Stock Market Crash: Causes, Investor Impact, and Future Outlook

Why in the News?

The BSE Sensex fell 1.9%, reaching an 8-month low, driven by foreign investor exits, high valuations, and weak corporate earnings. Experts suggest domestic slowdown is the key factor, while investment strategies focus on large-cap and multi-asset funds.

Causes of the Market Crash:

- Sensex Decline: The BSE Sensex fell 9%, hitting an 8-month low.

- Key Factors:

- Earnings disappointments and high valuations led to foreign investor exits.

- Global factors: Strengthening USD, better returns on US bonds, and investment shifts.

- Domestic slowdown: Weaker corporate results and reduced investor confidence.

Impact and Investor Reactions:

- Market Correction: The Nifty has dropped below its historical average.

- Foreign Portfolio Investors (FPIs) continue selling, while Domestic Institutional Investors (DIIs) are buying.

- Retail Investors remain stable, whereas high-net-worth individuals (HNIs) show concern.

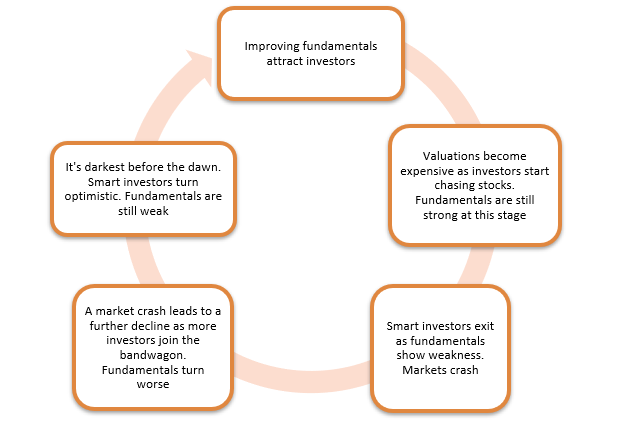

Future Outlook & Investment Strategy:

- Will the Market Decline Further?

- As long as FPIs sell, markets will remain volatile.

- Fundamentals remain strong, and once selling stabilizes, recovery is expected.

- Investment Approach:

- Avoid panic selling unless holding momentum stocks.

- Large-cap stocks and mutual funds are safer investment choices.

- Multi-asset allocation funds offer balanced exposure.

- Economic Resilience:

- No macro instability; demand-side issues can be addressed with monetary and fiscal policies.

- Budget income tax cuts may boost consumption and investments.

- Housing sector recovery is crucial for sustained economic momentum.

About the Regulation of Stock Markets in India:

- Securities and Exchange Board of India (SEBI)

- Regulates stock markets, ensuring transparency and investor protection.

- Oversees market intermediaries like stock brokers, stock exchanges, and mutual funds.

- Established as a statutory body under the SEBI Act, 1992.

- Monitors insider trading and fraudulent practices.

- Reserve Bank of India (RBI)

- Regulates the Government Securities (G-Secs) market and monetary policies.

- Manages foreign exchange regulations and capital flows.

- Ensures financial stability by overseeing banking sector liquidity.