Aadhaar-enabled Payment System (AePS)

Context: Recently a popular YouTuber, shared how his mother’s bank account was drained using an Aadhaar-linked fingerprint without needing a two-factor authentication. His mother was not informed of the transactions by her bank, via message or otherwise.

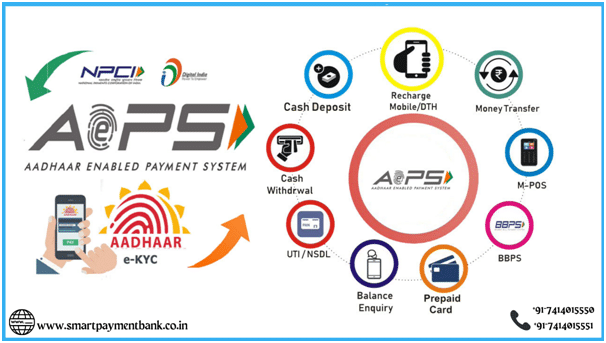

What is AePS?

- The Aadhaar-enabled Payment System (AePS) is a bank-led model which allows online financial transactions at Point-of-Sale (PoS) devices and micro ATMs of any bank using Aadhaar authentication.

- The model removes the need for OTPs, bank account and other financial details. It allows fund transfers using only the bank name, Aadhaar number, and fingerprint captured during Aadhaar enrolment, according to the National Payments Corporation of India (NPCI).

Is AePs enabled by default?

- Neither the Unique Identification Authority of India (UIDAI) nor NPCI mentions clearly whether AePS is enabled by default.

- Cashless India, a website managed and run by the MeitY, says the service does not require any activation, with the only requirement being that the user’s bank account should be linked with their Aadhaar number.

- Users who wish to receive any benefit or subsidy under schemes notified under section 7 of the Aadhaar Act, have to mandatorily submit their Aadhaar number to the banking service provider.

How is biometric information leaked?

- While Aadhaar data breaches have been reported in 2018, 2019, and 2022, the UIDAI has denied any breach of data.

- In response to media reports, the UIDAI said that the Aadhaar data, including biometric information, is fully safe and secure.

- However, UIDAI’s database is not the only source from where data can be leaked.

- Aadhaar numbers are readily available in the form of photocopies, and soft copies, and criminals are using Aadhaar-enabled payment systems to breach user information.

How do you secure your Aadhaar biometric information?

- The UIDAI is proposing an amendment to the Aadhaar (Sharing of Information) Regulations, 2016, which will require entities in possession of an Aadhaar number to not share details unless the Aadhaar numbers have been redacted or blacked out through appropriate means, both in print and electronic form.

- The UIDAI has also implemented a new two-factor authentication mechanism that uses a machine-learning-based security system, combining finger minutiae and finger image capture to check the ‘liveness’ of a fingerprint.

- Additionally, users are also advised to ensure that they lock their Aadhaar information by visiting the UIDAI website or using the mobile app. This will ensure that their biometric information, even if compromised, cannot be used to initiate financial transactions.

- It can be unlocked when the need for biometric authentication arises, such as for property registration and passport renewals, after which it can again be locked.

What can be done in case of a financial scam using Aadhaar?

- If users have not already locked their Aadhaar biometric information, they should do so immediately in case of any suspicious activity in their bank accounts. Users are also advised to inform their banks and the concerned authorities as soon as possible.

- Timely reporting can ensure that any money transferred using fraudulent means is returned to the victim.

- The RBI in a circular has stated that a customer’s entitlement to zero liability arises where the unauthorised transaction occurs, and the customer notifies the bank within three working days of receiving a communication from the bank regarding such unauthorised transaction.

| Practice Question

1. How has Aadhar enabled services has changed the governance structure of India? |