A FOUR-POINT ACTION PLAN FOR INDIA’S INVESTMENT CHARTER

Syllabus:

GS 3:

- Effects of Liberalization on the Economy, Changes in Industrial Policy and their Effects on Industrial Growth.

- Investment Models.

Why in the News?

Prime Minister Narendra Modi’s call for an “investment-friendly charter” during the Niti Aayog meeting aims to boost foreign direct investment (FDI) in India. This initiative comes in response to India’s underperformance in attracting FDI compared to other major economies, necessitating strategic reforms.

Source: BS

Context and Overview

- Prime Minister’s Initiative: Prime Minister called for an “investment-friendly charter” during the ninth Governing Council Meeting of Niti Aayog on July 27.

- Objective: The charter aims to outline policies, programs, and processes to attract more investments, enhancing India’s global investment appeal.

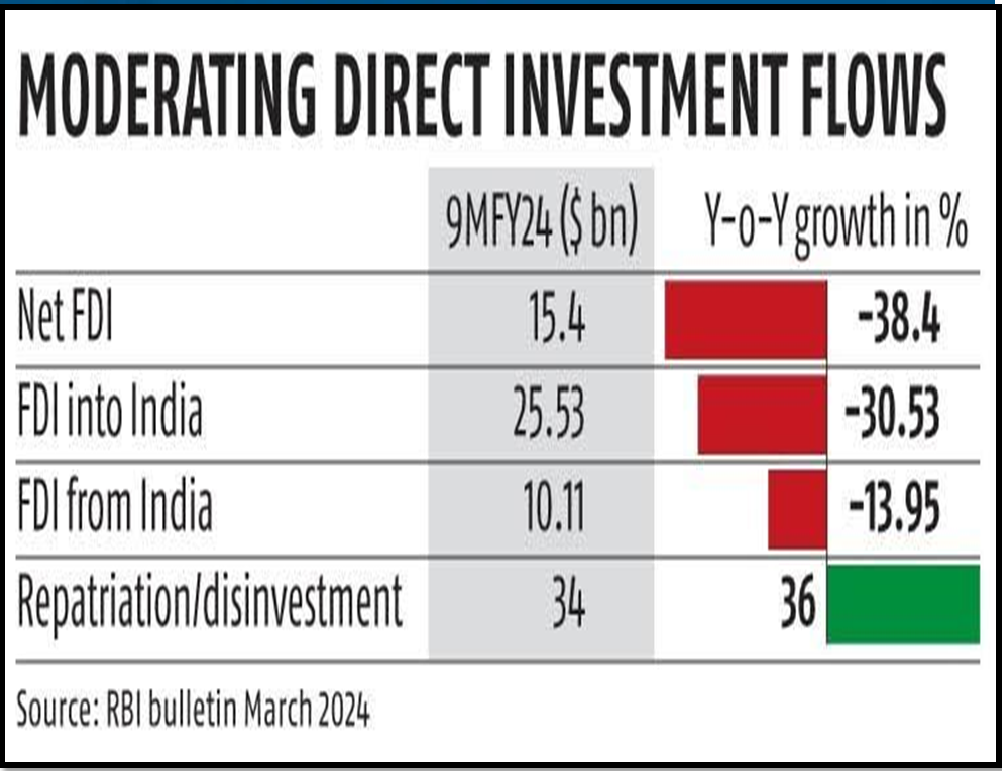

- Current FDI Status: Despite potential, India attracted only $44.4 billion in FDI in 2023-24, 1.1% of GDP, showing the need for strategic reforms.

- Global Comparison: India lags behind countries like China and Brazil in FDI, highlighting the necessity for improved investment strategies.

- Sectoral Investment Gaps: Key sectors like electronics and technology remain underfunded, limiting economic growth and innovation.

- Four-Point Plan: The proposed plan includes leveraging FDI data insights, reducing cost disadvantages, enhancing ease of doing business, and creating a robust FDI evaluation framework.

| Foreign Direct Investment (FDI)

About:

FDI Routes:

o No prior government approval required. o Up to 100% allowed in non-critical sectors.

o Necessary in certain sectors or for investments above specific thresholds. o Administered by the Department for Promotion of Industry and Internal Trade (DPIIT) and RBI. Examples of Approval via Auto and Government Route:

Foreign Investment Promotion Board (FIPB):

Foreign Portfolio Investment (FPI) About:

Important Features:

o Occurs without gaining ownership.

o Investors earn returns through dividends, interest, and capital appreciation. Example:

Regulatory Body:

|

Leverage Data Insights

- FDI Potential: India attracted $44.4 billion of FDI in 2023-24, only 1.1% of its GDP, indicating significant untapped potential for growth in foreign investments.

