ED’s Money Laundering Probes: Challenges and Insights Revealed

Why in the news?

The Financial Action Task Force’s report highlights the Enforcement Directorate’s operations, revealing challenges in prosecution rates and the need for enhanced investigative capacity in India.

Key Insights on ED’s Money Laundering Investigations:

- Investigation Sources and Trends:

- The Enforcement Directorate (ED) investigates money laundering based on various leads, with 47% of cases initiated from public complaints and media reports.

- Between April 2018 and October 2023, the ED examined 4,163 cases, with state law enforcement agencies contributing 37% of the leads.

- The Financial Intelligence Unit (FIU) provided data for only 23 cases during this period.

- Challenges and Capacity Issues:

- Despite a surge in investigations from 195 in 2018-19 to 1,180 in 2021-22, the prosecution complaints increased at a lower rate—only 20% of investigations led to prosecution.

- Currently, the ED employs 1,052 investigators, with plans to triple its workforce in five years to enhance capabilities.

- Conviction Rates and Legal Framework:

- Among the investigated cases, only 28 resulted in convictions, indicating a low success rate.

- The FATF report highlights a lack of uniformity in understanding required financial investigations and emphasises the need for better training for law enforcement to combat money laundering effectively.

Definitions in the Prevention of Money Laundering Act (PMLA) 2002:

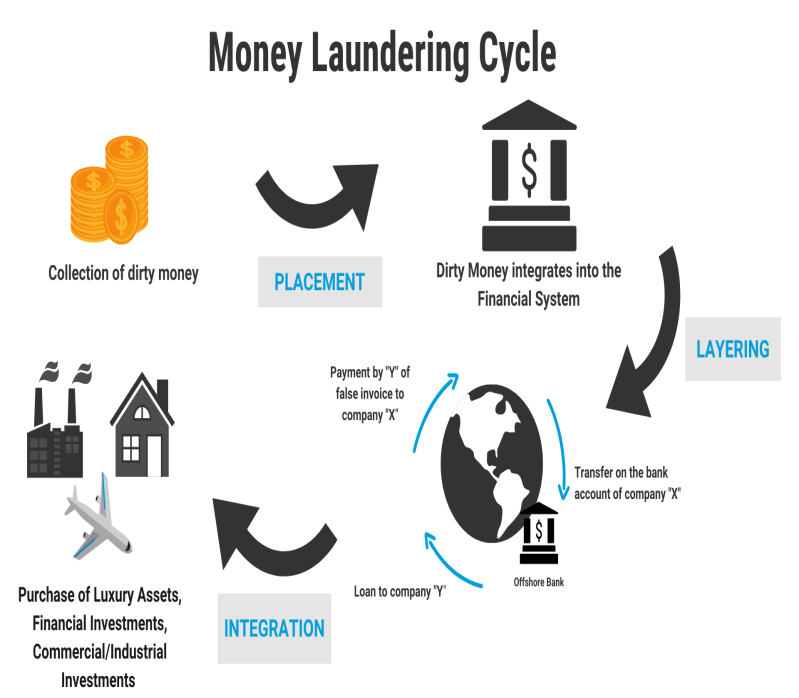

- Money Laundering: The process of disguising illegally obtained proceeds as legitimate.

- Adjudicating Authority: Appointed to oversee cases regarding attachment and confiscation of property.

- Appellate Tribunal: Established for hearing appeals against the Adjudicating Authority’s orders.

- Financial Institution: Includes banks, chit fund companies, co-operative banks, housing finance institutions, and non-banking financial companies.

- Intermediary: Entities linked to the securities market, such as stock-brokers and investment advisers.

Key Concerns Related to PMLA:

- Broad Scope of Offences: Covers various offences beyond money laundering, including fraud, forgery, and even copyright violations, diluting its focus.

- Selective Enforcement: The Enforcement Directorate (ED) has discretion in initiating probes, risking arbitrary actions against citizens without clear guidelines.

- Testimonial Compulsion: Individuals summoned by the ED must disclose information under threat of prosecution, raising constitutional concerns.

- Lack of Judicial Oversight: Search and seizure actions are conducted without sufficient judicial checks, undermining individual rights.

- Prosecution Without Scheduled Offence: Allows prosecution for money laundering without proving the underlying scheduled offence, challenging fairness principles.

- Lack of Transparency: No clear procedures for investigations or access to Enforcement Case Information Report (ECIR)

About the Enforcement Directorate (ED):

- Overview: A specialised agency focused on enforcing economic laws, primarily against money laundering and foreign exchange violations.

- Functions:

- Enforces PMLA, FEMA, FEOA, and COFEPOSA.

- Collaborates with other agencies like CBI, Income Tax Department, and Customs.

Associated Article:

https://universalinstitutions.com/ed-can-summon-anyone-for-any-information-sc/