IS THE CENTRE BEING INIQUITOUS IN STATE TRANSFERS?

Syllabus:

GS 2:

- Parliament and State Legislatures—Structure, Functioning, Conduct of Business.

- Government Policies and Interventions for Development in various sectors.

Why in the News?

Recent accusations by opposition Chief Ministers suggest the Centre is discriminating against non-NDA States in resource allocation, sparking debates on the fairness of fiscal transfers and the role of institutions like NITI Aayog. This controversy highlights ongoing tensions in Centre-State financial relations.

Source: Print

Context and Overview:

- Opposition Boycotts: Opposition Chief Ministers boycotted and walked out of the NITI Aayog meeting chaired by the Prime Minister, alleging discrimination against non-NDA States by the Centre.

- Bias Concerns: The central question revolves around whether the Centre is unfairly distributing resources among States, favoring NDA-ruled States over others.

- Union Budget Issues: The Union Budget has raised concerns with Opposition leaders, who claim it allocates resources unfairly, benefiting certain States disproportionately.

- Political Implications: Allegations of bias in resource allocation have significant political implications, potentially impacting Centre-State relations and federal cooperation.

- Historical Context: Past instances of perceived favoritism in central transfers add to the current controversy, highlighting long-standing issues in Centre-State financial dynamics.

- Administrative Challenges: These tensions create administrative bottlenecks, affecting the implementation of policies and overall governance in States alleging discrimination.

Role of NITI Aayog

- Abolition Context: The Planning Commission was abolished to provide States with greater flexibility through untied resources, increasing devolution to 42%.

- Capital Grants: NITI Aayog can offer capital grants through a consultative process, addressing inter- and intra-regional inequalities without the rigidity of centrally sponsored schemes.

- Institutional Role: Despite complaints, the Planning Commission served as a forum for addressing regional inequalities and facilitating Centre-State dialogues, a role diminished under NITI Aayog.

- National Development Council: The disbandment of the National Development Council has further weakened the institutional framework for Centre-State cooperation.

- Think Tank Limitations: NITI Aayog’s limited powers, confined to being a think tank, reduce its effectiveness in addressing the financial needs and concerns of States.

- Call for New Body: A credible, politically neutral body is needed to facilitate transparent, professional discussions between the Centre and States on financial matters.

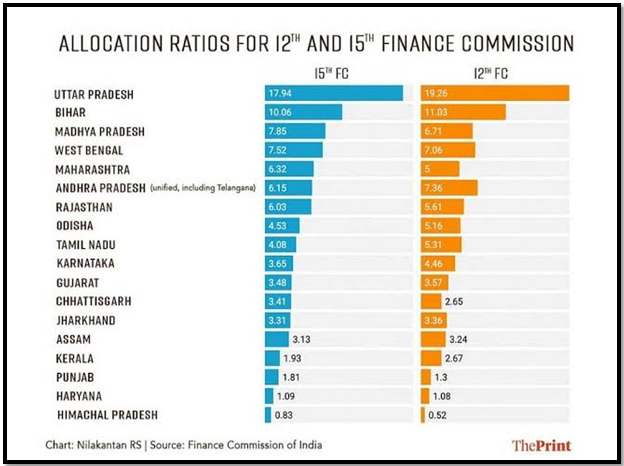

Tax Resource Distribution

- Devolution Formula: A single devolution formula cannot satisfy all States, necessitating the judicious use of grants to address post-devolution disparities.

- Collection Criteria: Using tax collection or origin as criteria for tax devolution can lead to increased inequality in resource distribution among States.

- Per Capita Income: States witnessing declines in transfers due to higher per capita income rankings need mechanisms for grants to maintain fiscal stability.

- State-Specific Needs: Addressing State-specific needs and challenges requires targeted grants rather than relying solely on a devolution formula.

- Divisible Pool Share: Increasing the share of States in the divisible pool to 50% can help address concerns of better-performing States and ensure fair resource distribution.

- Grant Mechanism: Grants should be based on clear criteria and States should present cases for their specific needs and the required financial support.

Cesses and Surcharges

- Increasing Reliance: The significant increase in cesses and surcharges over time, kept outside the net proceeds, raises concerns about transparency and fairness.

