China is world’s largest debt collector

Syllabus:

GS 2: India and its Neighbourhood

Why in the News?

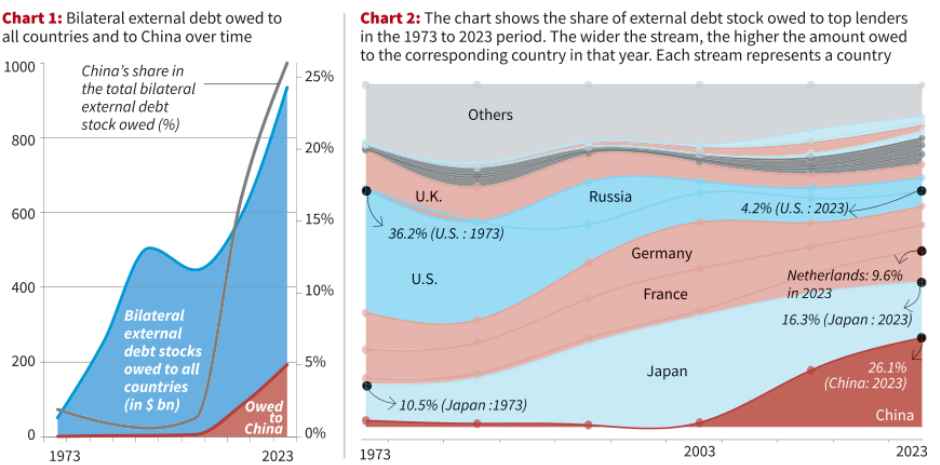

Recently, China has now become the country with the largest foreign debt, with more than 25% of global bilateral external debt owed to it by the end of 2023.

Introduction

- China emerged as the world’s largest bilateral lender at the end of 2023, accounting for more than 25% of global bilateral external debt.

- Its external debt has soared over the two decades, driving up debt in many countries.

- This rapid growth has raised concerns, as many countries face the economic crisis related to China’s massive debt.

China Dominates as Global Lender

- 20 years ago, China’s role in global debt was relatively minor, dominated by Japan, Germany, France, the United States and the United Kingdom

Rapid Credit growth over two decades

- Over the past 20 years, China’s external debt has grown rapidly, leading to significant increases in bilateral debt in many countries.

- China’s credit practices have contributed significantly to the rapid accumulation of external debt in many countries.

What is Bilateral external debt?

- Bilateral external debt refers to money borrowed by a country from foreign governments.

- This analysis does not include debt from institutions such as the International Monetary Fund (IMF) or private bondholders.

Expanding Chinese bilateral debt

- Total external debt of all countries increased from $49.5 billion in 1973 to $741.4 billion in 2023.

- At the same time, China’s specific debt rose sharply from $1 trillion to $193.1 trillion.

- Until 2003, China’s share of global bilateral external debt was only 1%. However, it increased to 6% in 2013 and will reach 26% in 2023.

Chinese dominance among creditors

- In 1973, the United States ranked among the two largest creditors in the world.

- In the 1990s, Japan overtook the United States to become the top creditor in 2013.

- By 2023, China will replace Japan as the largest creditor, with the Netherlands coming in third.

Increasing dependency on Chinese loans

- Many countries have become increasingly dependent on Chinese loans.

- By 2023, Pakistan owed China $22 billion, accounting for nearly 60% of its bilateral debt.

Struggling borrowers

- Many countries that have borrowed heavily from China are facing financial difficulties.

- Laos: One of Asia’s poorest countries, owes China $6 trillion by 2023, more than 75% of its bilateral debt. Laos struggles with high inflation, depreciation and slow growth.

- Angola: Sub-Saharan Africa’s second largest oil producer owes China $17 billion, representing 58% of its external debt.

- Democratic Republic of Congo: owes the two countries 88% to China. Chinese companies own or finance 15 of its 19 cobalt mines, deepening its economic dependence.

- Sri Lanka: Sri Lanka handed over its Hambantota port to China in 2017 due to Sri Lanka’s default on the debt, accounting for 50% of its $8 billion debt to China.

How it will impact global economy?

- Debt reliance: Rising Chinese debt perpetuates fiscal constraints for many countries, making them dependent on China’s monetary policies.

- This can increase China’s geopolitical influence in these countries.

- Financial risks of borrowers: Overborrowing from China has worsened financial crises in many countries, leading to issues such as inflation, devaluation and low growth.

- Countries like Laos, Sri Lanka and Angola are examples of how China’s debt dependency can push countries into prolonged financial crisis.

- Impact on global trade and wealth: China’s Belt and Road Initiative (BRI) projects have allowed China to dominate critical infrastructure and resources in Borrowing countries.

- For example, the influence of China on cobalt production in the Congo and the Hambantota port in Sri Lanka is emphasized as is the attachment of debt to strategic assets.

Concern for India and the world at large

Geopolitical implications

- China’s growing clout as a creditor raises concerns about its geopolitical ambitions, especially in neighboring India.

- Projects under the BRI such as those in Sri Lanka and Pakistan pose strategic challenges for India, especially in terms of maritime security and regional impact.

Debt-trap countries

- Critics say China’s lending practices resemble “Debt trap diplomacy,” where countries issue unsustainable loans for profit.

- This approach allowed China to control key assets such as ports and mines in creditor countries.

Economic instability in neighboring countries

- Economic crises in countries such as Sri Lanka and Pakistan could spill over into neighboring regions including India, creating potential security and refugee challenges

Global financial risk

- If countries default on China’s debt, it could destabilize global financial markets.

- China’s lending practices also create imbalances, reducing the influence of multilateral institutions such as the IMF.

How to deal with Growing Chinese Bilateral debt diplomacy?

Encourage Transparency in lending practice

- Greater transparency among Chinese Lenders is needed to ensure fairness and avoid exploitation.

- Borrowing countries should look for long-term impact of when to accept Chinese debt, especially for large-scale infrastructure projects.

Diversity of lenders

- Countries need to diversify their external Borrowings to reduce their dependence on China.

- Multinational corporations and countries such as Japan and the United States and other lenders may play a larger role in providing sustainable financing options.

Strengthening regional cohesion

- India can cooperate with other countries to provide alternatives to Chinese finance, especially in areas where credit dependence is vulnerable.

- Projects like the Quad’s infrastructure initiatives can act as a counterbalance to China’s BRI.

Conclusion

China’s rapid rise as the second largest creditor has reshaped the global credit landscape, creating both opportunities and challenges. Globally, transparent credit practices and financing strategies are needed to reduce the risk posed by unsustainable debt.

Source: The Hindu

Mains Practice Question:

Examine the impact of China’s rise as the second largest creditor on global economic stability, particularly in crisis-prone developing countries.