides the quality of human resources; knowledge sector. | – | – |

| Quinary | Involves high-level decision-making. | Bureaucracy and corporate sector | – |

- On the basis of ownership; the economy can be divided into the following three sectors:

| Sector | Ownership & Control | Main Focus | Funding Source | Benefits | Examples |

| Public Sector | Government (fully or majority stake) | Public service and welfare | Taxes, duties, excise | Job security, housing, benefits, pensions | Railways, defence, police, civil administration, health, education |

| Private Sector | Individuals or private companies | Profits, efficiency | Promoters/owners capital, loans, shares, debentures | Better salaries, merit-based promotions, incentives | IT, finance, consulting, services, pharma, hospitality, tourism |

| Public-Private Partnership (PPP) | Partnership between public and private sectors | Combine public accountability and private efficiency | Various, including foreign and domestic investment | Brings together public accountability and private sector efficiency | Metro projects, airports, telecom infrastructure |

On the basis of working conditions; the economy can be divided into the following two:

| Sector | Description | Benefits | Prevalence in India | Examples |

| Organised Sector | Good, fixed working conditions with social security | Job security, fixed hours, social benefits | Low | Banking, teaching, nursing |

| Unorganised Sector | Casual, seasonal employment without formal protection | – | High, but lacks formal protection and stable income | Self-employed, gig economy workers, daily wagers |

Domestic Economy and Its Sectors

Components of a Domestic Economy

The domestic economy comprises all resident economic units that can be categorized into:

1. Households: These are groups of people who share accommodation and engage collectively in saving, consumption of certain goods and services, and may participate in productive activities.

2. Legal Entities: These are units that have the capability to engage in economic transactions, make decisions, and conclude contracts independently. Legal entities can be further divided into:

- Governments

- Enterprises or Corporations

- Non-profit entities (including legal or social entities)

Sectors of the Domestic Economy

The domestic economy is broadly divided into three larger sectors, each with its unique functions and components.

| Sector Name | Description | Key Components and Functions |

| General Government Sector | Encompasses all departments providing free services to the public, classified based on objectives and functions rather than ownership. | · Provide goods and services to households financed through taxes or other incomes.

· Redistribute wealth via transfers. · Produce non-market goods and services. · Examples include governance, defence, national security, health, education. |

| Real Sector | Refers to all real or non-financial elements of the economy. | · Enterprises (non-financial corporations) involved in the production of market goods and non-financial services.

· Households. · Non-profit institutions serving households. · It’s considered the sector that holds money or the money-holding sector. |

| Financial Sector | Comprises the economy’s money-issuing corporations primarily involved in financial activities and intermediation. | · Banks, institutions that borrow and lend, entities attracting funds from shareholders for equity investment, or bodies investing in securities with funds raised from policyholders.

· Excludes corporations not incurring liability on their own account for provisioning financial assets, like brokers, dealers, stock exchanges. |

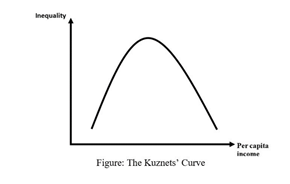

Kuznets Curve

Origin

The curve is named after Simon Kuznets, an economist who first proposed this theory in the 20th century. Kuznets hypothesized that in the early stages of economic development, a nation tends to experience an increase in inequality. This is largely because the benefits of economic growth are not evenly distributed across the population. However, as the economy continues to develop and matures, the distribution of income becomes more equitable.

Economic Transition

The Kuznets Curve illustrates a critical phase of transformation in an economy’s structure:

- Initially, economies are predominantly agricultural with low levels of income per capita and relatively low inequality.

- As economies start to industrialize, there’s a migration of labor from agriculture to more productive industrial sectors. This transition often leads to increased economic inequality because industrial sectors can generate higher income but may not initially benefit the entire population equally.

- Over time, with further economic development and increased income per capita, income inequality begins to decrease. This decrease is attributed to factors like the spread of education, more equitable government policies, better social safety nets, and a shift towards more knowledge-based sectors that offer broad employment opportunities.

Examples and Exceptions

- The curve has been observed in the historical economic development of countries such as England, Sweden, France, and Germany, where rapid industrialization led to initial increases in inequality followed by a reduction as these economies matured.

- However, not all countries follow this pattern. The Netherlands and Norway, for instance, have experienced different trajectories of inequality, highlighting that the Kuznets Curve is a general model and may not apply universally.

Environmental Kuznets Curve

Development

The EKC was first developed by economists Gene Grossman and Alan Krueger and later gained popularity through endorsements by entities like the World Bank. It applies the logic of the Kuznets Curve to environmental concerns, positing that as economies grow and industrialize, their environmental impact worsens until a turning point is reached.

Mechanism

- The initial phase of economic development is often associated with high levels of pollution and environmental degradation, as industries prioritize growth over environmental concerns.

- As economies reach higher levels of income, there’s a shift in priorities towards sustainability, driven by increased public awareness, the availability of more advanced technology, and the financial means to implement cleaner practices.

- This results in improvements in environmental indicators, such as air and water quality, even as the economy continues to grow.

Examples

A classic example of the Environmental Kuznets Curve is the reduction in sulfur dioxide levels in the USA. Despite the increasing number of cars, stricter regulations, technological advancements, and cleaner fuels have led to a decrease in pollution levels, illustrating the potential for economic development to coexist with environmental improvement.

UPSC QUESTION PAPERS

1. Which of the following activities include the real sector in the economy? (2022)

1. Farmers harvesting their crops.

2. Textile mills converting raw cotton into fabric.

3. A commercial bank lending money to a trading company.

4. A corporate body issuing rupee-denominated bonds overseas.

(a) 1 and 2 only

(b) 2, 3 and 4 only

(c) 1, 2 and 4 only

(d) 1, 2, 3 and 4 only