A DIGNIFIED PEACEFUL PASSING IS EVERYONE’S RIGHT

SYLLABUS:

- GS 2: Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

Focus:

- Wilful default cases on the rise: Banks filed suits against 36,150 NPA accounts to recover Rs 9.26 lakh cr in FY23

About Wilful Defaulter

Introduction to Wilful Defaulter:

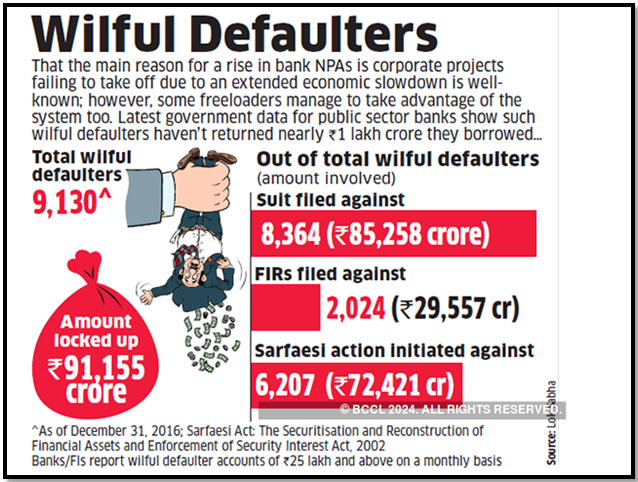

Wilful defaulters are entities or individuals who fail to repay their debts despite having the financial capacity to do so. The concept was formalized by the Reserve Bank of India (RBI) under its regulatory powers granted by Sections 21 and 35A of the Banking Regulation Act, 1949. The RBI’s Master Circular outlines the criteria and processes banks and financial institutions should follow to determine if a default is wilful.

Criteria for Identifying Wilful Defaulters:

The RBI specifies that a wilful default occurs under any of the following circumstances:

- Non-repayment of Obligations: The debtor does not meet repayment obligations despite having the capacity, indicating a deliberate intention not to repay the loan.

- Misuse of Funds: Funds are utilized for purposes other than those for which they were originally borrowed.

- Siphoning Off Funds: There is evidence that funds have been siphoned off, and the assets created from the borrowed funds do not justify the sum utilized.

- Disposal of Assets: Assets acquired with borrowed funds are disposed of without the lender’s knowledge, which can hinder recovery efforts.

Extended Implications for Group Companies:

- If group companies of the wilful defaulting entity fail to honor guarantees or letters of comfort when invoked by lenders, these companies are also categorized as wilful defaulters.

Consequences for Wilful Defaulters:

- Reporting to CIBIL: Banks and financial institutions must report suit-filed accounts of wilful defaulters quarterly to the Credit Information Bureau (India) Ltd (CIBIL).

- Disclosure of Directors: The names of current and past directors associated with the defaulting account are reported to warn other banks and financial institutions.

- Restrictions on Business Activities: Wilful defaulters are barred from initiating new business ventures for five years from the date they are declared as such.

- Legal Actions: Lenders are encouraged to initiate legal actions, which may include criminal proceedings, against defaulters to expedite the recovery of dues.

- Management Changes: Lenders have the authority to change the management of a company declared a wilful defaulter.

Legal Framework:

Currently, there is no specific law targeting wilful defaulters directly. The RBI has established guidelines for declaring a borrower as a wilful defaulter, and banks take action under existing laws such as the SARFAESI Act, Companies Act, 2013, and the Fugitive Economic Offenders Act to manage these cases.

Background and Court Decisions

- Bombay High Court Ruling: The Bombay High Court quashed a central government provision that allowed public sector banks to issue Look Out Circulars (LoCs) against wilful defaulters, citing violations of the fundamental rights to life and equality.

- Legal Implications: The decision was based on the premise that such provisions infringe on fundamental rights under Articles 21 and 14 of the Constitution.

