Number Theory: Demand, Welfare, Growth -The Budget’s Trilemma

Why in the News?

- The National Statistical Office (NSO) released the first advance estimates for GDP for the financial year 2024-25 on January 7.

- India’s economy is projected to witness a year-on-year (YoY) slowdown in GDP growth:

- Growth rate for 2023-24: 2%

- Expected growth rate for 2024-25: 4%

- The YoY decline may not fully reflect the underlying challenges facing the economy, potentially leading to misinterpretations of its current state.

Analysis of GDP Growth in 2023-24 and 2024-25

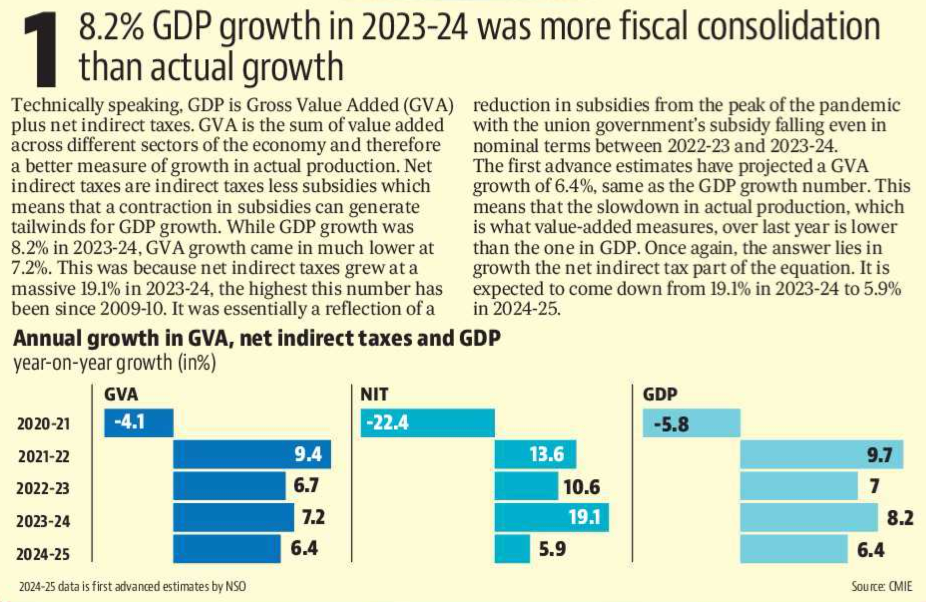

Fiscal Consolidation vs. Actual Growth

- GDP and GVA Differentiation:

- GDP = Gross Value Added (GVA) + Net Indirect Taxes.

- GVA reflects value addition across sectors and is a better indicator of actual production growth.

- Net indirect taxes are indirect taxes less subsidies which means that a contraction in subsidies can generate tailwinds for GDP growth.

2023-24 Performance:

- GDP growth: 2%.

- GVA growth: 2%.

- Net Indirect Taxes surged by 1%, the highest since 2009-10, primarily driven by a reduction in subsidies.

Subsidy Reduction: Union government subsidies declined nominally from 2022-23 to 2023-24, reflecting fiscal consolidation post-pandemic.

Projections for 2024-25: Both GDP and GVA growth are projected at 6.4%, indicating:

- A lesser slowdown in actual production compared to GDP.

- Net indirect tax growth is expected to fall sharply from 1% in 2023-24 to 5.9%, contributing to the narrowing gap between GDP and GVA growth.

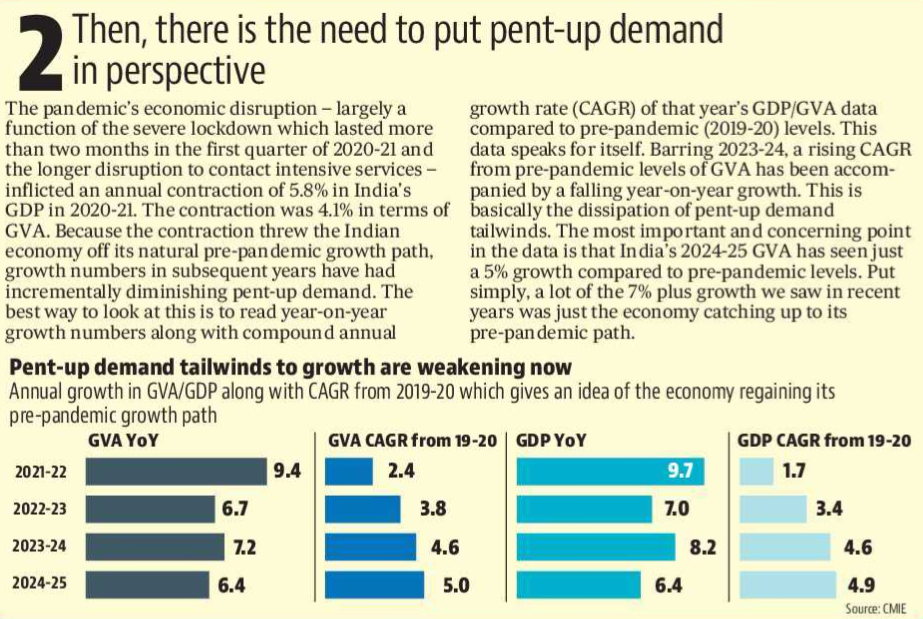

Understanding the Impact of Pent-Up Demand on Growth

- Pandemic Disruption: The pandemic, particularly the two-month lockdown in Q1 2020-21 and the prolonged disruption of contact-intensive services, led to a significant economic contraction:

- GDP contraction: 5.8% (2020-21).

