Income-Tax Act, 1961 vs. Income-Tax Bill, 2025

Syllabus:

GS 3: Indian Economy

Why in the News?

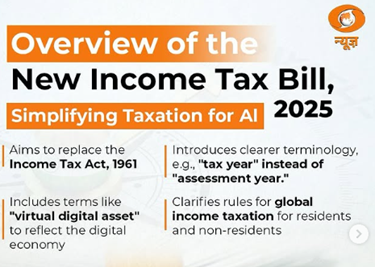

Recently, the Union Finance Minister introduced the Income-Tax Bill, 2025, aiming to replace the Income-Tax Act, 1961. The bill seeks to simplify tax laws but raises concerns over legal complexities and expanded government powers.

Income-Tax Bill, 2025: Reform or Mere Repackaging?

- Union Finance Minister introduced the Income-Tax Bill, 2025, in Parliament this February, aiming to replace the existing Income-Tax Act, 1961.

- The government asserts that the new bill will simplify tax laws, making them more accessible for taxpayers and administrators.

- However, despite its claims of clarity and predictability, the bill appears to be more of a structural overhaul rather than a substantive reform, retaining many of the complexities of the previous law.

- Additionally, certain provisions grant tax authorities excessive powers, raising concerns about privacy and fairness.

Need for a New Tax Law

- The Income-Tax Act, 1961, has been in place for over six decades and has accumulated numerous amendments, making it difficult to interpret.

- The government argues that the law has become cluttered with provisions, exceptions, and non-obstante clauses, leading to confusion among taxpayers and professionals alike.

- The new bill seeks to:

- Remove ambiguities and reduce litigation.

- Introduce a clearer and more predictable tax framework.

- Enhance ease of compliance for individuals and businesses.

Challenges in Simplifying Legal Language

- Many jurisdictions worldwide have moved towards plain language drafting to make laws more accessible.

- The idea is that simpler legal texts improve transparency and help governments remain accountable.

- However, some critics argue that:

- Simplification may lead to loss of precision.

- Legal technicalities require specific language to maintain accuracy.

- Despite these concerns, global examples suggest that making laws clearer does not necessarily compromise accuracy.

- In fact, easier-to-understand laws promote better compliance and reduce unnecessary litigation.

Does the Bill Truly Simplify Tax Laws?

- Despite its stated objective of simplification, the Income-Tax Bill, 2025, fails to embrace a truly accessible approach.

- The bill continues to use complex and complex legal language.

- For example:

- The phrase “notwithstanding anything contained to the contrary” has been replaced with “irrespective of anything to the contrary”, but this does little to improve clarity for common taxpayers.

- Many provisions remain densely worded, making them as difficult to interpret as those in the 1961 law.

Minimal Policy Changes, Maximum Repackaging

- One of the biggest criticisms of the bill is that it does not introduce substantial changes in taxation policy.

- The government’s approach to taxing income remains largely unchanged.

- As a result, the new draft law:

- Functions more like a restructured version of the 1961 Act.

- Primarily consolidates provisions without fundamentally altering tax policies.

- Could have been achieved through amendments instead of a complete overhaul.

- While the bill does remove some outdated provisions and organizes compliance timelines into structured tables and schedules, these changes do not significantly alter how taxes are levied and collected.

Persistent Complexity and Ambiguities

- Despite its efforts, the bill retains many of the same complexities that plague the existing law.

- Key issues include:

- Continued reliance on cross-referencing between different sections, making interpretation difficult.

- Retention of vague terminologies that leave room for litigation.

- Unclear restructuring that does not eliminate the law’s litigious nature.

Referencing Old Legislation: A Missed Opportunity?

- One of the major drawbacks of the new bill is that it still references the existing Income-Tax Act, 1961.

- For instance:

- The definition of “income” under Section 2(49) includes references to Section 2(24) of the 1961 Act.

- If core definitions require references to the old law, the effectiveness of this “simplification” exercise is questionable.

Impact on Litigation and Compliance

- One of the bill’s stated objectives is to reduce litigation.

Reopening of Settled Legal Interpretations

- By altering wording without substantive policy change, the Bill may lead to fresh legal disputes.

Reassessment of Income

- Previously, tax reassessments required authorities to have a “reason to believe” that income had escaped taxation.

- In 2021, this changed to allow reassessment based on “information,” including data from a “risk management strategy.”

- The Bill retains this provision without defining “risk management strategy,” leaving room for arbitrary actions.

- These changes may actually:

- Reopen settled legal debates, leading to fresh court battles.

- Cause confusion among taxpayers due to restructured provisions.

- Increase compliance burden instead of reducing it.

Expanding Government Powers: The Search and Seizure Debate

- Perhaps the most controversial aspect of the bill is its approach to search and seizure provisions.

- The current law already grants tax authorities significant powers to search individuals and businesses, seize assets, and demand documents.

- The new bill expands these powers further:

- Officials can now inspect “any information stored in an electronic media or computer system.”

- The definition of “computer system” includes digital storage, social media accounts, and virtual digital spaces.

- Authorities can override access codes and directly enter digital platforms.

- This marks a significant shift from the present law, which does not explicitly permit digital searches.

- With digital communication being deeply integrated into personal and professional life, these provisions raise serious concerns about privacy.

- This digital intrusion is particularly alarming given the Supreme Court’s 2017 ruling in Justice K.S. Puttaswamy vs. Union of India, which upheld the right to privacy.

Lack of Judicial Oversight in Digital Searches

- The bill does not introduce any judicial safeguards for digital searches.

- Currently, tax authorities already demand access to digital devices, even though legal backing for such actions is debatable.

- If enacted, the new law will:

- Legitimize unrestricted access to personal emails, social media accounts, and digital applications.

- Allow tax officials to conduct intrusive searches without judicial approval.

- Create potential risks of data misuse and privacy violations.

Should the Bill Be Reconsidered?

- The bill presents itself as a reformist step but appears to be more of a structural reorganization rather than a substantive overhaul.

- Given the following concerns:

- Lack of real simplification: Legal language remains complex and difficult for common taxpayers.

- Unchanged tax policies: The bill does not introduce fundamental shifts in taxation.

- Potential for increased litigation: Many provisions may be subject to fresh legal interpretation.

- Expanded powers of tax authorities: Digital searches raise serious privacy and constitutional concerns.

Lessons from Other Jurisdictions

- Nations like the UK and Australia have restructured tax laws to make them easier for citizens to understand.

- India’s new Bill does not embrace similar reforms, leaving legal complexities unresolved.

Conclusion

The Income-Tax Bill, 2025, repackages existing provisions without major improvements. Instead of an overhaul, refining the 1961 Act to enhance clarity and fairness would be more effective, as the bill fails to ensure predictability and simplification.

Source:

The Hindu

Mains Practice Question:

The Income-Tax Bill, 2025, aims to simplify taxation but retains many complexities of the 1961 Act. Critically analyze whether the bill achieves its objective of reducing litigation and improving tax compliance.