- Policy Review Opportunity: The court’s decision provides a moment for policymakers to reconsider the entire concept of “wilful defaulter”.

- Comparative Jurisprudence: The court’s judgment aligns with previous rulings that require natural justice in designating someone as a wilful defaulter.

- Possible Government Response: There is speculation that the government might establish a statutory basis for Public Sector Enterprises (PSEs) to initiate LoCs.

Wilful Defaulter Framework

- Definition and Consequences: A wilful defaulter is someone who has defaulted on their loans and faces severe restrictions such as being barred from credit and equity markets.

- Regulatory Prohibitions: The RBI and SEBI impose various bans on wilful defaulters, including restrictions on extending new credit and participating in IPOs.

- Legal Authority: Banks and NBFCs have the legal authority to classify borrowers as wilful defaulters, leading to significant penal consequences.

- Implications for New Ventures: Those labeled as wilful defaulters are restricted from launching or financing new ventures, affecting their business operations and growth potential.

- Insolvency Proceedings: Wilful defaulters are also prohibited from submitting resolution plans under the Insolvency and Bankruptcy Code of 2016.

Procedural Concerns and Legal Problems

- Natural Justice Violations: The process of designating someone as a wilful defaulter often bypasses the principles of natural justice, as commercial lenders themselves make the determination.

- Conflict of Interest: Lenders may not be impartial in these proceedings, potentially leading to biased designations.

- Judicial Interventions: There have been multiple judicial interventions mandating procedural fairness in the designation process.

- Lack of Procedural Safeguards: Historically, procedural safeguards were not emphasized, leading to potential abuses in the designation process.

- Institutional Design Flaws: The original intent of the wilful defaulter framework was for information sharing, not blacklisting, highlighting a misalignment in its current application.

Policy Considerations and Future Directions

- Reevaluation of Wilful Defaulter Concept: Given the evolving financial landscape, there is a need to reassess the utility of the wilful defaulter framework.

- Impact of Modern Insolvency Laws: The introduction of contemporary insolvency laws offers alternative mechanisms for dealing with defaulters, questioning the necessity of the wilful defaulter framework.

- Potential for Reform: Policymakers should consider whether the current framework aligns with the goals of fairness and justice in financial regulations.

- Institutional Capacity and Compliance: Enhancing the institutional capacity of regulatory bodies could improve compliance with natural justice.

- Public and Financial Market Implications: The ongoing use of the wilful defaulter designation has broader implications for the financial market and public trust in the banking system.

| The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002:

Overview: The SARFAESI Act enables banks and financial institutions to directly seize and dispose of collateral in cases of loan defaults, facilitating the swift recovery of outstanding dues without requiring court intervention. Key Provisions: Enforcement of Security Interests: The Act empowers banks to enforce their security interests by issuing demand notices to borrowers who default on their loans. Asset Possession and Sale: It allows financial institutions to take possession and subsequently sell the collateral assets to recover the due amounts. The Insolvency and Bankruptcy Code (IBC), 2016: Purpose and Framework: The IBC establishes a unified legal framework for resolving insolvencies and bankruptcies in India, aimed at expediting the resolution of stressed assets and fostering a creditor-friendly regime. Key Features: Initiation of Proceedings: Both debtors and creditors have the right to initiate insolvency proceedings against defaulting borrowers. Timely Resolution: The Code emphasizes a time-bound resolution process to quickly address and resolve insolvencies. Institutional Setup: It created the National Company Law Tribunal (NCLT) and the Insolvency and Bankruptcy Board of India (IBBI) to administer and oversee the insolvency proceedings. |

Source:Indian Express

Mains Practice Question:

Critically analyze the concept of “wilful defaulter” in the Indian financial system in light of recent judicial interventions. Discuss the implications of the Bombay High Court’s ruling on Look Out Circulars (LoCs) issued against wilful defaulters and suggest measures to align the wilful defaulter framework with principles of natural justice and financial fairness. (250 words)

Associated Articles: