An opportunity to rethink India’s pension system

Relevance:

GS – 2 – Important aspects of Governance, Transparency and accountability

Why in the news?

- The global revolution in welfare underscores the importance of strong social support systems.

- India’s proposed Unified pension scheme should ensure adequate financial support for retirees.

- A robust welfare system is needed to safeguard the welfare of retirees under the new pension scheme.

Reforming the Indian pension system

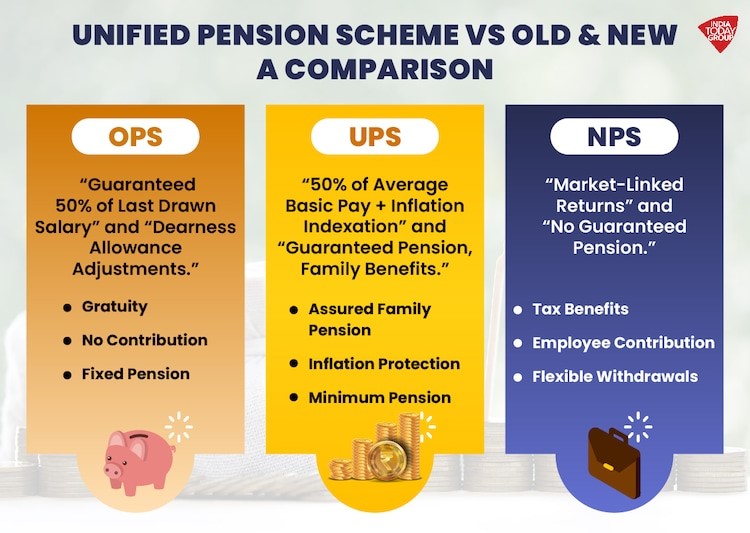

- India’s pension system has evolved over time, and three main structures have been identified:

- Old Pension Scheme (OPS)

- New Pension Scheme (NPS)

- Proposed Unified Pension Scheme (UPS)

- Each plan affects retirees differently – OPS is considered more secure whereas NPS links retirement income to market fluctuations, making it less predictable.

- The global shift away from neoliberal policies has recomplicated discussions of welfare.

- Against this backdrop, UPS must make significant changes to ensure it better meets the needs of retirees

OPS: Commitment to Social Security

- The Old Pension Scheme (OPS), prevalent before 2004, provides a defined benefit pension for government employees.

- The pension was determined and based on the employee’s last salary drawn.

- Under OPS, the government was the sole distributor of pensions.

- This policy provided retirees with stability and protection against financial market risk.

- With a fixed pension linked to a final salary, retirees could plan with confidence, ensuring a guaranteed income throughout retirement.

- OPS has demonstrated the government’s commitment to Social Security by ending market dependency and providing guaranteed pensions.

Why did the Center change its pension plan?

- In 2004, the Government of India replaced the Old Pension Scheme (OPS) with the New Pension Scheme (NPS).

- The shift has been from a defined benefit model (OPS) to a defined contribution model (NPS), where both the employee and the government contribute to the pension fund.

- Pension payments under the NPS are linked to market performance, making retirees’ incomes vulnerable to market fluctuations.

- These changes reflect neoliberal ideology, reducing state involvement in welfare and shifting risk to individuals.

- NPS retirees have been vulnerable to market fluctuations, effectively placing their futures at the mercy of speculative market conditions. NPS has been criticized because protections once provided by the state under OPS have eroded.

- An economic downturn can reduce benefits, threatening the financial stability of retirees.

- The market model has also raised concerns about the commercialization of the public good and the weakening of the country’s social responsibility.

A recurring welfare system

- Globally, the neoliberal era that has dominated economic systems for decades is showing signs of retreat.

- The financial crisis of 2008 highlighted the dangers of over-reliance on markets, leading to calls for stronger social protectionism and a return to welfare.

- The COVID-19 pandemic has intensified the demand for government intervention to protect the health and livelihoods of citizens, reinforcing the transition towards prosperity.

- Similar trends can be seen in India, where there is a growing demand for the return of state-sponsored welfare programs.

Proposed Unified Pension Scheme (UPS)

- The Unified Pension Scheme (UPS) announced by the Modi government is an attempt to provide a balanced universal pension for state share and market share.

- While UPS aims to address the issues created by the new pension system (NPS), it is still in its infancy and significant improvements need to be made to make it a viable option.

- Criticism of UPS

- Critics say UPS promises to pay pensions but offers reduced benefits compared to the old pension plan (OPS) and exposes retirees to market-based risks

- Requiring 25 years of service to receive a full pension puts later entrants at a disadvantage.

- Concerns about liquidity shortages raise fears of future pension delays or corpus shrinkage.

- Currently, the scheme applies only to central government employees, excluding many public sector employees such as teachers, which could lead to future pay increases.

- One key aspect of the UPS that needs attention is the need for greater state intervention to ensure that retirees are not made vulnerable to market forces.

- Although UPS offers a universal plan, its plan should include market volatility protection, possibly providing a minimum guaranteed pension similar to OPS.

Issues of government contributions

- The level of government contributions to the Unified Pension Scheme (UPS) needs to be adjusted to better balance market certainty and pension security.

- The UPS hybrid model does not fully mitigate the risks of market uncertainty and may not provide a balanced pension plan.

- Overlap is a major concern; UPS needs to expand employment to all industries, including informal workers, who currently lack adequate pension protections.

- In line with the global trend towards welfare, UPS should be expanded to provide pension security not only for government employees but also for government employees.

Tensions between pension schemes

- The comparison between the Old Pension Scheme (OPS), the New Pension Scheme (NPS), and the Unified Pension Scheme (UPS) highlights the tension between state-sponsored welfare and market-dominated schemes in the Indian pension system

- The OPS provided stable and predictable pensions, fully subsidized by the state.

- The NPS diverted retirees’ financial security into the volatile world of investment markets, creating uncertainty and vulnerabilities.

Opportunity for growth

- Although the globalization of neoliberalism and the resurgence of welfare policy, although limited, provide an opportunity to rethink the Indian pension system.

- A successful reorganization of UPS can protect the financial security of retirees by addressing the shortcomings of the NPS.

- Ensuring that UPS supports retirees with a robust welfare system, rather than leaving them vulnerable to market forces, is essential to creating an inclusive and sustainable retirement system.

Alternative articles

https://universalinstitutions.com/india-approves-unified-pension-scheme-balancing-ops-and-nps/