Global Trends Shaping Economy 2025

Syllabus:

GS 3:

- Indian Economy and issues related to planning and mobilization of resources.

- Global impact on Indian Economy

Why in the News?

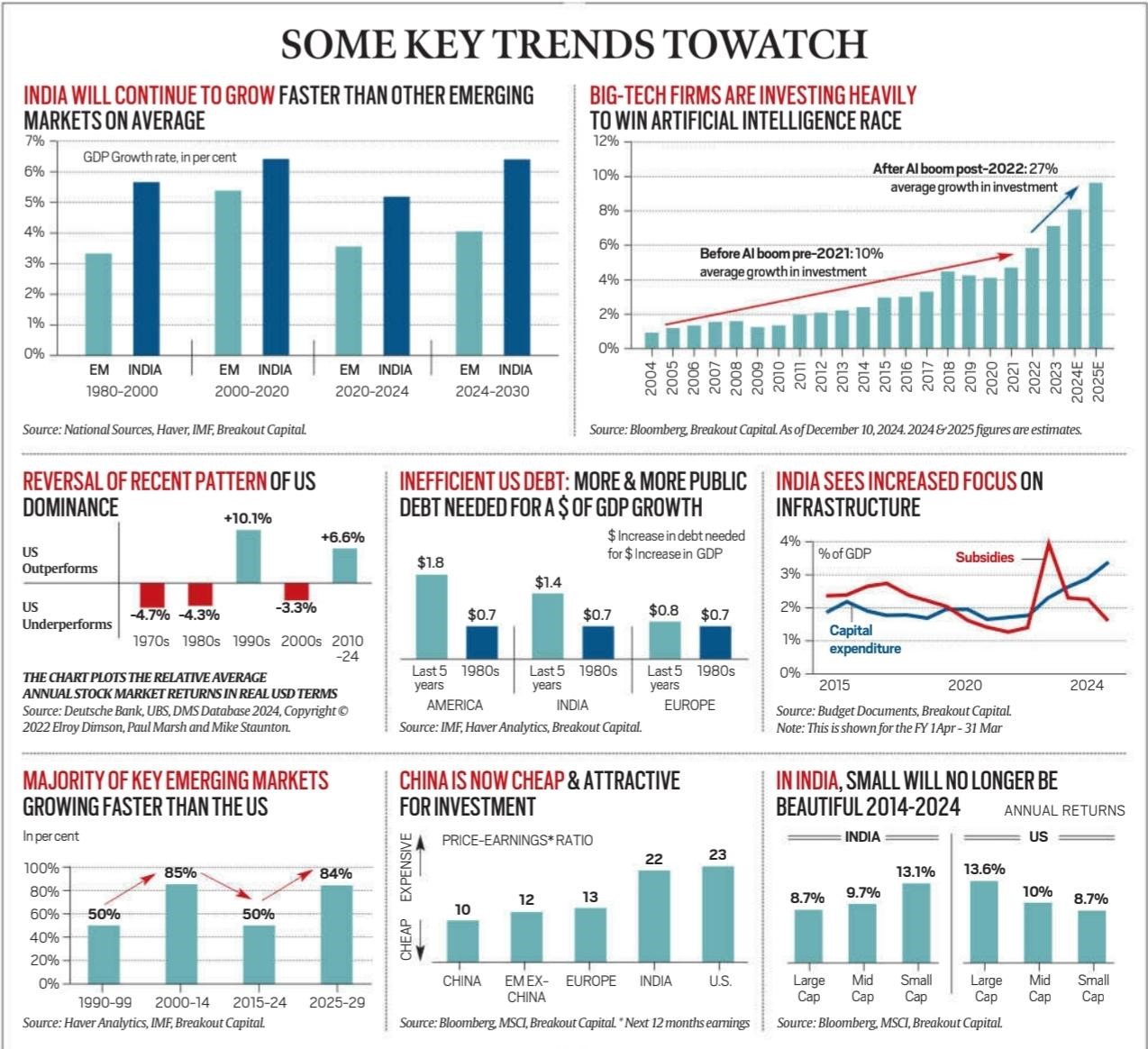

- Ruchir Sharma, a renowned investor and author, discussed 10 major economic trends for 2025 with Prannoy Roy, focusing on the US, China, and India.

- Key themes include the reversal of US dominance, emerging market growth, China’s investment potential, and India’s infrastructure push.

Reversal of American Dominance

- American Overperformance: Over the past 15 years, the S. stock market has outperformed the rest of the world by 6.6% annually. This trend might reverse.

- Creative Destruction Lag: Dominance by a few large companies contradicts the principle of capitalism, where new entrants replace older players.

- Fiscal Deficit Concerns: The U.S. fiscal deficit, averaging 8% of GDP, is twice as high as other economies, raising sustainability concerns.