- GVA contraction: 4.1% (2020-21).

Post-Pandemic Recovery Dynamics:

- The contraction pushed the economy off its pre-pandemic growth trajectory, resulting in incrementally diminishing pent-up demand in subsequent years.

- To understand this, year-on-year (YoY) growth must be assessed alongside the Compound Annual Growth Rate (CAGR) compared to pre-pandemic levels (2019-20).

Key Observations:

- CAGR Trends: A rising CAGR (from pre-pandemic levels) has coincided with falling YoY growth, reflecting the dissipation of pent-up demand tailwinds.

- 2024-25 Concern: GVA in 2024-25 is projected to grow by only 5% compared to pre-pandemic levels, highlighting the limited contribution of true growth beyond catching up to the pre-pandemic trajectory.

- The 7%+ growth rates seen in recent years largely represent a recovery rather than sustainable economic expansion. This underscores the need to evaluate growth data with a focus on underlying fundamentals rather than just headline numbers.

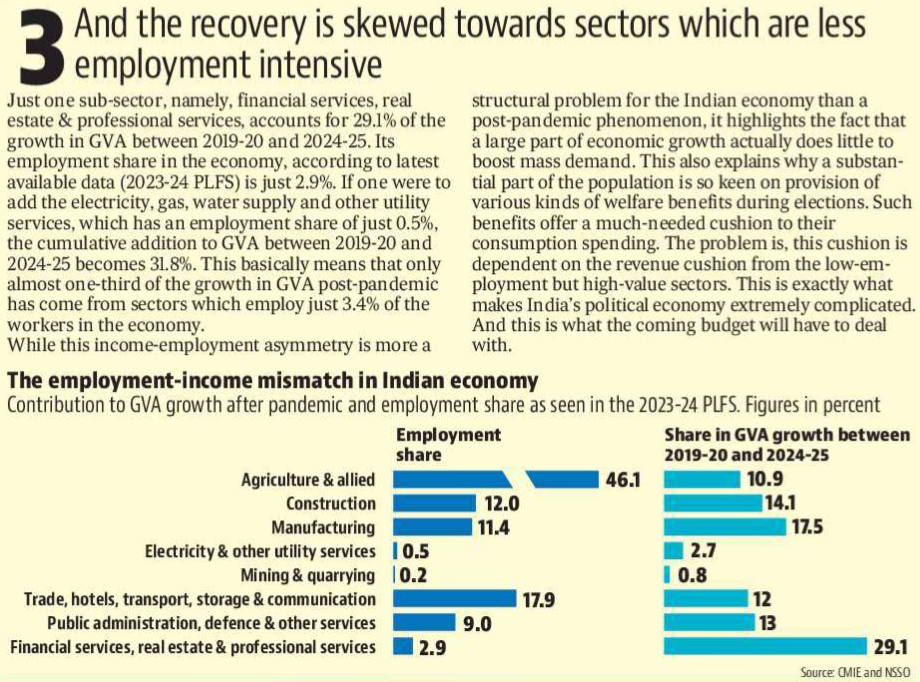

Skewed Recovery Towards Less Employment-Intensive Sectors

Sectoral Contribution to GVA Growth (2019-20 to 2024-25):

- Financial Services, Real Estate & Professional Services:

- Accounts for 1% of GVA growth.

- Employs just 9% of the workforce (2023-24 PLFS data).

- Electricity, Gas, Water Supply & Other Utility Services:

- Adds another 7% to GVA growth.

- Employs a mere 5% of the workforce.

- Combined, these sectors contribute 8% of GVA growth but employ only 3.4% of the workforce.

- Income-Employment Asymmetry:

- This structural issue reflects the disconnect between economic growth and mass employment generation.

- Limited employment-intensive growth undermines mass demand despite headline GDP increases.

Impact on Political Economy:

- The reliance of a significant portion of the population on welfare benefits stems from insufficient growth in employment-intensive sectors, which impacts consumption spending.

- Welfare benefits depend on revenue from low-employment, high-value sectors, creating a fragile economic balance.

Implications for the Budget:

- Addressing this imbalance is crucial for fostering inclusive economic growth.

- Policies need to focus on boosting employment-intensive sectors to enhance demand and reduce dependence on welfare support.

Mains question

Discuss the challenges posed by income-employment asymmetry in India’s post-pandemic recovery and suggest policy measures to ensure inclusive and employment-intensive economic growth. (250 words)