“TAX IMPLICATIONS FOR LANDOWNERS IN JOINT DEVELOPMENT AGREEMENTS”

Why in the news?

Recent updates highlight the complexities of tax obligations, including capital gains, TDS, and GST, for landowners engaged in joint development agreements with builders.

source:wilimedia

Capital Gains Taxation:

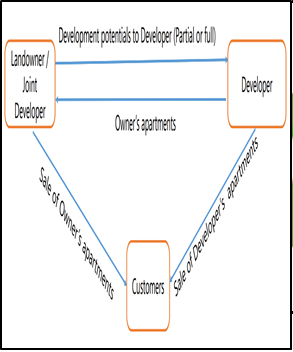

- Joint Development Agreements (JDAs) involve landowners exchanging land for constructed units or additional compensation.

- Tax implications under JDAs can be complex, with capital gains tax liability arising when the project receives a completion certificate, as per Section 45(5A) of the Income Tax Act, 1961.

- For example, if Mr. A, who bought a house in 1998 for ₹20 lakh, enters a JDA in 2021 and the project completes in 2024, his capital gains would be calculated based on the fair market value as of 2001 and indexed accordingly.

- A’s total consideration would be ₹3.20 crore, leading to a capital gains tax liability of ₹27.70 lakh at a 20% tax rate, excluding surcharge and cess.

Tax Deduction at Source (TDS):

- TDS at 10% under Section 194-IC applies to the ₹20 lakh advance payment received by Mr. A, which can be carried forward in annual income tax returns until the capital gain is taxed.

- Hardship money received by Mr. A during construction is classified as a capital receipt and is not taxable under Section 45(5A), nor is TDS deducted on this amount.

About Section 45(5A) of The Income Tax Act, 1961: Key Points

Pursuant to a Joint Development Agreement (JDA):

Taxation:

|