- Dependence on the Dollar: The U.S. benefits from the dollar’s reserve currency status but faces risks as global trade diversifies.

- Tech Overinvestment: Massive spending on AI by American firms could lead to diminishing returns, impacting profits and market dominance.

India’s Growth Momentum

- Stabilized Fiscal Deficit: India’s fiscal deficit has stabilized, with increased focus on capital expenditure and reduced subsidies.

- Higher Growth Rate: India’s GDP growth, projected to outpace other emerging markets, is supported by its low per capita income base.

- Productive Investments: Investments in infrastructure and reduced reliance on fiscal stimulus have created a stable growth environment.

- Strategic Trade Agreements: India is signing more regional trade agreements, diversifying trade relations and reducing dependency on traditional partners.

- Neighbourhood Trade Potential: Despite regional agreements, India underutilizes trade with neighbors, which could lower transport costs and boost regional synergies.

Emerging Markets Shining Again

- Cleaned Economic Excesses: Emerging markets have reformed post-2000s excesses, paving the way for sustainable economic growth.

- Reduced Fiscal Stimulus Dependence: Unlike the U.S., emerging markets rely less on fiscal stimulus, creating room for organic growth.

- Infrastructure Focus: Increased infrastructure spending is driving long-term growth in countries like India, Indonesia, and Brazil.

- Shift in Global Investments: Investors are beginning to recognize opportunities outside the U.S., especially in undervalued emerging markets.

- Growth Projections: Economies like India are expected to grow 5-2% faster than the emerging market average, according to historical trends.

China’s Investment Revival

- Undervalued Assets: With a low price-to-earnings ratio of 10, China offers cheaper investment opportunities compared to India (23) and the S. (22).

- Diamonds in the Rough: Companies like BYD demonstrate innovation and competitiveness despite broader economic challenges.

- Tech Leadership: Despite bearish sentiments, Chinese firms excel in cutting-edge technologies, maintaining their relevance in global markets.

- Demographic and Debt Challenges: While structural issues persist, selective investments in resilient companies can yield high returns.

- Market Sentiment Shift: Widespread bearishness on China may create contrarian opportunities for discerning investors.

Global Trade Diversifying Beyond America

- Rise of Regional Trade: Bilateral and regional trade agreements are growing, with most new trade corridors bypassing the S.

- India’s Trade Strategy: India has accelerated trade agreements, including with the UK and Oman, breaking a decade-long hiatus.

- European Trade Expansion: The EU has signed major agreements with Latin American nations, reducing tariffs and boosting intra-regional trade.

- Reduced U.S. Influence: Global trade is increasingly conducted without reliance on American policies, signaling a shift in power dynamics.

- Neighboring Trade Success: Countries with robust trade relationships with neighbors, like China, demonstrate economic efficiency and growth.

Private Funding and AI Overinvestment

- Private Funding Surge: Global private funding grew from $1 trillion in 2000 to $14 trillion in 2024, overtaking public market funding.

- Overcapitalization Risks: Excessive private capital flow, especially in tech and AI, raises concerns about unsustainable valuations.

- India’s Early Stage: While India’s private funding is growing, it remains small compared to global levels, limiting exposure to risks.

- AI Spending Boom: Tech giants are investing heavily in AI, with spending jumping from 10% to 21% annually, impacting profitability.

- Consumer-Centric Benefits: Historically, technological revolutions have benefited consumers and new entrants more than established firms.

Obesity and the Search for Solutions

- S. Obesity Epidemic: With 44% obesity rates, the U.S. faces the highest levels among major economies, far above the global average.

- Weight Loss Drugs Craze: Drugs like Ozempic have driven sales from $3 billion to $24 billion in just four years, creating dependency concerns.

- Side Effects Awareness: Google searches for drug side effects have surged by 300%, reflecting growing skepticism about long-term efficacy.

- Temporary Weight Loss: Studies show weight loss of 18% during use, but most users regain weight after discontinuation, averaging 5-6% loss.

- Skepticism Over Magic Solutions: Sustainable weight management requires lifestyle changes, with drugs offering only partial and temporary relief.

Conclusion

These trends reveal significant shifts in global economic dynamics. While the US faces challenges with fiscal deficits and tech overdependence, India emerges as a promising growth leader through infrastructure investments. Meanwhile, China’s undervalued companies could provide opportunities despite structural issues. Global trade is diversifying away from America, and private funding is recalibrating after explosive growth. Lastly, tackling health issues like obesity requires sustainable, long-term strategies.

Source: Indian Express

Mains Practice Question

Discuss the evolving global economic trends with a focus on the implications of America’s fiscal policies, India’s growth trajectory, and China’s emerging investment potential. Evaluate how these factors shape the global economic order in 2025.