- Limited Period Use: Constitutionally, cesses and surcharges are intended for limited periods for specific purposes, but their prolonged use undermines this principle.

- Centre’s Compensation: The Centre has compensated for the increased devolution share by raising cesses and surcharges, which are not shared with States.

- Financial Burden: Changes in the spending ratio of centrally sponsored schemes, shifting more burden to States, further strain State finances.

- Untied Funds: The cumulative amount from cesses and surcharges not shared with States in an untied format exacerbates fiscal imbalances.

- FC Recommendations: Increasing the State’s share in devolution to 50% and ensuring cesses and surcharges are used transparently can address these issues.

Revenue Deficit Grants and Borrowing Limits

- Revenue Deficit Grants: These grants are crucial for States with fiscal deficits post-tax devolution, ensuring they can meet their financial obligations.

- Borrowing Limits: States face hard budget constraints, unlike the Centre, necessitating restrictions for macroeconomic stability, but the Centre must also manage its deficit.

- Social Sector Investments: States like Kerala, investing heavily in the social sector, face fiscal constraints and need continued support through revenue deficit grants.

- Fiscal Prudence: Some States appear fiscally prudent by investing less in the social sector, but this comes at a social cost, highlighting the need for balanced financial support.

- Compensation Mechanisms: States historically disadvantaged in the devolution process should be compensated through targeted grants to address their specific needs.

- 16th FC Role: The 16th Finance Commission should continue providing revenue deficit grants and ensure a balanced approach to Centre-State financial relations.

About the Finance Commission of India (FCI)

16th Finance Commission of India

|

Concerns About Resource Allocation

- Declining Role of Budget: Post-economic liberalization, the Union Budget’s role in resource allocation to States has diminished, but recent schemes for specific States raise fiscal concerns.

- Discretionary Grants: Discretionary grants, lacking clear criteria, introduce arbitrariness in resource distribution, undermining cooperative fiscal federalism principles.

- Political Announcements: Recent budget announcements for selected States coincide with political developments, raising questions about the rationale behind these decisions.

- Historical Patterns: This phenomenon continues a trend observed over the past decade, where political factors influence financial allocations to States.

- Impact on Federalism: Such practices can weaken the spirit of cooperative federalism, leading to mistrust and tension between the Centre and States.

- Need for Transparency: To address these concerns, there must be greater transparency and rule-based criteria in allocating discretionary grants to States.

Way Forward

- Increase Transparency: Implement rule-based criteria for discretionary grants to ensure fair and transparent resource allocation, reducing perceived biases.

- Strengthen NITI Aayog: Enhance NITI Aayog’s powers to include financial decision-making, enabling it to effectively address regional inequalities and foster cooperative federalism.

- Revive Consultative Bodies: Reinstate the National Development Council or create a similar forum for regular Centre-State dialogue on financial matters, ensuring collaborative decision-making.

- Equitable Tax Distribution: Consider increasing the States’ share in the divisible pool to 50%, ensuring fair distribution of Union tax resources among all States.

- Targeted Grants: Develop mechanisms for targeted grants to address State-specific needs and fiscal challenges, supporting States with unique socio-economic conditions.

- Limit Cesses and Surcharges: Restrict the use of cesses and surcharges to limited periods and specific purposes, ensuring these revenues are transparently and effectively utilized.

- Fiscal Responsibility: Both the Centre and States should adhere to fiscal responsibility, maintaining macroeconomic stability while supporting necessary social investments.

- Strengthen Cooperative Federalism: Foster a spirit of cooperative federalism by prioritizing mutual respect and collaboration between the Centre and States, focusing on collective national development.

Conclusion

Addressing the concerns of fiscal inequity and enhancing transparency in resource allocation is crucial for strengthening cooperative federalism in India. Implementing rule-based criteria for grants and fostering regular Centre-State dialogue can ensure equitable distribution and support national development.

Mains Practice Question

Discuss the implications of perceived biases in resource allocation by the Centre on the financial stability and development of States. Suggest measures to enhance transparency and fairness in fiscal transfers within the framework of cooperative federalism.

Source :The Hindu

Associated Article: