UNDERSTANDING PROFESSIONAL TAX IN INDIA

Relevance: GS – 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in the news?

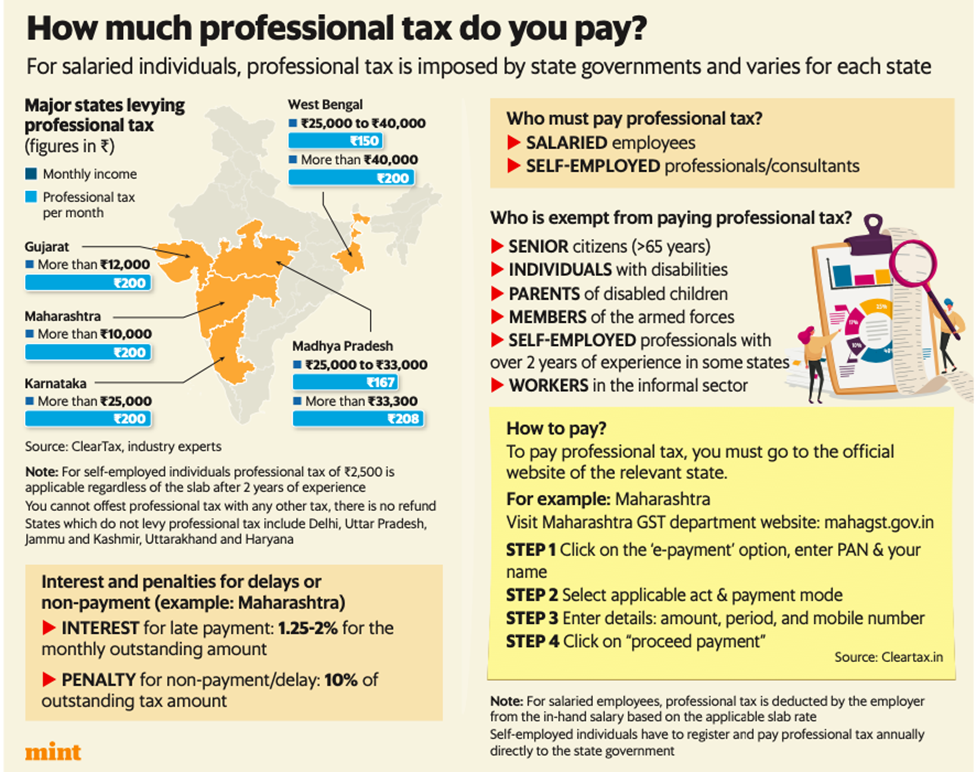

- Professional tax is a state-specific tax, capped at ₹2,500 per year.

- Levied differently across states—some impose it monthly, while others do not levy it at all.

- Applies to individuals earning income through profession, trade, or employment.

- Liability extends to both salaried employees and the self-employed.

- Often overlooked by self-employed individuals, who may not realize their obligation to pay it.

Key Points in Professional Tax in India

- Introduction and History: Professional tax has been part of India’s tax system since 1949. Initially, the maximum limit was capped at ₹250 per annum.

- Amended in 1988: In 1988, an amendment raised the cap to ₹2,500 per annum. This ₹2,500 limit has remained unchanged since the 1988 amendment.

- State Imposition & Applicability: Levied by state governments. It is mandatory for all individuals, including both employees and self-employed professionals.

- For Employees:

- The tax is deducted by the employer based on income slabs defined by the respective state.

- Employers remit the deducted tax to the state government on behalf of the employee.

- For Self-Employed Professionals:

- Required to register and pay the tax themselves.

- For self-employed individuals, experience is considered as a criterion.

- Payment is typically due before 30 April each year.

- Self-employed individuals and consultants with less than two years of experience are not required to pay professional tax.

- Tax Thresholds & Caps: Income thresholds determine the tax amount for employees. The tax is capped at ₹2,500 per year, in accordance with Article 276 of the Indian Constitution.

- Exemptions: Certain individuals are exempt from paying professional tax, including:

- Senior citizens above 65 years of age.

- Parents or guardians of mentally disabled children.

- Individuals with permanent physical disabilities.

- Members of the armed forces.

State Variations in Professional Tax

- Authority to Levy: Article 276 grants state governments the power to levy and collect professional tax. The application of this tax varies significantly across states, leading to a diverse set of rules and rates.

- Slab-Based Rates: Most states that levy professional tax use slab-based rates, where the amount payable depends on the individual’s income.

- Monthly Collection in Some States: In states like Maharashtra, Karnataka, and West Bengal, the tax is collected monthly. The total annual amount is capped at ₹2,500 in these states.

- States Not Levying Professional Tax: States such as Delhi, Haryana, and Uttar Pradesh do not levy professional tax.

Paying Professional Tax

- Registration: Self-employed individuals must first register with their state’s tax department.

- Payment Process: Payments are typically made online through the state’s designated tax portal. It is crucial to monitor payment deadlines to avoid penalties or interest charges.

- Penalties in Maharashtra:

- Late Registration: ₹5 per day.

- Late Payment: Monthly interest rate of 1.25-2.00%.

- Non-Payment or Delays: 10% penalty on the tax amount.

- Late Return Submission: Penalty of ₹1,000.

Compliance Issues in Professional Tax

- Payment Challenges: Each state has its own designated portal for tax payments. Technical issues on these portals can sometimes make the payment process cumbersome.

- Consequences of Non-Payment: If professional tax is not paid, the tax department may send a reminder and a notice. Notices can sometimes be delayed and may arrive years after the due date.

- Detection Difficulties: Not having a GST number can make it harder for authorities to detect non-payment, but the obligation to pay professional tax remains.

- Non-Offsettable Tax: Professional tax cannot be offset against any other tax and must be paid in full.

- Importance of Compliance: Many, especially the self-employed, may be unaware of their obligation. Compliance is crucial to avoid penalties and to remain in good standing with the law.

Way Forward for Professional Tax in India

- Awareness Campaigns: Launch initiatives to educate self-employed individuals about their obligations regarding professional tax. Utilize social media, workshops, and seminars to disseminate information.

- Streamlined Registration Process: Simplify the registration process for self-employed individuals to encourage compliance. Develop user-friendly online portals for easier access and navigation.

- Unified Tax Structure: Consider standardizing professional tax slabs across states to reduce confusion and ensure fairness. Evaluate the feasibility of a uniform tax rate to minimize administrative complexities.

- Incentives for Timely Payments: Introduce incentives for individuals who pay their professional tax on time, such as discounts or rebates. Encourage states to adopt a more lenient penalty structure for first-time offenders.

- Monitoring and Enforcement: Strengthen monitoring mechanisms to identify non-compliance effectively. Establish clear protocols for addressing non-payment issues and ensuring timely communication with taxpayers.

- Feedback Mechanism: Create a feedback system for taxpayers to report issues or suggest improvements regarding the professional tax system.

- Collaboration with Professional Bodies: Collaborate with professional associations and bodies to promote compliance and provide resources.

- Periodic Review of Tax Structure: Conduct regular reviews of the professional tax system to assess its effectiveness and relevance.

Alternative articles

https://universalinstitutions.com/indian-taxation-system/

Mains question

Discuss the challenges and implications of state-specific professional tax in India. Describe your views with respect to the legal obligations of the individuals. (150 words)