A VERDICT ON THE MONEY BILL THAT INDIA AWAITS

Syllabus:

GS 2:

- Indian Constitution: Evolution, Features.

- Government Policies and Interventions.

Why in the News?

The Supreme Court of India is set to hear a pivotal case on the definition and use of Money Bills. This decision will impact numerous laws passed without Rajya Sabha approval, questioning the constitutionality of bypassing the upper house and affecting India’s legislative balance.

Source:ToI

Context and Overview:

- What is the case?: In the coming weeks, a seven-judge Bench of the Supreme Court will hear arguments on critical questions regarding the contours of a Money Bill.

- Origin of Case: The reference to the seven-judge Bench stems from a 2019 verdict in Rojer Mathew vs South Indian Bank Ltd., challenging the Finance Act, 2017.

- Federal Architecture: The Court’s ruling will impact numerous legislations enacted without Rajya Sabha’s approval, affecting India’s federal structure and power divisions.

- Act’s Impact: The Finance Act, 2017, altered the authority and jurisdiction of 26 tribunals, merging bodies, prescribing qualifications for members, and imposing various service conditions.

- Petitioners’ Argument: Petitioners argued that the changes were too extensive to meet Money Bill criteria, requiring both Houses of Parliament’s approval, except for Money Bills per Article 109.

- Constitutional Clarity: The Court’s interpretation will clarify the constitutional boundaries of what can be included in a Money Bill, potentially setting a precedent for future legislation.

| What is a Money Bill?

Definition:

Constitutional Basis:

Procedure:

|

Articles and Definitions

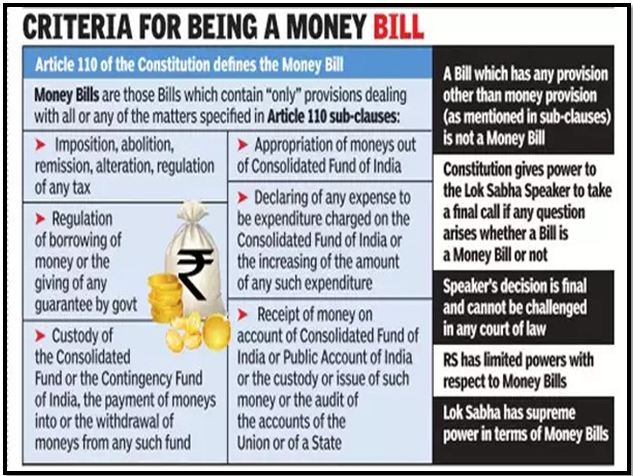

- Article 110(1): This article defines a Money Bill, listing subjects like tax imposition, money borrowing regulation, and appropriation of cash from the Consolidated Fund of India.

- Deeming Fiction: Article 110(1) creates a deeming fiction, stating that a draft law with provisions dealing with the matters listed will be deemed a Money Bill.

- Speaker’s Authority: Article 110(3) states that the Speaker of the Lok Sabha has the final say in determining whether a proposed legislation is a Money Bill or not.

- Simple Reading: A simple reading of the definition suggests that a Bill with subjects beyond those in Article 110(1) cannot qualify as a Money Bill.

- Finance Act’s Scope: The Finance Act, 2017, made sweeping changes to tribunals and granted the Union Executive extensive rule-making powers, going beyond Money Bill criteria.

- Tribunal Changes: The Act determined tribunal members’ salaries from the Consolidated Fund of India, fitting Money Bill items but mostly amending substantive laws.

- Judicial Independence: The law invaded principles essential to judicial independence by rearranging panels and granting the Union Executive control over tribunal administration.

A Colourable Exercise of Power

- Court’s Task: The Court’s task in Rojer Mathew should have been straightforward, as changes through a Money Bill to office terms and executive power were subterfuge.

- Obvious Perception: It was evident that the Finance Act, 2017, was a colourable exercise of power, perverting the Constitution’s plain language to defeat its basic thrust.

- Majority Opinion: The five-judge Bench felt constrained by prior precedent, particularly the K.S. Puttaswamy vs Union of India (2018) case regarding the Aadhaar regime’s validity.

