MuleHunter.AI: RBI’s AI Tool for Fraud Prevention

Why in the news?

The Reserve Bank of India launched MuleHunter.AI, an AI-based system, to detect mule accounts, strengthen financial security, and ensure compliance with anti-money laundering regulations after successful pilot testing.

MuleHunter.AI: Transforming Fraud Detection in Banking

- The Reserve Bank of India (RBI) has launched MuleHunter.AI, an AI/ML-powered tool developed by the Reserve Bank Innovation Hub (RBIH).

- It targets financial fraud by identifying mule accounts used for illegal transactions, with successful pilot tests conducted at two major public sector banks.

Features and Advantages

- Mule Account Detection: MuleHunter.AI tracks and flags bank accounts involved in fraudulent transactions, reducing the risk of financial fraud.

- Real-Time Monitoring: It ensures instant surveillance of transactions, enabling quick action against suspicious activities.

- Advanced Data Analytics: The tool uses AI/ML algorithms to analyze vast datasets, identifying patterns indicative of illicit behavior.

- Enhanced Collaboration: MuleHunter.AI fosters cooperation between banks, payment providers, and law enforcement agencies to combat digital fraud effectively.

- Regulatory Support: It strengthens compliance with anti-money laundering (AML) and counter-terrorism financing (CFT) regulations.

Understanding Mule Accounts:

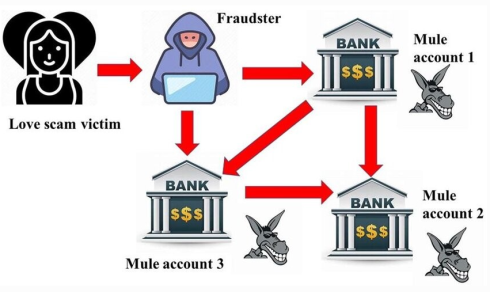

- Mule accounts, often owned by low-income or uneducated individuals, are exploited by criminals to launder money.

- These account holders, referred to as “money mules,” are left as scapegoats, while actual perpetrators evade detection.

- AI provides a robust solution to address this critical issue, bolstering the financial ecosystem’s security and integrity.

What are Mule Accounts and Money Mules?

- Mule Accounts: Bank accounts used for laundering illicit funds, often sourced from individuals with low technical literacy.

- Money Mules: Innocent account holders exploited by criminals, often becoming investigation scapegoats.

Government Measures:

- Conducted meetings with RBI, I4C, and banks to address digital fraud.

- Emphasized AI/ML tools, staff training, and withdrawal restrictions.

- Hosted RBI “Zero Financial Frauds” hackathon for innovative solutions.

MuleHunter.AI

- AI tool by RBI for detecting mule accounts using transaction data analysis.

- Pilot tests showed improved fraud detection efficiency and accuracy.

MuleHunter.AI marks a significant advancement in fraud detection, promoting a safer banking environment and enhancing the fight against financial crimes.

Sources Referred:

PIB, The Hindu, Indian Express, Hindustan Times