- Global Comparison: In 2022, India was the world’s seventh-largest FDI recipient with $49.4 billion, far behind China ($189.1 billion) and Brazil ($86.1 billion).

- Source Countries: Most of India’s FDI comes from Singapore and Mauritius, accounting for 49% of cumulative FDI from April 2001 to March 2024, often exploiting tax treaties.

- Sectoral Distribution: Manufacturing attracted 30% of India’s FDI, but crucial sectors like electronics and technology remain underfunded, limiting overall economic growth.

- Telecom Investments: The telecom sector received only $713 million in 2022-23 and $282 million in 2023-24, highlighting a need for increased investment in high-potential areas.

- Food Processing: Foreign investments in food processing are insufficient, given India’s agricultural strengths, necessitating a strategic reassessment to boost this sector.

Reduce Cost Disadvantages

- Competitive Costs: India must offer a competitive cost base to attract businesses shifting from China or other locations, addressing high raw material costs and tariffs.

- Raw Material Costs: Local units face high raw material costs due to import dependence and tariffs, making non-traditional production less competitive.

- Energy Costs: Industrial electricity costs in India range from $0.08 to $0.10 per kWh, higher than China’s $0.06 to $0.08 and Vietnam’s $0.08 to $0.09 per kWh.

- Infrastructure Gaps: Despite significant investment, India’s infrastructure and logistics lag behind China and Vietnam, affecting overall efficiency and attractiveness.

- Credit Costs: Lending rates in India are around 9-10%, compared to China’s lower rates of 4-5% and Vietnam’s moderate rates of 7-8%, impacting business costs.

- Supply Chains: China benefits from efficient supply chains, while Vietnam offers competitive costs with low or zero tariffs, positioning them as more attractive investment destinations.

Enhance Ease of Doing Business

- Priority Sectors: Identify and focus on priority sectors where India’s manufacturing and export capabilities are weak, such as electronics, computers, and precision equipment.

- PLI Scheme: Recast the Production-Linked Incentive (PLI) scheme to support higher value addition and deep manufacturing in key sectors, enhancing global competitiveness.

- Anchor Manufacturers: Invite top global firms as anchor manufacturers to drive technological innovation and productivity, similar to Suzuki’s impact on the automobile sector.

- Government Coordination: Ensure effective coordination between investors and senior government officials, with dedicated officers assigned to projects for prompt assistance.

- Ready-to-Manufacture: Establish operation-ready industrial zones with pre-approved permissions to allow investors to start production quickly, improving investment attractiveness.

- Logistics Efficiency: Ensure quick factory-to-ship movement through dedicated freight corridors and strategically located industrial zones near ports to enhance export capabilities.

Create FDI Evaluation Framework

- National Interests: Ensure foreign investments align with national interests and protect strategic autonomy, focusing on industries that boost exports and technological capabilities.

- MSME Protection: Protect micro, small, and medium enterprises (MSMEs) from adverse FDI impacts to maintain employment and economic diversity, crucial for sustainable development.

- National Security: Implement strict checks to prevent national security risks in sectors like defense, telecom, and infrastructure, learning from robust frameworks in the US, EU, and Japan.

- Strategic Autonomy: Preserve India’s strategic autonomy by scrutinizing FDI beyond investments from countries with shared land borders, ensuring long-term economic stability.

- Policy Predictability: Assure global investors of policy predictability with minimal arbitrary changes, fostering a stable investment environment and boosting investor confidence.

- Dispute Resolution: Establish efficient dispute resolution systems to minimize protracted legal battles, ensuring a smooth and attractive investment climate for foreign investors.

Conclusion

To capitalize on its potential, India needs a comprehensive investment strategy. By addressing cost disadvantages, enhancing ease of doing business, and implementing a robust FDI framework, India can attract more global investments, fostering sustainable economic growth and technological advancement.

Source:Mint

Mains Practice Question:

Discuss the key challenges India faces in attracting foreign direct investment (FDI) and propose measures to enhance its global investment appeal. How can the proposed “investment-friendly charter” contribute to overcoming these challenges?

Associated Article: