A REFORM WINDOW

Relevance: GS3: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in the News?

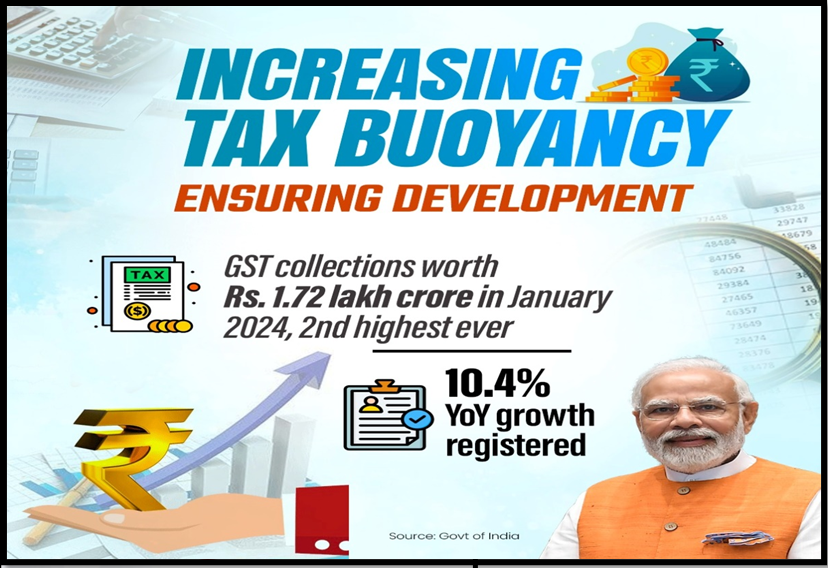

- A significant surge in Goods and Services Tax (GST) revenues, surpassing expectations and reaching unprecedented levels.

- The buoyancy in GST collections holds critical implications for India’s fiscal health, indicating robust economic activity and potential revisions to fiscal targets.

- Substantial increase in GST revenues prompts discussions on policy reforms, including rationalizing tax rates, phasing out compensation cess, and optimizing revenue mobilization strategies.

- The uptick in GST collections serves as a key economic indicator, reflecting consumer spending patterns, business activity, and overall economic sentiment.

- Impact of GST trends on businesses, influencing investment decisions, pricing strategies, and compliance measures amidst evolving tax dynamics.

Buoyant GST Revenues

- Positive Revenue Trends:

- Net direct tax collections increased by 19.9% by mid-March, reaching 97% of revised Budget targets;

- Goods and Services Tax (GST) revenues totaled a robust 220.18 lakh crore, with gross GST revenues in March crossing 21.78 lakh crore;

- Average monthly collections in 2023-24 grew by 11.6% to over 21.68 lakh crore, establishing a new revenue norm.

- Government Satisfaction:

- The uptick in collections addresses the Centre’s concerns regarding GST performance and surpasses revised estimates presented in the interim Budget.

- Central GST collections exceeded expectations, prompting a potential revision of targets for 2024-25.

Factors Driving Revenue Growth

- Compliance Efforts:\

- Increased collections may result from raised tax demands for past years and crackdowns on evasion tactics like fake invoices;

- Net GST revenue growth, along with rising domestic transaction collections, indicates robust economic activity.

- Concerns and Considerations:

- A slight decline in GST on goods imports in March suggests potential cutbacks in discretionary consumption.

- Despite this concern, overall GST trajectory provides confidence for prioritizing GST reforms.

What is the Current Framework of the GST System?

About GST

- The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold for domestic consumption.

- The GST is paid by consumers, but it is remitted to the government by the businesses selling the goods and services.

- It is essentially a consumption tax and is levied at the final consumption point.

- It was introduced through the 101st Constitution Amendment Act, 2016.

- It has subsumed indirect taxes like excise duty, Value Added Tax (VAT), service tax, luxury tax etc.

Existing Tax Structure

- Central GST (CGST) covers Excise duty, Service tax etc.

- State GST (SGST) covers Value Added Tax (VAT), luxury tax etc.

- Integrated GST (IGST) covers inter-state trade.

- IGST is not a tax but a system to coordinate state and union taxes.

There are four major GST slabs

- 5%, 12%, 18% and 28%.

- Some demerit and luxury goods, which are in the 28% bracket, attract additional levy of cesses, the proceeds of which go to a separate fund meant to compensate states for revenue shortfall and repayment of compensation related loans.

Recommended Reforms

- Rationalization of GST Rates:

- There is a need to revive plans for rationalizing multiple GST rates, extending it to excluded items like electricity and petroleum products;

- Reduction of high levies on essential products such as cement and insurance is essential for economic growth.

- Phasing Out GST Compensation Cess:

- The GST Compensation Cess, utilized for repaying COVID-19 pandemic-era borrowings, generated 21.44 lakh crore last year.

- Consideration should be given to winding down the cess earlier than the extended March 2026 deadline, avoiding its replacement with a new levy except for demerit goods like tobacco.

- Sensible Taxation Policies: Taxing hybrid vehicles over 40% contradicts India’s green objectives and hampers consumption and private investments.

Implementation and Way Forward

- Policy Implementation:

- The government must actively pursue GST reforms, including rate rationalization and cess phase-out, to sustain revenue growth and enhance economic efficiency;

- Revising GST targets for 2024-25 based on current revenue trends will facilitate effective fiscal planning.

- Stakeholder Engagement: Collaboration with industry stakeholders and state governments is crucial for garnering support for GST reforms and ensuring smooth implementation.

- Public Awareness: Educating the public about the rationale behind GST reforms and their potential benefits is essential for garnering public support and minimizing resistance.

- Monitoring and Evaluation:

-

- Regular monitoring of GST revenue trends and their impact on economic indicators will facilitate timely adjustments to reform strategies;

- Evaluation of the effectiveness of implemented reforms will provide insights for further refinement of GST policies.

- Monitoring and Evaluation:

Conclusion

- Buoyant GST revenues present an opportune moment for prioritizing GST reforms to enhance revenue efficiency and foster economic growth;

- Implementation of recommended reforms, stakeholder engagement, and public awareness efforts are essential for realizing the full potential of GST in driving India’s economic development.

GST Council:

|

Mains question:

Discuss the significance of the recent surge in Goods and Services Tax (GST) revenues in India. Examine the factors driving this surge and evaluate the implications for fiscal policy and economic reforms. Suggest measures to sustain this momentum and address challenges in the GST regime. (250 words)

Associate Article:

https://universalinstitutions.com/need-for-single-rate-gst-exemption-less-taxation-eac-pm-chairman-bibek-debroy/