GOVT MAY RAISE AT LEAST ₹10,000 CRORE IN NEXT PHASE OF SOVEREIGN GREEN BONDS

Relevance: GS – 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

Why in the news?

- In 2023-24, the government issued sovereign green bonds worth ₹20,000 crore, despite the absence of a mention in the budget.

- The government aims to raise ₹20,000-25,000 crore in 2024-25 through green bonds.

- This initiative is significant for financing various clean energy and sustainability projects.

- The private sector currently issues the majority of green bonds in India.

Union Government’s Plans for Sovereign Green Bonds

- Planned Issuance (Oct-Mar): Govt has raised at least ₹10,000 crore through sovereign green bonds. It is an effort to secure funds for various sustainability initiatives.

- Overall Borrowing Schedule for 2024-25: Issue sovereign green bonds worth ₹20,000-25,000 crore with an aim to fund climate mitigation initiatives.

- First Half Issuance (Apr-Sep): Notified plans to raise ₹12,000 crore through green bonds. It has the potential to raise up to ₹15,000 crore in the second half to meet the full-year target.

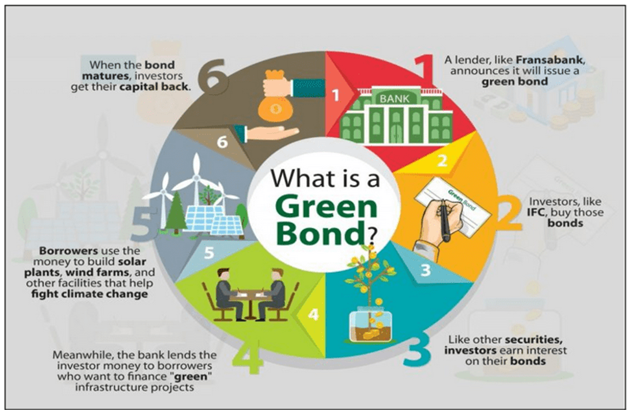

Purpose of Green Bonds:

- Address funding requirements for environmental and climate-related initiatives.

- Proceeds allocated to green schemes of central ministries and departments such as: New and renewable energy; Environment, forests, and climate change; Housing and urban affairs; Railways

- Funds cannot be used for projects related to fossil fuel extraction, production, or distribution, or nuclear power.

- Issuance Schedule: Second half of the year’s borrowing plans through green bonds to be released in the next quarter.

- Likely more borrowing through green bonds in the second half if costs are not higher than government securities.

Pricing Strategy for Green Bonds

- The Government aims to price green bonds lower than conventional government securities. This strategy relies on the environmental benefits’ appeal.

- The pricing strategy, known as ‘greenium’ reflects a premium investors might pay for green bonds due to their positive environmental impact.

- Green bonds offer investors a chance to align portfolios with sustainable goals while potentially enjoying favorable returns.

Ambitious Green Target (India’s Energy Goals)

|

Challenges and Market Dynamics for green bonds (The Energy and Resources Institute Report):

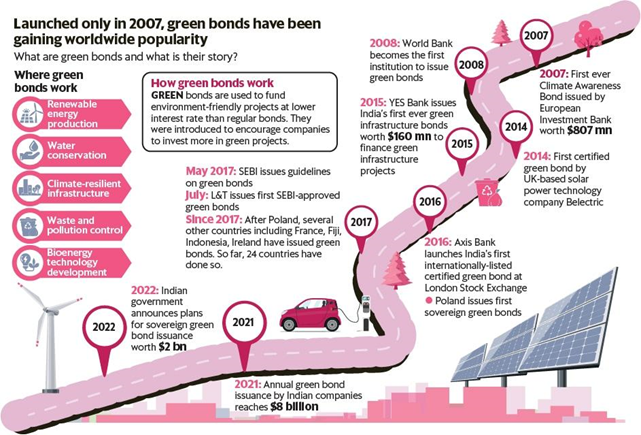

- Private Sector Dominance: The private sector has largely led green bond issuance in India, covering as much as 84% of the total share, signifying the potential for further growth in the domestic market.

- Sectoral Focus: Dominant share of project financing through green bonds has been directed towards the energy sector, with unexplored potential for financing sustainable initiatives in other sectors.

- Greenium Effect: The presence of a “green premium” or “greenium” indicates that investors are willing to accept lower yields on green bonds compared to conventional bonds. But the lack of a separate sustainability fund in India may hinder the ‘greenium.’

- Regulatory Landscape: The Securities and Exchange Board of India (SEBI) has established a framework mandating green bond issuers to disclose environmental objectives and project selection criteria, strengthening transparency and investor confidence.

- Sovereign Green Bonds: The Indian government’s introduction of sovereign green bonds represents a significant step towards sustainability, aligned with the country’s climate action goals and commitment to the Paris Agreement.

- Investor Demand: Dedicated green bond funds have experienced a 17% year-on-year increase in total net assets, suggesting robust investor demand for green investments amidst a recovering fixed-income market.

- Pricing Challenges: Larger Indian companies often prefer to raise green bonds abroad, as the limited yield benefit in the primary market compared to conventional bonds poses challenges for domestic issuance.

- Untapped Potential: Despite the growing relevance of green bonds, they still occupy only a small share (3.8%) of the Indian bonds market, highlighting the vast untapped potential for accelerating growth through strategic market and policy interventions.

Way forward for Sovereign Green Bonds

- Enhancing Regulatory Framework: Establish clear and standardized guidelines for green bond issuance to ensure transparency and attract both domestic and international investors.

- Promoting Domestic Demand: Encourage local institutional investors, such as pension and insurance funds, to allocate a portion of their portfolios to sovereign green bonds, thereby increasing domestic market participation.

- Regular Issuance Schedule: Develop a systematic program for repeat sovereign green bond issuances to build investor confidence and establish a predictable market for sustainable investments.

- Tax Incentives and Benefits: Explore the introduction of tax benefits for green bond investors to enhance their attractiveness and encourage broader participation in the market.

- Collaboration with Financial Institutions: Foster partnerships between the government and financial institutions to mobilize resources and provide guidance on sustainable investment opportunities.

- Clear Project Pipeline: Define and label sustainable activities through interoperable frameworks to guide capital flows, ensuring that investors can easily identify credible green projects.

- International Cooperation: Engage in dialogues with other emerging market economies within the G20 to share best practices and promote local currency green bond issuances.

- Public Awareness Campaigns: Implement educational initiatives to inform investors about the benefits and risks associated with green bonds, enhancing overall market understanding and participation.

- Strengthening Sustainability Reporting: Mandate comprehensive sustainability reporting for green bond issuers to instill trust and ensure accountability in the use of proceeds.

- Leveraging Global Trends: Align India’s green bond strategy with global market trends, capitalizing on the growing demand for sustainable finance to attract foreign investments and enhance the country’s green credentials.

Alternative articles

https://universalinstitutions.com/green-finance/

https://universalinstitutions.com/direct-listing-in-gift-city-soon-sovereign-green-bonds-ready/

Mains question

Discuss the significance of sovereign green bonds in India’s sustainable development strategy. Evaluate the challenges and opportunities associated with their issuance in the context of climate change and economic growth. (250 words)