- Aadhaar Act: Justice Sikri’s majority opinion in K.S. Puttaswamy concluded that the Aadhaar Act met Money Bill conditions, overlooking the broader provisions of the statute.

- Provision Range: The Aadhaar Act provisions ranged from demographic and biometric enrolment to penalties and statutory authority establishment, beyond Article 110(1) subjects.

- Seven-Judge Remit: The seven-judge Bench now has to consider the implications of the word “only” in Article 110(1), with decisions affecting numerous legislations bypassing the Rajya Sabha.

Role of the Upper House

- Rajya Sabha Bypassed: The Finance Act, 2019, made amendments to the Prevention of Money Laundering Act, 2002, through a Money Bill, raising significant legal questions.

- Supreme Court Ruling: The Supreme Court upheld many amendments in Vijay Madanlal Choudhary vs Union of India (2022), but kept open the validity of making them through a Money Bill.

- Constitutional Backbone: Justice Chandrachud, in Rojer Mathew, emphasized that the Rajya Sabha is crucial for the federal structure and pluralism of India.

- Constitutional Unit: The Rajya Sabha is an indispensable unit for ensuring deliberate dialogue and cannot be ignored in resolving potential differences between Parliament houses.

- Ensuring Access: Money Bills ensure the Rajya Sabha does not block government access to the treasury for administration, but using them to bypass legislative checks undermines the Constitution.

- Democracy’s Foundation: If the Court allows this practice to continue unchecked, it may endanger the foundations on which India’s democracy stands.

Implications for Recent Legislation

- Finance Act, 2019: The Finance Act, 2019, made substantial amendments to the Prevention of Money Laundering Act, 2002, via a Money Bill, raising questions on legislative process integrity.

- PMLA Amendments: Changes included redefining “proceeds of crime” and empowering the Enforcement Directorate with arrest, attachment, and search and seizure powers.

- Judicial Scrutiny: The Supreme Court upheld these amendments in Vijay Madanlal Choudhary vs Union of India (2022), but left open the question of their validity through a Money Bill.

- Rajya Sabha’s Role: This ruling highlights the critical role of the Rajya Sabha in scrutinizing and debating significant legislative changes that impact citizens’ rights and governance.

- Legislative Bypassing: The frequent use of Money Bills to bypass the Rajya Sabha undermines the legislative process and compromises the balance of power envisioned in the Constitution.

- Potential Precedent: The seven-judge Bench’s decision will set a precedent for how future legislation is classified and passed, ensuring that the Rajya Sabha’s role is preserved.

Way Forward: Ensuring Judicial Review

- Speaker’s Certification: The Speaker’s certification of a Bill as a Money Bill must be subject to judicial review to prevent misuse and uphold constitutional integrity.

- Bright-Line Rules: Clear and bright-line rules are needed to define the standards for reviewing the Speaker’s decision, ensuring transparency and accountability.

- Constitutional Safeguards: Judicial review acts as a constitutional safeguard against potential overreach by the executive and ensures adherence to the Constitution’s intent.

- Balancing Power: Judicial oversight is essential in maintaining the balance of power between the legislative and executive branches, protecting democratic principles.

- Legislative Integrity: Ensuring that the classification of Bills is subject to judicial scrutiny preserves the integrity of the legislative process and prevents arbitrary decision-making.

- Public Confidence: A robust system of judicial review fosters public confidence in the legislative process, reinforcing the rule of law and democratic governance.

Conclusion

The Supreme Court’s ruling on the Money Bill classification will have profound implications for India’s legislative process. Ensuring judicial review and maintaining the Rajya Sabha’s role are critical for preserving the constitutional balance and safeguarding democratic governance.

Source:The Hindu

Mains Practice Question:

Discuss the significance of judicial review in the context of Money Bills in India. How does the use of Money Bills impact the federal structure and the legislative process? Illustrate with recent examples.

Associated Article:

https://universalinstitutions.com/supreme-courts-consideration-of-money-bills/