AN UNEXPECTED BOUNTY

Syllabus:

GS 2:

- Government Policies and Interventions

GS 3:

- Indian Economy and issues relating to Planning, Mobilization of Resources,

- Reserve Bank of India.

Focus:

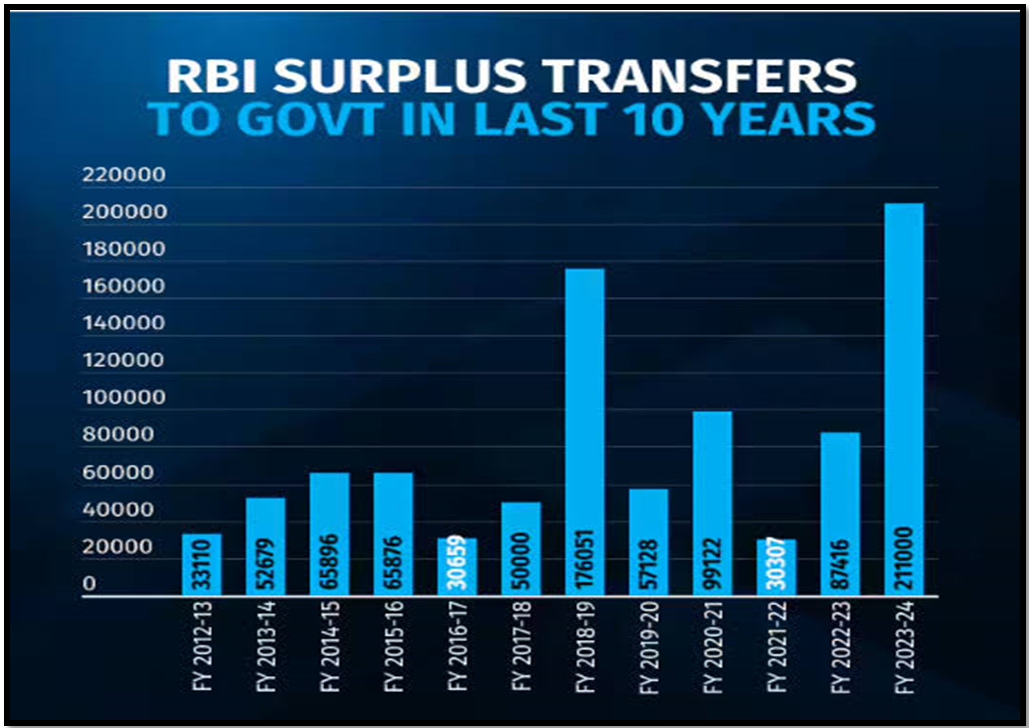

The recent unexpected dividend transfer of Rs 2.11 lakh crore from the RBI to the central government has sparked significant debate. This windfall, much larger than anticipated, prompts crucial questions about fiscal management and how the government plans to utilize this surplus amid economic recovery.

Source: Data.co

Fiscal Management Principles

- Prudent Levels: Fiscal deficits should be maintained at prudent levels, ideally around 3% of GDP for the Centre, as per the Fiscal Responsibility and Budget Management (FRBM) Act.

- Economic Adjustment: Deficit spending should vary based on economic conditions—higher during downturns and lower during upturns.

- Economic Stabilization: Adjusting deficit levels helps stabilize the economy by boosting demand during bad times and curtailing it during recoveries to avoid inflation.

- Symmetric Policies: Larger-than-normal deficits should be followed by smaller-than-normal deficits to prevent spiraling government debt.

- Global Practice: These principles are followed by prudent countries worldwide to avoid debt problems and stabilize growth cycles.

India’s Fiscal Challenges

- Persistent Deficits: Historically, Indian governments have struggled to maintain deficits within prudent levels, regardless of economic conditions.

- Pandemic Impact: During the pandemic, the fiscal deficit shot up to 9.2% of GDP in 2020-21, a necessary increase given the economic shock.

