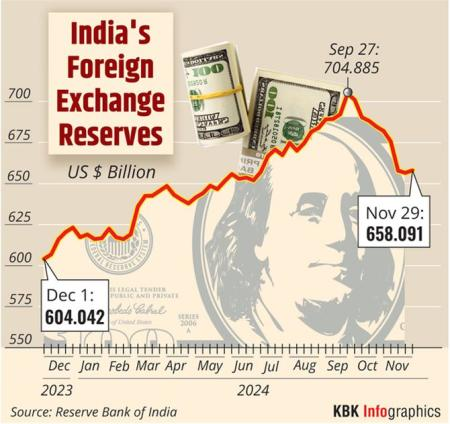

India’s Forex Reserves Rise to $658.1 Billion

Why in the news?

India’s forex reserves increased by $1.5 billion to $658.1 billion after an eight-week decline, driven by RBI interventions and fluctuating foreign portfolio investments, enhancing economic stability.

Forex Reserves Surge After Eight-Week Decline:

- India’s foreign exchange reserves increased by $1.5 billion, reaching $658.1 billion.

- The surge follows an eight-week decline in reserves, marking a positive turnaround.

- The Reserve Bank of India (RBI) reported the latest figures amid fluctuating foreign portfolio investments (FPIs) and active currency market interventions.

Contributing Factors:

- The rise in reserves is largely attributed to the RBI’s interventions in the currency markets to stabilize the rupee.

- Foreign portfolio investments also played a role, although they have been volatile.

- The increase in forex reserves highlights the country’s ability to weather external economic pressures, contributing to financial stability.

What are Foreign Exchange Reserves?

- Assets held by a central bank in foreign currencies, including bonds, treasury bills, and government securities.

- After the 1990-91 economic crisis, India was advised to maintain reserves for 12 months of import requirements.

Key Components of India’s Forex Reserves:

- Foreign Currency Assets

- Gold Reserves

- Special Drawing Rights (SDRs)

- Reserve Position with the IMF

Majority of reserves are held in US dollars.

About Foreign Currency Assets (FCA):

- Foreign Currency Assets (FCA): Assets held in foreign currencies, mainly in US dollars, affected by exchange rate fluctuations of non-US currencies like the euro, pound, and yen.

- Special Drawing Rights (SDRs): IMF-created reserve asset, based on a basket of currencies; can be exchanged for freely usable currencies; interest paid on SDR holdings.

- Reserve Position in IMF: A portion of the IMF quota, accessible without conditions, providing emergency funds to member countries.

Sources Referred:

PIB, The Hindu, Indian Express, Hindustan Times