Misread India’s GDP.

Data has been cherry-picked to misread India’s GDP figure

Relevance

- GS Paper 3 Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

- Inclusive growth and issues arising from it.

- Tags: #GDP #NSO #Data #statistics #currentaffairs #upsc.

Why in the News?

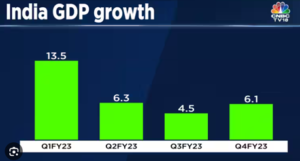

As per NITI Aayog, India to clock GDP growth of 6.5 pc in FY24 despite high crude oil prices. In recent times, India has witnessed a surge in articles critiquing its economic data, with some alleging selective data manipulation. This analysis dissects two key articles that raise questions about India’s GDP growth rate and highlights potential flaws in their arguments.

Debunking GDP Growth Rate Controversy

The Misleading Use of GDP Price Deflator

- Authored challenges India’s reported first-quarter GDP growth rate of 7.8 percent. A central argument questions the calculation of real GDP, emphasizing the volatility of the GDP price deflator compared to the consumer price index. The authors’ selective use of data and timeframes to support their argument is highlighted.

Normalizing Data over a Decade

- To counter this bias, data is normalize over a uniform ten-year period ending in 2022-23, revealing a reduced gap between CPI headline inflation and the GDP price deflator.

- This implies that volatility, if present, normalizes over time. Moreover, substituting the GDP price deflator with a stable CPI measure significantly alters the real GDP growth rate, challenging the reported figures.

Implications for Economic Narrative

- A critical observation is made regarding the narrative suggesting a rapid economic deceleration, which aligns with the authors’ viewpoint.

- However, it is important to consider the GDP price deflator’s composition, with a larger weight placed on the wholesale price index, which can contribute to volatility during global uncertainties like the Ukraine war and the pandemic.

Comparing Expenditure Components

- The article further dissects the comparison of expenditure components of GDP over yearly and quarterly periods, showcasing instances where growth accelerates. This analysis challenges the notion of a consistent economic slowdown.

Critiquing the National Statistical Office (NSO)

Inflated GDP Growth Numbers

- A reputed economist criticizes the NSO for publishing inflated GDP growth numbers for the first quarter.

- The argument centers on the expenditure side of GDP underestimating output value, resulting in a 2.8 percent discrepancy.

Historical Deviations and Data Revisions

- This critique is countered by highlighting historical deviations in GDP data, which average around (-) 1.1 percent yearly and only 0.5 percent quarterly.

- It is essential to recognize that the first-quarter estimate is not final, with six revisions to GDP data, often rectifying discrepancies over time.

Comparing GDP and GDI

- Drawing a parallel with US GDP data, which typically exhibits a 1 percent gap with GDI(Gross Domestic Income), this analysis shows that the gap has widened post-COVID. India’s average divergence remains lower at 0.5 percent, suggesting a reasonable margin of error.

The Lopsided GDP Growth Estimate

Manufacturing and GDP Growth

- Finally, the article questions the accuracy of the reported 7.8 percent growth rate by examining leading indicators.

- In particular, it highlights the robust growth in manufacturing, where the EBIDTA of ex-BFSI entities has increased significantly. This suggests the potential for an upward revision in GDP figures.

Conclusion

These critical articles may not fully appreciate the intricacies of the methodology employed in national accounts computation and may wrongly cast doubts on the statistical body. While acknowledging discrepancies, India’s economic momentum remains strong, positioning it as one of the world’s fastest-growing economies.

| Gross Domestic Product

Gross Domestic Product, commonly known as GDP, quantifies the aggregate worth of all end-stage products and services generated within the territorial boundaries of a nation during a defined timeframe. GDP serves as a key metric for gauging a country’s economic performance and its overall well-being. Calculating GDP · India calculates its GDP using two distinct methodologies, which yield similar but not identical results. The first method is based on economic activity at factor cost, while the second is based on expenditure at market prices. These methods lead to the computation of nominal GDP (using current market prices) and real GDP (adjusted for inflation). Among these figures, GDP at factor cost is the most commonly observed and reported. Types of Gross Domestic Product 1. Real GDP · Real GDP represents the total value of all goods and services produced by an economy in a specific year, expressed in prices from a chosen base year which is 2011 for India. It is also referred to as constant-price GDP or inflation-corrected GDP. 2. Nominal GDP · Nominal GDP measures a country’s economic output while considering current market prices. Unlike real GDP, it does not account for inflation or changes in price levels, which can potentially overstate the growth rate. All products and services in nominal GDP are valued at the prices at which they were sold during the reporting year. 3. GDP Per Capita · GDP per capita is a metric that quantifies the GDP on a per-person basis within a country’s population. It provides insights into the average productivity or living standards in an economy. There are three variations of GDP per capita: nominal, real (inflation-adjusted), and purchasing power parity (PPP) GDP per capita. 4. GDP Purchasing Power Parity (PPP) · Although not a direct GDP measure, purchasing power parity (PPP) is used by economists to compare one country’s GDP to others in “international dollars.” This comparison adjusts for differences in local prices and the cost of living, enabling cross-country assessments of real output, income, and living standards. |

Sources: Indian Express

Mains Question

“Critically analyze the arguments presented for challenging India’s GDP growth rate calculation methodology. Do these critiques hold merit, and what implications do they have for India’s economic narrative?” 250words.