- Slow Reduction: Despite economic recovery, the deficit has been slow to decrease, with the target for 2024-25 still higher than pre-pandemic levels.

- Fiscal Deterioration: The consolidated central and state government deficit is around 8.5-9% of GDP, well above the 6% recommended by the FRBM Act.

- Debt Levels: Total government debt has been over 80% of GDP in recent years, compared to an average of 74% in the decade before the pandemic.

RBI’s Unexpected Dividend

- Significant Transfer: The RBI announced a transfer of Rs 2.11 lakh crore to the central government, double the budgeted amount.

- Spending Debate: There is a debate on whether the government should increase its capital expenditure (capex) with this surplus.

- Capex Growth: The interim budget indicated a slowdown in capex growth for 2024-25, which might be reconsidered with the surplus.

- China’s Example: Excessive capex, as seen in China’s infrastructure projects, can lead to unmanageable debt.

- Capex Necessity: The government should carefully assess the true need and kind of capex required rather than indiscriminately increasing spending.

How Does the RBI Determine the Allocation of Dividends?

|

Evaluating Capital Expenditure

- Stimulating Growth: Governments spend on capex to stimulate growth and meet economic needs, but the pace and focus must be justified.

- Infrastructure Problem: While India needs infrastructure development, it doesn’t need to solve all issues at once.

- Capex Pace: Since the pandemic, the government’s capex spending has grown at an average annual rate of 30%, which may not need to be sustained.

- Essential vs. Non-Essential: Not all capex is essential for growth, e.g., revitalizing BSNL and MTNL or investing in bullet trains may not be critical.

- Economic Stimulation: Given the strong economic performance, the government should use the surplus to reduce the fiscal deficit rather than stimulate an already strong economy.

Impact Associated with Dividend Transfer by RBI

- Debt Reduction: Utilizing the surplus to lower government debt can improve India’s fiscal health and credit ratings.

- Inflation Control: Reducing the deficit can help control inflation by preventing excess demand in the economy.

- Investor Confidence: Prudent fiscal management can boost investor confidence, attracting more foreign and domestic investments.

- Infrastructure Development: Targeted and efficient capital expenditure can address critical infrastructure needs, boosting long-term growth.

- Economic Stability: Following fiscal discipline principles can stabilize economic cycles and mitigate risks associated with excessive borrowing.

- Public Services: Improved fiscal health allows for better funding of essential public services, enhancing overall social welfare.

- Policy Credibility: Adherence to fiscal principles and transparent use of the surplus can strengthen the credibility of government policies and economic management.

Way Forward

- Fiscal Prudence: Prioritize reducing the fiscal deficit closer to the FRBM Act’s 3% target to ensure long-term economic stability.

- Targeted Capex: If capital expenditure is necessary, focus on high-impact, essential infrastructure projects rather than non-critical areas like revitalizing BSNL or bullet trains.

- Debt Management: Use the surplus to manage and reduce government debt, which has been over 80% of GDP in recent years.

- Economic Assessment: Conduct a thorough assessment of the economy’s true state to determine if additional spending is needed to support growth.

- Policy Symmetry: Follow a symmetric fiscal policy by balancing larger-than-normal deficits with smaller-than-normal ones post-recovery.

- Transparency: Ensure transparent and accountable spending to build public trust and confidence in fiscal decisions.

- Long-term Planning: Develop a long-term fiscal strategy that balances immediate economic needs with sustainable growth and stability

Conclusion

The government must carefully consider its options with the RBI’s unexpected surplus. Prioritizing fiscal prudence and adhering to established management principles is essential to ensure long-term economic stability, rather than increasing capital expenditure indiscriminately. The upcoming Union Budget will indicate the government’s fiscal strategy and economic priorities.

Source:The Hindu

Mains Practice Question:

The recent substantial dividend transfer from the RBI to the central government has raised significant debates on its optimal utilization. Discuss the fiscal management principles that should guide this decision and evaluate the potential implications of increased capital expenditure versus reducing the fiscal deficit.

Associated Article: