ARE SPECIAL CATEGORY STATES JUSTIFIED?

Syllabus:

- GS-2- Asymmetric federalism , cooperative and competitive federalism

Focus :

- The article examines the rationale behind granting special category status to certain Indian states, highlighting the historical context, issues of dependency, lack of accountability, and political influences. It advocates for revisiting the status with improved accountability, monitoring mechanisms, and capacity building to ensure efficient use of central funds and sustainable development.

Source - TET

Introduction

- Revival of Demands: The demand for special category status has been revived by leaders like Chandrababu Naidu and Nitish Kumar.

- Promises and Politics: Andhra Pradesh was promised this status during the bifurcation to form Telangana. Nitish Kumar has consistently pushed for this status to address Bihar’s backwardness.

- Historical Context: The concept of special category states was introduced to address the specific disadvantages of economically backward hill states and the North-Eastern region.

Rationale for Special Category Status

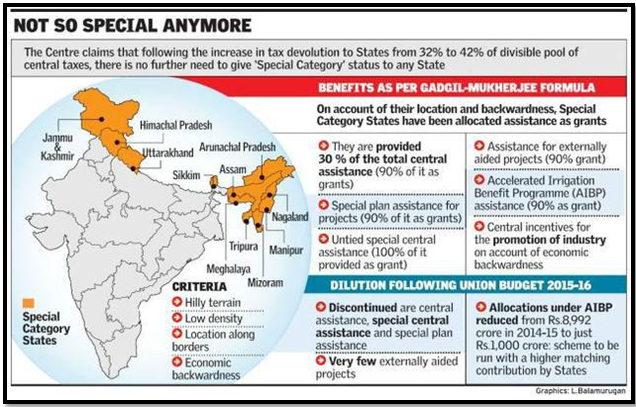

- Geographical and Economic Disadvantages: Eleven states, including all North-Eastern states and Himalayan states, were designated as special category due to their remoteness, isolation, and lack of resources.

- Central Assistance: The status aimed to provide liberal access to central funds to mitigate these disadvantages.

- Structural Weaknesses: The status was an attempt to address inherent structural weaknesses and capacity constraints of these states.

Issues with the Special Category Status

- Dependency: The status created overwhelming dependence on central funds, leading to complacency among the states.

- Lack of Accountability: The flow of funds was not linked to performance or accountability, leading to inefficient use of resources.

- Political Instability and Misgovernance: Some states could not utilize the resources effectively due to political instability and insurgency.

Evolution of Funding Mechanisms

- Gadgil Formula: During the Planning era, the Gadgil formula was used to allocate 30% of total plan assistance to special category states, with a 90% grant and 10% loan structure.

- Centrally Sponsored Schemes (CSS): Over time, the focus shifted to CSS, which appropriated most of the plan resources, reducing the impact of the Gadgil formula.

- Direct Transfers: Abolished in 2013-14 due to constitutional anomalies, direct transfers had bypassed state governments.

- Umbrella Schemes: CSS were restructured into umbrella schemes, continuing the flow of funds to special states but without addressing accountability issues.

Current Political Context

- Fourteenth Finance Commission: The 14th Finance Commission increased states’ share in divisible tax revenues but did not specifically address special category status.

- De Facto Abolition: Statements by officials suggested that special category status had been effectively abolished, though the benefits for these states remained protected.

- Continued Benefits: Excise duty concessions, income tax holidays, and subsidies continue to be provided to companies setting up in these states.

Revisiting the Special Category Status

- New Demands: If special category status is awarded to Andhra Pradesh and Bihar, existing flaws must be corrected.

- Accountability and Monitoring: Introduce mechanisms for periodic review, target-based assistance, and performance incentives.

- Institutional Capacity: Improve institutional capacities to effectively utilize budgetary allocations and avoid additional waste.

Conclusion

- Balanced Approach: The transfer of resources should be accompanied by accountability and performance markers to ensure efficient use of funds.

- Empowering States: The goal should be to empower states to become self-reliant and reduce dependence on central assistance.

- Sustainable Development: A balanced approach will contribute to sustainable development and equitable growth across all states.

Source:The Economic Times

Mains Practice Question :

GS-2

“Critically examine the rationale behind the special category status for certain Indian states. Discuss the challenges associated with this status and suggest measures to improve accountability and performance in the allocation and utilization of central funds.”(250 words)